FTV Capital Overview

Founded in 1998, FTV Capital (formerly FTVentures) is a growth equity firm that has raised $6.2 billion funds to support high-growth companies offering innovative solutions in three sectors:

- Enterprise technology and service

- Financial services

- Payments and transaction processing

Jim Hale, Bob Huret, and Richard Garman are the Founding Partners at FTV Capital. The firm is based in San Francisco, California with additional offices in New York and Connecticut.

FTV Capital prefers to invest in companies through growth equity, buyouts, and venture capital over the long term.

Here are the typical characteristics of FTV companies:

- Provide innovative solution in FTV’s focus sectors

- $10 – $100 million annualized revenue

- High-growth businesses with at least 20% historical and near-term revenue growth

- Strong customer relationships for recurring revenue

- Management team looking for a partner focused on driving growth

The firm also provides access to its Global Partner Network® – a group of leading enterprises and executives who backed FTV portfolio companies for over two decades.

FTV Capital AUM

After the FTV VII fundraising event in early 2022, FTV Capital closed a $2.35 billion in capital commitments.

FTV Capital Interview Process & Questions

Interview process can always change with each candidate. However, the fundamental structure of the process stays the same. When you interview at FTV Capital (or a firm like it), you can expect the following:

- Interview process consists of 4 to 6 rounds

- For the initial rounds, junior investment professionals or the HR team take the lead. Then the more senior staff take over in the later rounds.

- Firms conclude the entire process after multiple weeks (unless it’s “on-cycle” or “on-campus” recruiting)

Be ready to answer a mixture of fit questions, behavioral questions, and technical / investing questions during the interview.

The Growth Equity Interview Guide can help you better prepare for such interviews. Feel free to check it out.

Why FTV Capital

Interviews like to know your motivation behind your application. They will ask you “why this firm” to see if you have solid reasons why you specifically chose their firm.

As much as you can, refrain from giving a generic answer. Try to do some research about the firm. One thing you can try is listening to interviews with its founders and investors.

For example, here’s an interview with Brad Bernstein, Managing Partner at FTV Capital:

More interviews

- Anirudh Singh sits down with Brad Bernstein, Managing Partner at FTV Capital

- Interview with with Kyle Griswold, a Partner of FTV Capital

FTV Capital Case Study

Good communication skills and technical knowledge are two valuable attributes that firms look for in their candidates. Case studies help firms to assess whether a candidate possesses these attributes. That’s why case studies almost always show up during interviews.

Most case studies at firms like FTV Capital focus on investment recommendation and financial modeling. However, cold calling case study may also be required for junior roles.

For a more detailed discussion of case studies, check out my Growth Equity Interview Guide.

FTV Capital Salary & Compensation

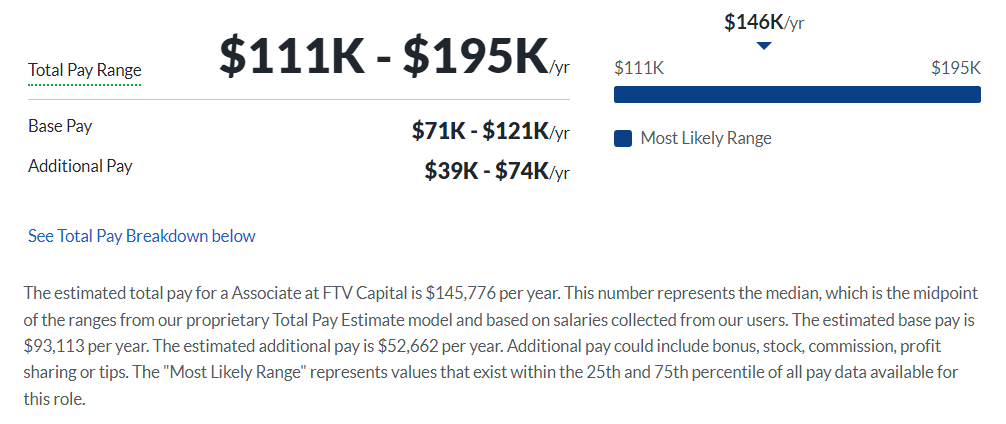

As per Glassdoor’s data, FTV Capital offers an estimated total pay of $145,776 per year to Associates. This figure represents the median and can vary based on your level of experience and qualification.

Associate

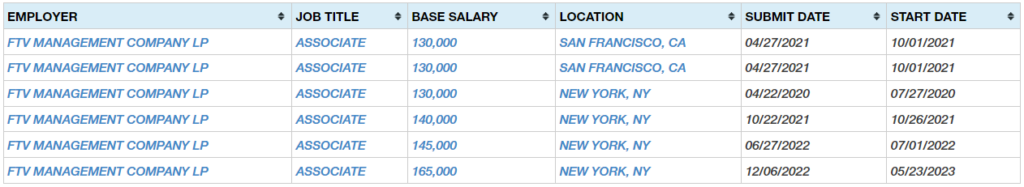

Based on other publicly available data, recent associates have earned salaries of $165,000 per year, while there is no recent data for analyst hires.

FTV Capital Careers, Jobs, & Internships

If you want to browse vacant positions at FTV Capital, check our job board where we also feature active job listings from other similar firms.

FTV Capital Portfolio & Investments

According to Crunchbase, FTV Capital made 131 investments since inception and operates 7 funds. Some of their notable deals include Docupace, SecurityCompass, and VikingCloud.

Notable Transaction: Sunlight Financial

Sunlight Financial is a platform for residential solar and energy storage lending. They partner with installers, distributors, and sales organizations to help homeowners save money.

In June 2018, FTV Capital made a strategic $50 million investment in Sunlight Financial. The fund was allocated for product suite expansion, platform improvement, and deepening relationships with companies that provide affordable loans for home upgrades.

As part of the agreement, FTV Capital managing partner Brad Bernstein and VP Mike Vostrizansky have joined the company’s board of directors.

According to Brad Bernstein, they supported Sunlight Financial because the company has built its platform to support expansion into adjacent products and markets, creating huge opportunities to build on the company’s success in solar.

Next Steps

Landing a role at firms like FTV Capital can be quite challenging and competitive. But you can ace your interview and maximize your chances of getting selected for the role with the help of Growth Equity Interview Guide.

Growth Equity Interview Guide is a self-paced online course which has already helped countless professionals break into the world of finance. Inside the course, you’ll find step-by-step lessons, expert tips, frameworks, and interview advice which are structured to make your interview preparation easier, simpler, and more effective.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity