Alpine Investors Overview

Alpine Investors is a private equity firm, located in San Francisco, CA, that primarily invests in software and services businesses.

One of the firm’s differentiating factors is their PeopleFirst operating philosophy which guides everything they do. They work with, learn from, and develop exceptional people to create a progressive cycle of financial and operational wins.

Alpine Investors is a B-Corp certified firm, a Great Place to Work™, and has been recognized as one of the Most Innovative Companies in 2023 by Fast Company.

They typically invest through means of buyouts, add-ons, carve-outs, recapitalization and growth capital.

Graham Weaver is the Founder and CEO of Alpine Investors. Weaver formed the idea for his private-equity firm in a dorm room at Stanford Business School in 2001.

Alpine Investors AUM

Alpine Investors manages $8 billion of assets as of March 31, 2022 according to the most recent regulatory filings.

Alpine Investors Interview Process & Questions

Firms can always make adjustments in their interview process with each candidate. However, some of the general nature of the process stays the same for Alpine Investors (or a firm like it)

- The interview process will consist of 4 to 6 rounds of interviews.

- Junior investment professionals or the HR team tend to supervise the initial rounds, while more senior staff handle the later rounds.

- Unless it’s “on-cycle” or “on-campus” recruiting, the entire interview process can take several weeks to conclude.

Interviews at Alpine Investors will have you answer a combination of fit questions, behavioral questions, and technical / investing questions.

To better prepare for interviews, check out my Growth Equity Interview Guide.

Why Alpine Investors

The most common question you’ll encounter during interviews is “Why this firm?”

Interviewers like to ask this question because they want to check if you’ve done some research and if you have specific reasons why you decided to join their team.

If you’ve done networking, this is the right time to mention whoever you’ve met at the firm and how their insights compelled you to apply at the firm.

Also, take some time to learn more about the firm. One of the best ways to do this is to listen to interviews with its founders, investors, and management team.

You can start with this great interview with Graham Weaver, Founder @ Alpine Investors:

More interviews

- Billy Maguy, Partner @ Alpine Investors, on their PeopleFirst Operating Philosophy

- Interview with Graham Weaver, Founder and Managing Partner of Alpine Investors

Alpine Investors Case Study

Interviewees are almost always required to perform a case study during interviews. Case studies is a means to evaluate the candidate’s technical knowledge and communication skills.

Most case studies at firms like Alpine Investors will require you to conduct financial modeling and investment recommendations. However, cold calling case studies can be included in the process for junior roles.

Check out my in-depth discussion of case studies inside my Growth Equity Interview Guide.

Alpine Investors Salary & Compensation

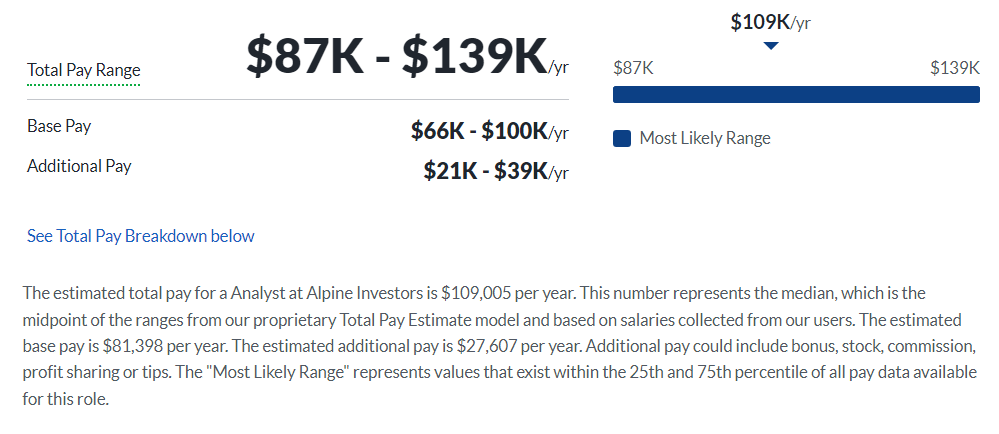

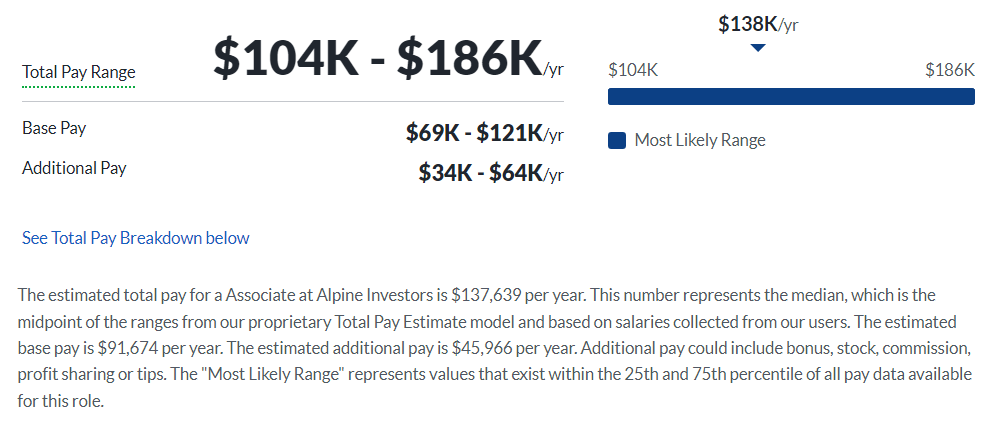

Analysts at Alpine Investors can earn an estimated total pay of $109,005 per year, while Associates make around $137,639 per year according to Glassdoor. These numbers represent the median, and can still vary depending on your experience, qualifications, and performance.

Analyst

Associate

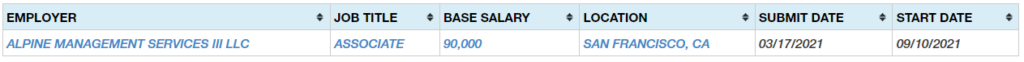

Recent associates at Alpine Investors have earned salaries of $90,000 per year as per other publicly available data, while there is no recent data for analyst hires.

Alpine Investors Careers, Jobs, & Internships

Head over to our job board to see open roles at Alpine Investors. We also feature job vacancies from other similar firms.

Alpine Investors Portfolio & Investments

According to Crunchbase, Alpine Investors has made 26 investments and operates 8 funds since inception. Some of their notable deals include Wild Microbes, RetailMeNot, and KrazyBee.

Notable Transaction: Homebot

Homebot is a client-for-life portal which provides personalized, actionable intelligence throughout the entire homeownership lifecycle to every client and prospect. It empowers consumers to build wealth through homeownership which maximizes repeat and referral business for lenders.

In January 2022, ASG, a portfolio company of Alpine Investors that purchases, builds, and operates vertical SaaS companies, acquired Homebot.

According to Mark Straucnh, Partner at Alpine Investors and Co-Founder of ASG, the homeownership market is valued at $30 trillion but is a largely ‘unmanaged’ asset class. Homebot is changing that, which is the primary reason for the strategic acquisition.

The acquisition helped Homebot to help even more mortgage lenders, homeowners, real estate professionals, and buyers.

Next Steps

Alpine Investors can provide an exciting career in finance to committed professionals. If you want to land a role at their firm, or any similar firms, make sure to check out my Growth Equity Interview Guide.

Inside this self-paced online course, you’ll find step-by-step lessons on the topics that firms like to go over during interviews such as case studies, valuation, financial modeling, and many more. The course also provides expert tips, mental models, and frameworks which are quite helpful when answering interview questions under pressure.

Get the course today and maximize your chances of landing a role in finance.

Break Into Growth Equity

Break Into Growth Equity