K1 Investment Management Overview

K1 Investment Management is a private equity firm that invests in high growth potential, enterprise software companies.

The firm often supports companies that have a proven business model and want to accelerate their growth through improvement in operations and funding.

K1 aims to partner with software teams to build global category leaders in several sectors such as security, fintech, and enterprise softwares.

Their approach includes providing a dedicated K1 Operations Team that helps implement high-performance strategies across all key functions. The same team stays with their chosen companies from start to finish.

Neil Malik founded K1 Investment Management in 2011 with headquarters currently located in Manhattan Beach, California.

K1 Investment Management AUM

From the most recent regulatory filings, K1 Investment Management has $13.2 billion in assets under management as of March 30, 2022.

K1 Investment Management Interview Process & Questions

K1 Investment Management and similar firms can always make changes in their interview process with each applicant. However, there are a few consistencies in the nature of their interview process which you can anticipate:

- The interview consists of approximately 4-6 rounds

- The initial rounds are under the supervision of junior investment professionals while the more senior staff conduct the later rounds

- Unless it’s an “on-cycle” or “on-campus” recruiting, expect the entire process to last multiple weeks

K1 Investment Management qualifies their candidates through a combination of fit questions, behavioral questions, and technical/investing questions.

To ace your interviews, check out and learn from my Growth Equity Interview Guide.

Why K1 Investment Management

Interviewers at investment firms almost always ask the question “Why this firm?” and K1 Investment Management is no exception.

When you encounter this common question, it’s best to mention whoever you’ve met at the firm during your networking efforts and how they’ve made a really positive impression on you.

You should also try to learn more about the firm through listening to interviews with its founders, investors, and key personnels.

For example, here’s an insightful interview with Denmark West, K1 Investment Management adviser:

K1 Investment Management Case Study

For investment firms like K1 Investment Management, case studies are a powerful tool to assess their candidate’s technical knowledge and ability to communicate. That’s why case studies almost always show up during interviews.

Most case studies focus on investment recommendations and financial modeling. But for junior roles, cold calling case study may also be required.

Check out my Growth Equity Interview Guide to see my in-depth discussion of case studies plus examples, expert tips, and frameworks.

K1 Investment Management Salary & Compensation

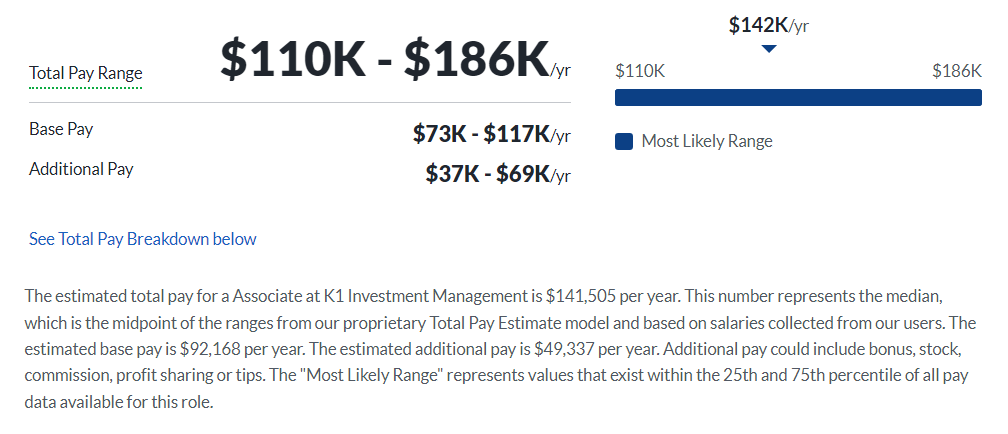

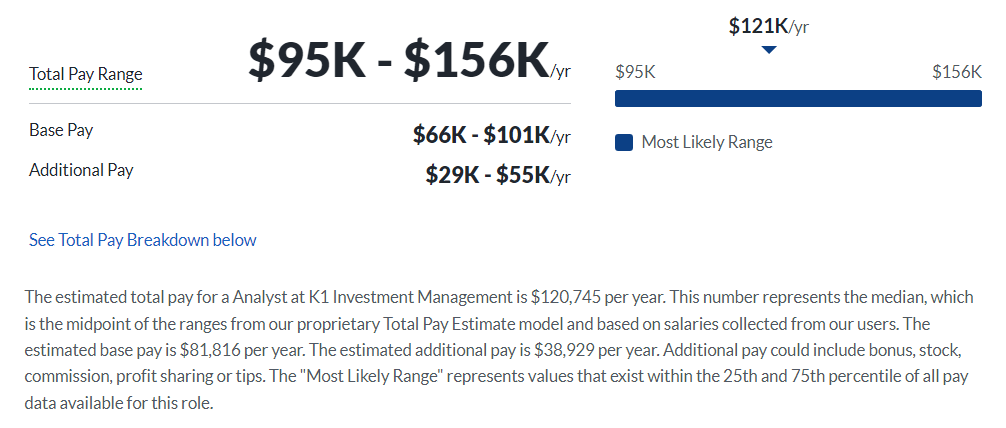

The estimated total pay for Associates at K1 Investment Management falls within $110,000 and $186,000, while the annual salary for Analysts are within $95,000 and $156,000, as per Glassdoor.

These figures may vary depending on your experience and qualifications but they should give you a good idea of the earning potential at K1 Investment Management.

Associate

Analyst

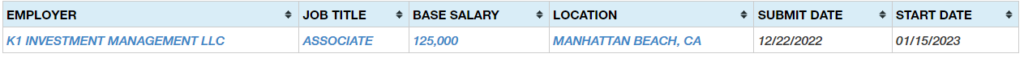

Based on other publicly available data, recent associates at K1 Investment Management have earned salaries of $125,000 per year, while there is no recent data for analyst hires.

K1 Investment Management Careers, Jobs, & Internships

To check recent job openings at K1 Investment Management, check out our job board where we also feature open roles from similar firms.

K1 Investment Management Portfolio & Investments

K1 Investment Management has 71 investments and manages 5 funds as per Crunchbase.

The firm has invested in various sectors such as HR Tech, Legal Tech, and GRC Software. Some of their notable deals include the acquisition of SecureAuth, Jobvite, and Allegro MicroSystems.

Notable Transaction: Atera

Atera is an Israeli software and services company that helps businesses manage and monitor their IT operations.

In February 2021, K1 Investment Management decided to support Atera through a $25 million investment – which also made K1 the first institutional investor in the company.

K1 took a minority stake in Atera Networks with plans to help the Tel Aviv-based company support product development, marketing, and expansion.

Atera is K1’s eighth deal in Israel.

Next Steps

K1 Investment Management is just one of many investment firms that provide amazing opportunities to professionals who want to get into the world of finance and investing. If you’re interested in working at such firms, I suggest you check my Growth Equity Interview Guide.

This self-paced online course will show you everything you need to gain a competitive edge, ace your interviews, and maximize your chances of securing a role in finance. Start learning today and make your interview preparation easier and more effective!

Break Into Growth Equity

Break Into Growth Equity