General Atlantic Overview

General Atlantic is a major player in the growth equity industry.

The firm invests with a high-conviction approach and always aims to create long-term value for its portfolio firms. They strive to work with firms that are innovating and transforming their industries.

It was back in 1980 when the firm was founded by Chuck Feeney and his colleagues at Atlantic Philanthropies – a charity created to help humanitarian organizations.

Feeney saw an opportunity to develop a new type of investment firm which focuses on growth equity instead of LBO. He believed that the returns could be used for philanthropic purposes.

Fast forward to today, their headquarters can be found in New York City, and has additional offices in other cities like London, Hong Kong, and Mumbai.

General Atlantic still follows Feeney’s principles and makes investments that align with their mission of pushing growth and innovation.

General Atlantic AUM

According to most recent regulatory filings, General Atlantic has $84.4 billion in assets under management as of June 30, 2022.

General Atlantic Interview Process & Questions

Interview processes may vary for each candidate depending on the firm. Nonetheless, here’s what you can expect when you interview at General Atlantic (or a similar firm):

- You’ll go through 4-6 rounds of interview

- The junior investment professional often lead the initial interviews, and senior folks will assess you in the later rounds

- Expect the interview process to last multiple weeks – unless it’s on-cycle or on-campus recruiting

For General Atlantic, the interview can include a mixture of fit, behavioral, technical and investing questions.

Check out our comprehensive interview guide if you want help preparing for interviews.

Why General Atlantic

The question that will most certainly come up during your interview is this:

“Why General Atlantic?”

This is the perfect chance to showcase your interest and explain what drew you to the role you’re applying for. If you’ve made connections with their employees, mention their names and explain how they have made a positive impression on you.

If you want to gain more insights into the firm and be well-prepared for this interview question, it’s best to hear directly from the firm’s investors. For this, I suggest listening to interviews of executives and key personnel at the firm.

Listen to this insightful conversation with Martín Escobari, Co-President, Managing Director and Head of General Atlantic’s business in Latin America:

More interviews

- General Atlantic’s investing strategy and the IPOs of 2021 with Bill Ford

- Interview with Gary Reiner, a Partner at General Atlantic (JumpCloud)

- Interview with Anton Levy, Co-President, Managing Director and Global Head of General Atlantic’s Technology sector (20VC)

General Atlantic Case Study

The interview process at General Atlantic always requires their candidates to do case studies.

Their case studies are designed to evaluate the candidates’ technical knowledge and communication skills. Usually, the case studies center around financial modeling and investment recommendations.

But for junior roles, there could be cold-calling case studies to also assess the candidates’ skills in that particular area. In any case, it’s best to always prepare for anything.

If you need help preparing for case studies, check out my comprehensive online course.

General Atlantic Salary & Compensation

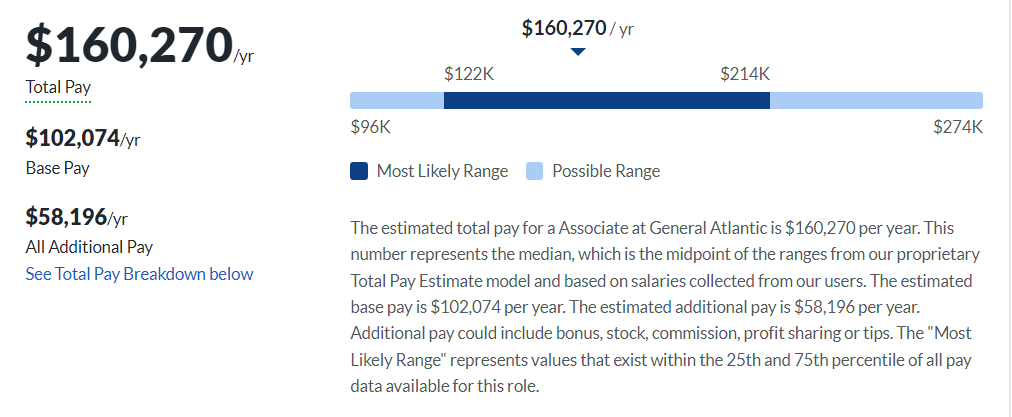

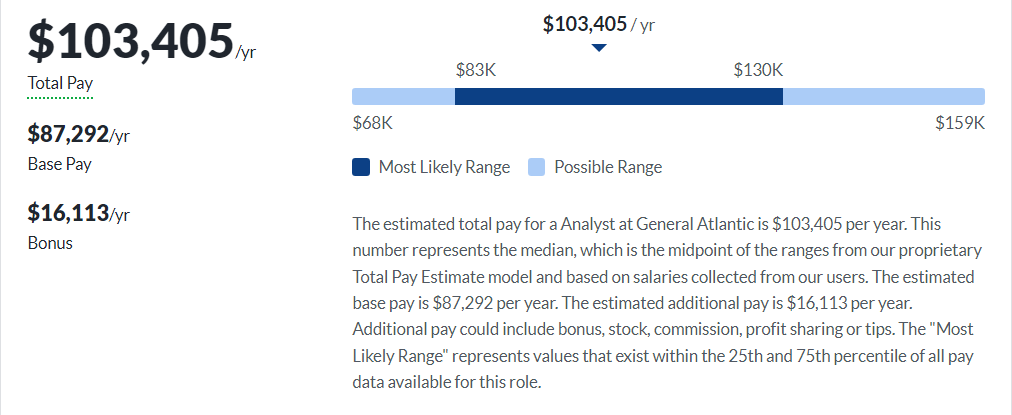

According to Glassdoor, you can earn an estimated total pay of $160,270 as an Associate at General Atlantic. And if you’re an Analyst, you can make around $103,405 per year.

These figures may change depending on your experience and qualifications.

Associate

Analyst

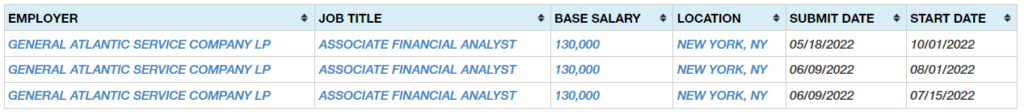

Based on other publicly available data, recent associates have earned salaries of $130,000 per year, while there is no recent data for analyst hires.

General Atlantic Careers, Jobs, & Internships

If you are interested in exploring job opportunities at General Atlantic, feel free to visit our job board, which lists all open positions at the firm and the likes.

General Atlantic Portfolio & Investments

General Atlantic is an expert when it comes to identifying high-growth firms with significant potential. According to Crunchbase, they made over 420 investments across two funds with notable investments on Airbnb, Alibaba, and Facebook.

Notable transaction: Facebook

In 2009, General Atlantic made a $60 million investment on Facebook (now Meta) for a 0.1% stake.

This skyrocketed Facebook’s valuation – reaching more than $100 billion during its 2012 IPO. General Atlantic sold a portion of its stake during the said IPO making an impressive return.

Today, Facebook is valued at over $1 trillion and General Atlantic has been a part of their successful growth. This only proves General Atlantic’s expertise on picking firms with high-growth potential and making long-term investments.

Next Steps

If you’re looking to land a finance role in growth equity firms like General Atlantic, the Growth Equity Interview Guide can equip you with the right knowledge, frameworks, and insider tips.

This competitive advantage will help you ace your interviews and maximize your chances of securing a role in finance.

Break Into Growth Equity

Break Into Growth Equity