Many consultants are interested in making the jump from consulting to private equity. Indeed, consulting is the second most common path into private equity, behind only investment banking.

However, it can be a difficult transition, and not all private equity firms are open to consultant hires.

In this article, I’ll lay out the benefits and challenges to making the jump, as well as various tips and strategies that can help you make the jump.

Can you move from consulting to private equity?

Yes, professionals with consulting experience can move into private equity.

Many private equity firms value the skills and expertise consultants bring to the table, such as analytical thinking, problem-solving, and communicating effectively with clients.

That being said, some firms are exclusively interested in hires with investment banking or other backgrounds.

They reason that investment banking provides more financial modeling training that will be directly useful and relevant for the job. Since private equity firms aren’t typically setup for zero-to-one mentorship, it can be tough to take candidates who don’t have these base skills.

This is why, sometimes transitioning from consulting to private equity can be challenging and may require additional preparation for your interviews.

A comparison of consulting and private equity as career options

Consulting and private equity are both lucrative and competitive career options that offer a wide range of opportunities.

Here is a comparison of these two career paths:

Nature of work: Consulting involves providing advice and expertise to clients on a wide range of business issues, while private equity involves actively acquiring and managing a portfolio of companies to improve their operations and increase their value.

Level of responsibility: Both paths expect lots of responsibility of their employees, but I’d say that there’s no higher responsibility than investing someone else’s money (which is what private equity investors do)

Earning potential: While both consulting and private equity can be high-paying careers, private equity investors make more money given their ability to share in the upside of their deals (e.g. carry, bonus, etc.)

Work-life balance: The demands of both consulting and private equity can make it difficult to achieve a healthy work-life balance. Both industries may require long hours and significant travel. While you’ll travel for deals in private equity, consulting is famous for the 4-days of travel per week grind, so keep that in mind too.

Clear career progression: Consulting firms tend to be large with a very hierarchical structure and clear paths for advancement. Since private equity firms tend to skew smaller, they also tend to be flatter, which can provide more opportunities but can also make career progress somewhat murkier. Also, in private equity firms, sometimes there’s a large pool of colleagues competing for relatively few partner roles (which older folks don’t give up lightly). This can stall your progression.

Exposure to new industries and clients: One of the best things about consulting and private equity is that they both offer the opportunity to work with a wide range of industries and clients. Each new deal or client project provides an opportunity to jump into a new industry and learn about a new part of the world.

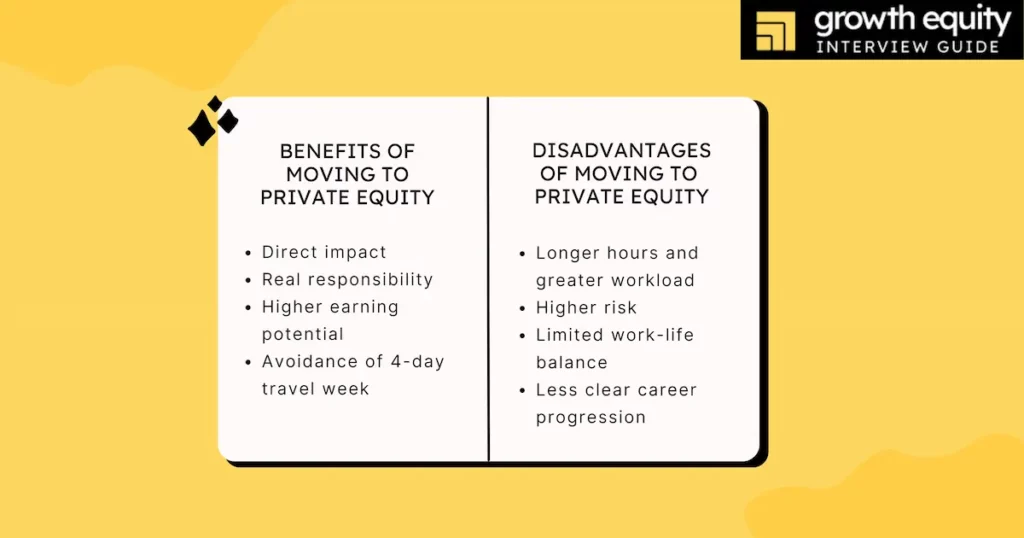

Benefits of moving to private equity

There are several potential benefits to moving from consulting to private equity, including:

- Direct impact: As owners of businesses, private equity professionals have the opportunity to make a significant impact on the companies in which they invest. Meanwhile, consultants are limited to advising from the sidelines. (This is one of the biggest reasons why I personally was attracted to private equity and growth equity investing)

- Real responsibility: Related to the previous point, private equity firms are investing other people’s money, which confers a level of responsibility that is unrivaled

- Higher earning potential: Private equity (and growth equity) professionals often earn higher salaries and have the potential to earn a share of the profits generated by successful investments through carry

- Avoidance of 4-day travel week – While private equity professionals travel for deals, they do not travel as frequently as most consultants, who are famous for their 4-days per week travel schedule while they are on-site with clients

- 66 lessons

- 12+ video hours

- Excels & templates

Disadvantages of moving to private equity

To be fair, let’s look at the downsides of moving from consulting to private equity. These include:

- Longer hours and greater workload: Private equity professionals may be required to work longer hours and take on a greater workload than they would in consulting, especially during the due diligence and deal-closing stages of an investment.

- Higher risk: Private equity involves a higher level of risk than consulting, as investments can sometimes fail to deliver the expected returns. Private equity firms may not have the same level of stability as consulting firms, as the success of their investments can be highly dependent on market conditions and investment outcomes

- Limited work-life balance: The demands of the private equity industry can make it difficult to achieve a healthy work-life balance; however, it is usually somewhat better than investment banking roles

- Less clear career progression: Private equity firms have career levels, but since firms are smaller, the career path is often less certain and your promotion every couple years is not always assured

It’s important to carefully weigh the potential benefits and disadvantages of a career in private equity before deciding to transition from consulting.

Tips for consultants looking to moving to private equity

Here are some pieces of advice for consultants interested in pursuing a career in private equity:

Specialize in an industry or vertical: It can be an edge and lower the hiring bar with private equity firms if you can brand yourself as an industry specialist in a specific niche they are looking to hire for. That’s why consultants interested in private equity may want to consider gaining additional industry-specific knowledge and experience, either through additional education or by seeking out opportunities for hands-on experience in their field of interest.

Consult on private equity transaction diligences: If you don’t want to brand yourself as an industry specialist, the next best way to get into private equity from consulting is to work on consulting teams that conduct due diligence for M&A or private equity transactions. While this isn’t one-to-one with what you’ll do as an investor, it will certainly give you an edge in recruiting since you’ll have deals to talk about and can claim to know the ropes a bit.

Build a strong financial foundation (aka LEARN MODELING): Private equity firms tend to look for candidates with a strong financial background and candidates who they won’t need to teach the basics. Consultants interested in private equity may want to consider gaining additional training. MBA and CFA can be helpful for this; however, there are other great options for learning how to ace financial modeling 🙂

Develop a network within the private equity industry: Building a strong network within the private equity industry can be crucial for sourcing investing job opportunities. Consultants may want to network with private equity professionals to build relationships and make connections in advance of recruiting. Check out my full guide on how to network with private equity and growth equity investors

Consider consulting roles within private equity firms: Many large private equity firms have in-house consultants who assist portfolio companies with operational or strategic issues. While these roles are not on the investing team, they can be interesting and great roles within private equity firms. One note, it’s uncommon (but not impossible) that one can transfer from one of these roles into private or growth equity. So, if you decide to go this route, you should be clear with yourself on whether you want to be on the investing team and whether you’ll have a shot at doing so at this firm.

Seek out firms who have hired consultants previously: LinkedIn is an incredible resources, and it offers free trials for their pro tools. Get a free trial and search for private equity firms that have employees who have worked in consulting before. This is the best way to know if they’d be open to hiring consultants again. There’s always a chance firms are open to it even though they haven’t hired one yet, but better to know your odds ahead of time. Once you have your list, start networking!

Final Takeaway

So that’s it. I’ve brought you from start to finish in our guide to private equity consulting.

To know more about the industry, we encourage you to conduct your own due diligence and speak with other professionals in this field through networking.

If you’re determined to join the ranks of a private equity firm, it’s up to you to distinguish yourself from the rest to secure an offer!

I hope these tips help!

Break Into Growth Equity

Break Into Growth Equity