Adams Street Partners Overview

In 1972, George Spencer and T. Bondurant French created Adams Street Partners.

Adam Streets Partners is a global private markets investment manager that provides comprehensive solutions for its investors. They specialize in venture capital, growth equity, buyouts and co-investments.

Their headquarters can be found in Chicago, Illinois with additional offices in Austin, Beijing, Boston, Chicago, London, Menlo Park, Munich, New York, Seoul, Singapore, Sydney, and Tokyo.

At Adams Street, every employee holds at stake at their firm. In other words, they invest in all of the offerings which creates a shared interest in the success of both the firm and their clients.

The firm remains as a private investment firm and has no publicly announced plans on going public..

Adams Street Partners AUM

According to most recent regulatory filings, Adams Street Partners has $51 billion in assets under management as of March 30, 2022.

Adams Street Partners Interview Process & Questions

Investment firms usually modify their interview process with each candidate.

But if you interview at Adams Street Partners, you should expect to undergo 4-6 rounds of interviews which could last for several weeks – unless it’s “on-cycle” or “on-campus” recruiting.

The junior investment professionals conduct the first rounds of interviews, while the more senior staff handle the later rounds.

Lastly, be sure to be prepared for a mixture of fit, behavioral, and technical / investing questions.

Just in case you need guidance for preparing for your interviews, check out my Growth Equity Interview Guide.

Why Adams Street Partners

One of the most common questions you’ll hear during interviews is this: “Why this firm?”

Now, if you’ve done networking with the employees at the firm, you should definitely mention all the positive experiences you’ve had during those interactions and the good things you’ve heard about the firm.

When answering this interview question, it helps a lot if you learn more about the firm. One of the best ways to do this is to listen to interviews with its founders, investors, and employees at the firm.

To start, here’s an amazing discussion with T. Bondurant French, CEO & CIO, Adams Street Partners:

More interview

Adams Street Partners Case Study

Case studies are often used during the interview process to assess their candidate’s technical knowledge and ability to communicate effectively.

For Adams Street Partners and other similar firms, their case studies usually revolve on investment recommendations and financial modeling, so make sure to include those in your preparation.

You’ll also have to complete a cold calling case study if you’re applying for a junior role.

Need help preparing for case studies? Check our comprehensive online course.

Adams Street Partners Salary & Compensation

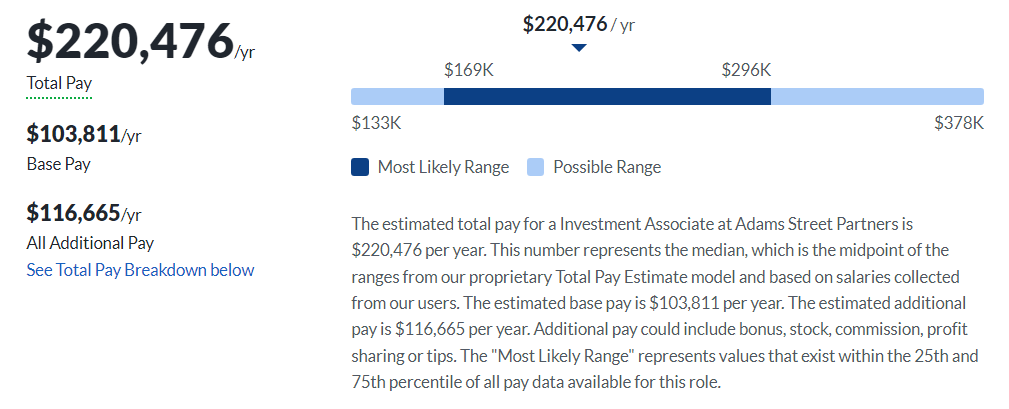

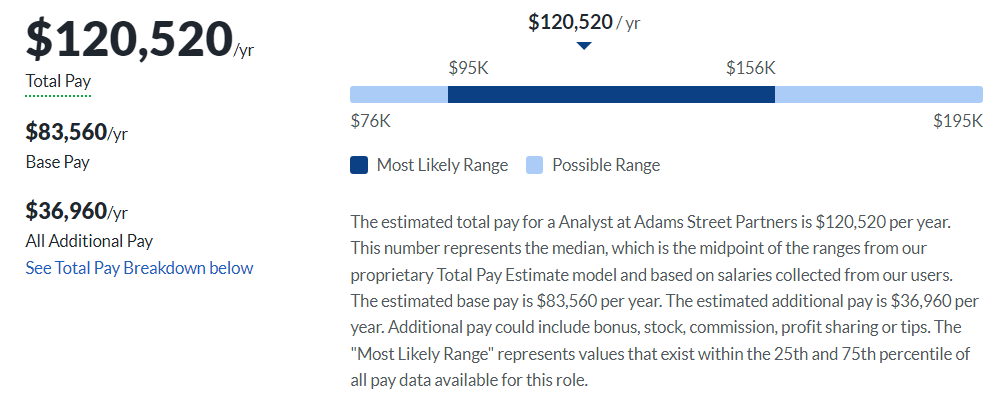

According to Glassdoor, when you work as an Investment Associate at Adams Street Partners, you can earn around $220,476 per year. If you’re an Investment Analyst at the firm, your estimated total pay is around $120,520 annually.

This may vary depending on your experience and qualifications.

Associate

Analyst

Adams Street Partners Careers, Jobs, & Internships

To find current job openings at Adams Street Partners and other similar firms, take a look at our job board.

Adams Street Partners Portfolio & Investments

Based on Crunchbase data, Adams Street Partners has made 229 investments across different industries and locations, and currently manages 11 funds.

Some of the firm’s notable deals include Zynga, LogRhythm, Jazz Pharmaceuticals, Proteus Digital Health, and VillageMD.

Notable Transaction: Proteus Digital Health

In 2004, Adams Street Partners, together with The Carlyle Group and EW Healthcare Partners, invested in a medical products company called Proteus Digital Health.

Proteus Digital Health is a healthcare technology company which creates patient monitoring systems in the form of wearable sensors and mobile apps to help patients check their medication adherence, vital signs, and other health metrics.

The investment helped Proteus Digital Health’s growth and innovation in the healthcare industry.

Afterward, they have secured more funds from various investors which included a $120 million investment in 2014 where Adams Street Partners also participated.

Next Steps

Ready to grab a career in finance? Growth Equity Interview Guide is just what you need to ace your interviews and stand out from the competition.

This online course is perfect for you regardless if you’re looking to make a career change or already have some background in finance. You’ll get everything you need to maximize your chances of landing a role in growth equity.

Take the Growth Equity Interview Guide and start learning today!

Break Into Growth Equity

Break Into Growth Equity