JMI Equity Overview

JMI Equity is a growth equity firm which invests primarily in software companies with:

- Proven business models

- Rich intellectual property

- High recurring revenue

- Long-term growth potential

The typical investments of JMI Equity range from $25 million to $250 million, and they are flexible as to the size, form, and structure of the investments they make.

The headquarters of JMI Capital is situated in Baltimore, with additional offices in San Diego and Washington D.C.

Harry Gruner founded JMI Equity in 1992 and also acts as the co-managing general partner of the firm. He had the privilege of participating in the growth of the software industry from infancy to where it is today.

Since their founding, JMI Equity has focused on supporting software firms through capital investments, advice, team-building, and effective value creation strategies.

JMI Equity AUM

As per the most recent regulatory filings, JMI Equity has $7.5 billion in assets under management as of April 22, 2022.

JMI Equity Interview Process & Questions

Firms can always modify their interview process with each candidate. However, when you apply at JMI Equity (or similar firms) and you get the chance to be invited for interview, you can likely expect the following:

- You’ll go through 4-6 rounds of interview

- Junior investment professionals handle the initial rounds, while the more senior folks conduct the later rounds

- Unless it’s an “on-cycle” or “on-campus” recruiting, the entire interview process can last several weeks

The interviews at JMI Equity will be a combination of fit questions, behavioral questions, and technical/investing questions.

Check out my Growth Equity Interview Guide if you need help preparing for interviews.

Why JMI Equity

“Why this firm” almost always comes up during interviews, and it’s one of the most important questions you need to answer properly.

If you’ve met professionals from their firm and had the chance to make connections, this is the perfect time to mention them and how they’ve made a really positive impression on you.

It also helps a lot if you learn more about the firm. One way you can do that is to listen to interviews with its founders, executives, and investors.

Listen to this interesting discussion between Mistral Venture Partners Founding Partner, Code Cubitt, and JMI Equity Founder and Managing GP, Harry Gruner:

More interviews

- Interview with Harry Gruner of JMI Equity

- Discussion with Peter Arrowsmith, a General Partner of JMI Equity

JMI Equity Case Study

Case studies are a common part of interviews. Firms use case studies to evaluate your technical knowledge and communication skills. The typical case study at firms like JMI Equity consists of financial modeling and investment recommendations. But for junior roles, interviewees are often required to conduct cold calling case studies as well.

If you’re looking for an in-depth preparation guide for case studies, check out my Growth Equity Interview Guide.

JMI Equity Salary & Compensation

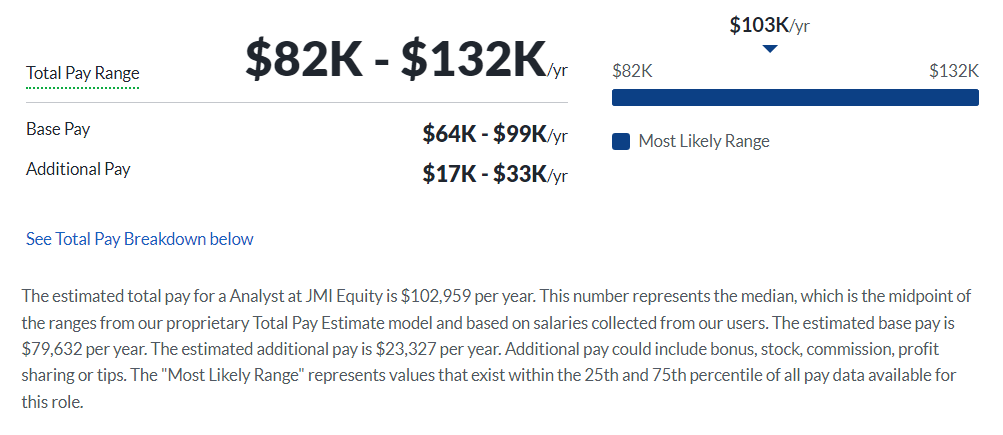

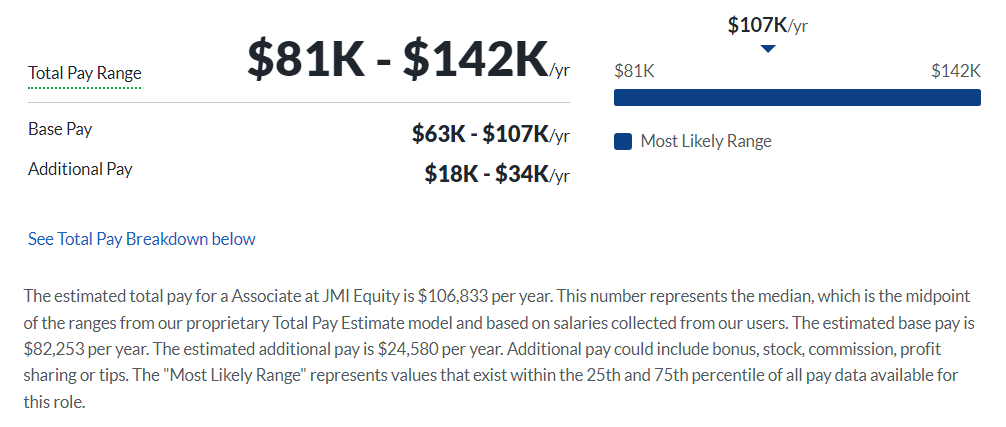

According to Glassdoor, JMI Equity offers an average total pay of $102,959 to Analysts and around $106,833 annual pay to Associates. These figures may still vary depending on your experience and qualifications.

Analyst

Associate

JMI Equity Careers, Jobs, & Internships

Browse through our job board to see open roles at JMI Equity. We feature active vacant positions from other similar firms as well.

JMI Equity Portfolio & Investments

JMI Equity has 168 investments across five funds, as per Crunchbase. The firm primarily invests in software companies. Some of their notable deals include RainFocus, Huntress, and Vence – which are all software and tech-based firms.

Notable Transaction: TimelyMD

TimelyMD provides telehealth services particularly to universities and colleges.

They experienced unprecedented growth due to the surge in demand for telemedicine and teletherapy during the COVID-19 pandemic.

Two factors also contributed to their success:

- They have licensed health-service providers available 24/7 across 50 states.

- They have immediate & scheduled mental health counseling, psychiatry, and health coaching services – all designed specifically for students, offered for free, without the hassle of traditional health insurance.

Due to these factors, TimelyMD became a trusted provider of telehealth services to colleges and universities in the US.

In January 2021, JMI Equity invested $60 million in TimelyMD.

This investment allowed TimelyMD to improve students’ virtual care experience, health literacy at schools, and service capacity.

Next Steps

If you are passionate about helping software companies grow and make an impact on their customer-base, JMI Equity is definitely a good choice to build your finance career. But in order to secure a role at JMI Equity (or similar firms), you have to stand out from other qualified candidates and impress your interviewers with your answers, knowledge, and skills.

That’s where my Growth Equity Interview Guide comes in.

This self-paced online course will help you better prepare for interviews through its step-by-step lessons, expert tips, and in-depth discussion of the topics that will most get asked by your interviewers.

Join countless professionals who have successfully made the leap into finance with the help of this course. Start learning today!

Break Into Growth Equity

Break Into Growth Equity