Declaration Partners Overview

Declaration Partners is a private equity firm that aims to provide capital and strategic resources to management teams and owners.

They seek to invest on behalf of family offices and partner with like-minded entrepreneurs, operators, and investors seeking to create the “next generation” of value.

The firm’s strategy includes Growth Equity, Real Estate, Platform Companies, Fund Seeding, and other opportunistic investments with an emphasis on long-term partnership.

Declaration Partners was established in 2017 and is headquartered in New York with an office in the Washington, DC area. Brian Frank is the Founder and the Managing Partner of Declaration Partners.

Since inception, Declaration Partners has already invested in real estate, healthcare, advertising, and artificial intelligence, and other related industries.The firm looks to make direct investments to maximize long-term capital appreciation.

Declaration Partners AUM

Declaration Partners has approximately $2.5 billion in assets under management across its investment strategies as of May 19, 2022 as per the most recent regulatory filings.

Declaration Partners Interview Process & Questions

The interview process can always have a few modifications for each candidate depending on the firm’s decision. However, if you interview at Declaration Partners (or a firm like it), you’ll likely experience the following:

- You’ll undergo 4 to 6 rounds of interview.

- The junior investment professionals or the HR team will conduct the initial interviews, while the more senior staff supervise the later rounds.

- Expect the interview process to last for multiple weeks – unless it is “on-cycle” or “on-campus” recruiting

During the interview at Declaration Partners, the interviewer will ask you a mixture of fit questions, behavioral questions, and technical / investing questions.

For more comprehensive interview lessons, expert tips, and resources, check out my Growth Equity Interview Guide.

Why Declaration Partners

“Why this firm” almost always comes up during interviews.

It’s one of the most common and important questions because it reveals whether the candidate has specific reasons for choosing the firm to build their career.

If you’ve had the chance to meet any employees at the firm, make sure to mention them and how they’ve made a really positive impression on you.

You can also look for interviews with the firm’s founders, investors, and management team so you can have a better idea how these individuals speak about the firm, their investing insights, and priorities so you can craft an answer that’s relevant and aligned with the firm’s direction, vision, and perspective.

Declaration Partners Case Study

Firms like Declaration Partners prefer candidates who have sufficient technical knowledge and good communication skills. One way firms assess these attributes is by having their candidates conduct case studies.

Most case studies require investment recommendations and financial modeling. However, junior roles are often required to do a cold calling case study as well.

If you need in-depth explanation and discussion on case studies, check out my Growth Equity Interview Guide.

Declaration Partners Salary & Compensation

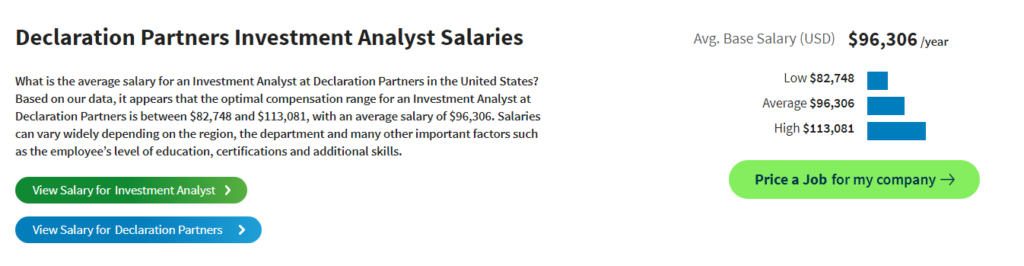

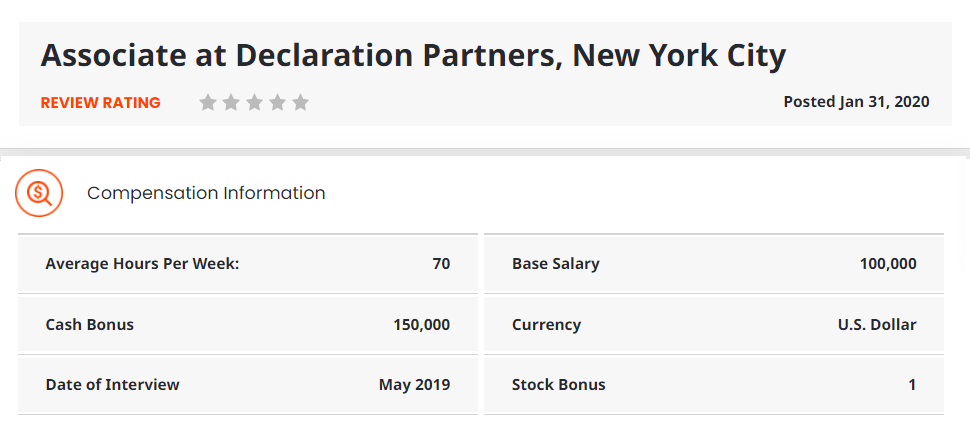

According to publicly available data, analysts and associates at Declaration Partners can earn an average base salary of $96,306 and $100,000 per year.

These figures do not include bonuses and can still vary depending on the candidate’s level of experience, qualification, and performance.

Analyst

Associate

Declaration Partners Careers, Jobs, & Internships

To view open roles at Declaration Partners, feel free to check out our job board where you can also browse through job vacancies at other similar firms.

Declaration Partners Portfolio & Investments

Declaration Partners has made 31 investments across real estate, healthcare, advertising, and artificial intelligence, and other related industries since inception, and operates one fund according to Crunchbase.

Some of their notable deals include ResortPass, Solidus Labs, and PetDx.

Notable Transaction: Sure

Sure is an insurance technology company that develops digital insurance softwares for global brands.

The company has created a mobile application that allows users to purchase insurance plans at their convenience, and also enables brands to launch insurance products via its end-to-end embedded insurance infrastructure.

In October 5, 2021, Declaration Partners and Kinnevik led a Series C funding which raised a $100 million investment for Sure.

This growth round helped with Sure’s global expansion, product development, and improvement of customer experience.

Next Steps

If you’re interested in landing a role at Declaration Partners (or a firm like it), I highly suggest you check out my Growth Equity Interview Guide.

Growth Equity Interview Guide is a self-paced online course which helps professionals ace their interviews and maximize their chances of securing their dream role in the finance industry.

The course contains step-by-step lessons, expert tips, and frameworks on interview topics such as case studies, valuation, financial modeling, and many more.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity