Brighton Park Capital Overview

Brighton Park Capital is an investment firm that focuses on software, information services, and tech-enabled services.

The firm works closely and has an active partnership with entrepreneurs and CEOs to help them build, attract, and nurture other members of the management team to drive growth agenda.

Brighton Park Capital was founded in 2019 and is located in Greenwich, Connecticut.

Mark F. Dzialga is the Founder and Managing Partner of Brighton Park Capital and is also a member of the Investment Committee. Aside from that, he was also a former Managing Director at General Atlantic – a global growth investment firm.

Before General Atlantic, Dzialga worked at Goldman Sachs where he advised many of the firm’s technology clients on mergers, acquisitions, and restructurings.

Brighton Park Capital AUM

According to most recent regulatory filings, Brighton Park Capital has $2.1 billion in assets under management as of April 27, 2022.

Brighton Park Capital Interview Process & Questions

Firms have the prerogative to change their interview process with each candidate. However, there are some parts of the process that remain consistent when you’re applying at Brighton Park Capital or similar firms.

- Expect to go through 4-6 rounds of interviews

- Junior investment professionals will handle the initial rounds, while the more senior staff will conduct the later rounds

- The entire interview process could take up to several weeks, unless it’s an “on-cycle” or “on-campus” recruiting

When you interview at Brighton Park Capital, expect to get a combination of fit questions, behavioral questions, and technical/investing questions.

If you want to be more prepared and feel more confident when you show up at interviews, check out my Growth Equity Interview Guide.

Why Brighton Park Capital

Every candidate who interviews at Brighton Park Capital (or a similar firm) has to answer the most common and important question: “Why this firm?”

If you’ve met employees from their firm during your networking efforts, this is the perfect chance to mention them and how they’ve made a really positive impression on you. It will help you stand out more from competitors.

Another thing that can help you provide an impressive answer to this question is to learn more about the firm. One way to do that is to listen to interviews with its management team, founders, and investors.

This interview with Mike Gregoire, Partner at Brighton Park Capital:

More interviews

- Mike Gregoire of Brighton Park Capital talks about strategies for growing through a recession

- Mike Gregoire: Operating at Scale (The BRIGHTON PARKast)

Brighton Park Capital Case Study

Candidates looking to land a role at Brighton Park Capital (or similar firms) almost always have to perform case studies. Firms use case studies to assess whether you have the technical knowledge and communications skills needed to succeed in the role.

Most case studies focus on financial modeling and investment recommendations. But for junior roles, interviewees often have to do cold calling case study as well.

For more expert tips and in-depth discussions on case studies, check my course Growth Equity Interview Guide.

Brighton Park Capital Salary & Compensation

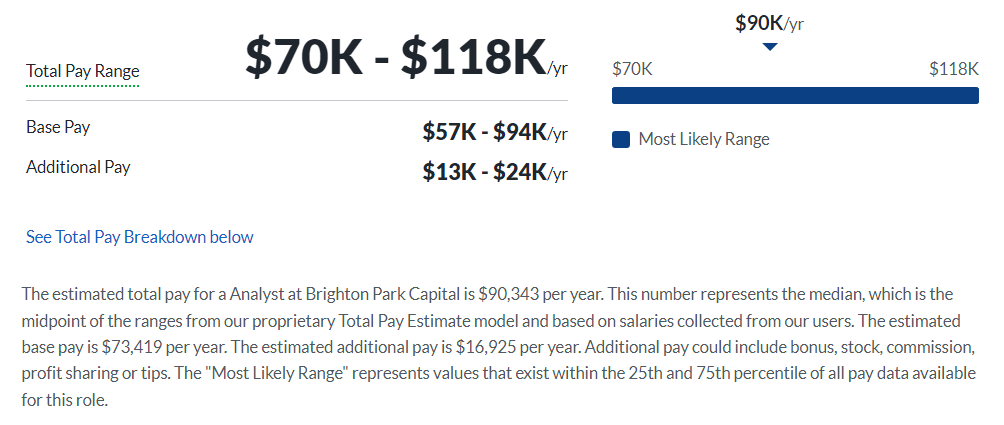

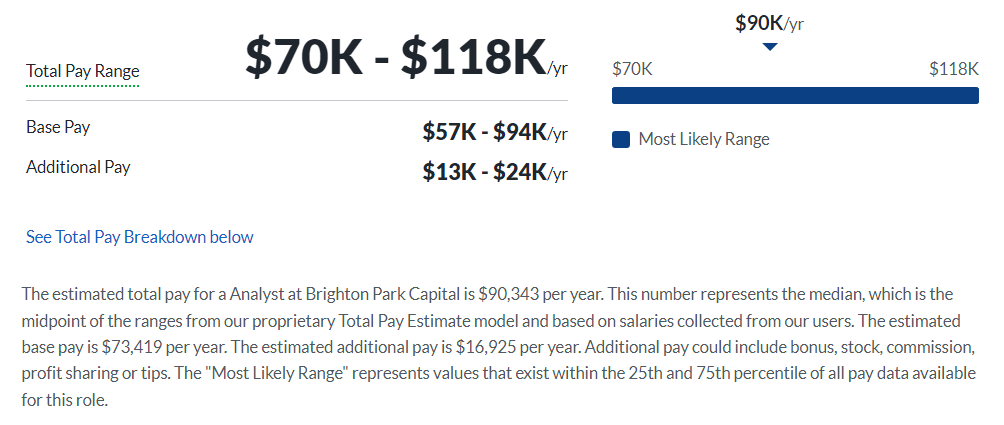

Based on Glassdoor’s recent data, Brighton Park Capital offers an estimated average pay of $70,414 to Associates and $90,343 to Analysts per year. These figures can vary depending on your qualifications and level of experience.

Associate

Analyst

Brighton Park Capital Careers, Jobs, & Internships

To view job vacancies at Brighton Park Capital, visit our job board. In our job board, we also feature open roles from other similar firms so you can easily browse through potential opportunities in finance.

Brighton Park Capital Portfolio & Investments

As per Crunchbase, Brighton Park Capital has 19 investments across two funds. Their notable deals include TheMathCompany, HTEC Group, and Darktrace – which are software and tech-enabled companies.

Notable Transaction: DataVisor

DataVisor is a US-based online fraud detection and risk management software for financial services and digital commerce.

DataVisor’s fraud and risk service uses machine-learning models and business-specific rules to help users identify these fraudulent patterns.

In December 2022, Bright Park Capital led a $40 million strategic growth investment in DataVisor, where investors NewView Capital and GSR Ventures also participated.

DataVisor used the fund to drive global strategy and expansion.

Next Steps

Brighton Park Capital is a good choice for professionals who have high interest in software and technology, and are also looking to break into the world of finance.

Regularly check our job board to stay updated with their open roles and make sure to prepare for interviews. If you don’t know what to focus on or how to best go about your interview preparations, check out my Growth Equity Interview Guide.

It’s a self-paced online course that contains step-by-step lessons, frameworks, and expert tips on the topics that almost always come up during interviews. Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity