KKR & Co. Inc. Overview

KKR & Co. Inc. is a global investment firm that manages multiple asset classes like private equity, real estate, energy, credit, and infrastructure.

The firm generates ROI for its investors through a long-term, disciplined approach through the help of A-level investment professionals. KKR does not only use their investors’ funds, but also involves its own capital when providing financing solutions.

Jerome Kohlberg, Jr. and cousins Henry Kravis and George R. Roberts worked together to build KKR & Co. Inc in 1976.

At the early times of KKR, the firm has done impressive transactions such as the 1989 LBO of RJR Nabisco and the 2007 LBO of TXU which is the largest buyout completed to date.

KKR & Co. Inc. is currently headquartered in New York and has offices in 21 cities around the world. Also, in January 2023, the firm realized its intentions to occupy Meta’s Office Space at 30 Hudson Yards.

In 2009, KKR listed 204.9 million common units worth around $2.2 billion, trading under “KKR” on the NYSE. The units represented 30% interest in KKR, and the principals held the remaining 70%.

KKR & Co. Inc. AUM

As per the most recent regulatory filings, KKR & Co. Inc. has $174.3 billion in assets under management as of May 3, 2022.

KKR & Co. Inc. Interview Process & Questions

Investment firms have the freedom to modify their interview process with each applicant, but if you interview at KKR & Co. Inc. (or similar firms), you can expect the following:

- Approximately 4-6 rounds of interview

- Junior investment professionals will be in charge for the initial rounds of interview, while the more senior staff will do the latter part

- Interview process can take up several weeks, unless it’s “on-cycle” or “on-campus recruiting event

The interviews at KKR & Co. Inc. will comprise behavioral, fit, and technical / investing questions. So it’s best to anticipate and prepare for any questions that may fall under these categories.

Check out my Growth Equity Interview Guide for more detailed interview insights and lessons.

Why KKR & Co. Inc.

When applying for a role at KKR & Co. Inc. or similar firms, there’s a high chance that you’ll get the questions, “Why this firm?”

This is the perfect time to share any experience and insights you’ve had during your networking efforts with KKR & Co. Inc. employees. Tell the interviewer about the positive impression they left on you and the good things they told you about the firm.

Another thing you can do to come up with an impressive answer to this question is to learn more about the firm from the perspective of its founders, management teams, and key personnels.

For example, listen to this interview with John Pfeffer, former Partner at KKR.

More interviews:

- Interview with Joe Bae, KKR co-CEO (CNBC Television)

- Discussion with George Roberts & Henry Kravis, co-founders of KKR

KKR & Co. Inc. Case Study

Case studies almost always show up during the interview process.

The case studies help firms like KKR & Co. Inc. evaluate your technical knowledge and communication skills.

Financial modeling and investment recommendations are the two main focuses of case studies. But for junior roles, cold calling case studies may be included as well.

To learn more about case studies preparation, take a moment to check my Growth Equity Interview Guide.

KKR & Co. Inc. Salary & Compensation

KKR & Co. Inc. makes sure that their investment professionals are well-compensated for their hard work and contribution to the firm’s growth.

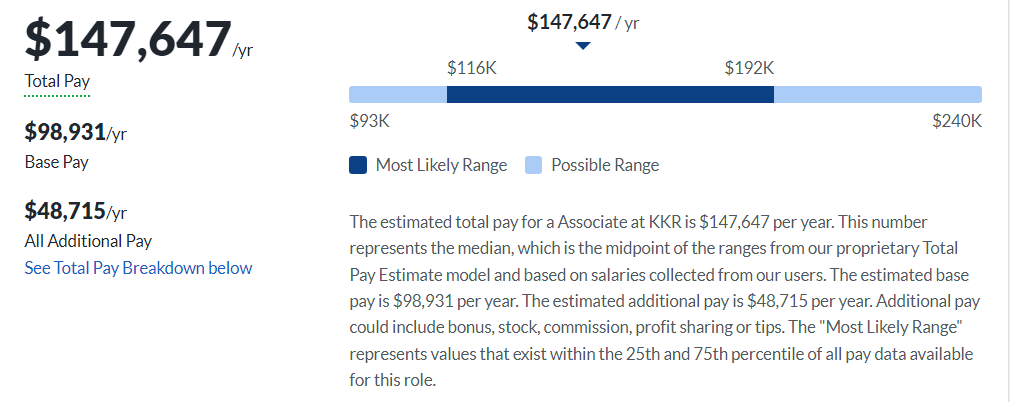

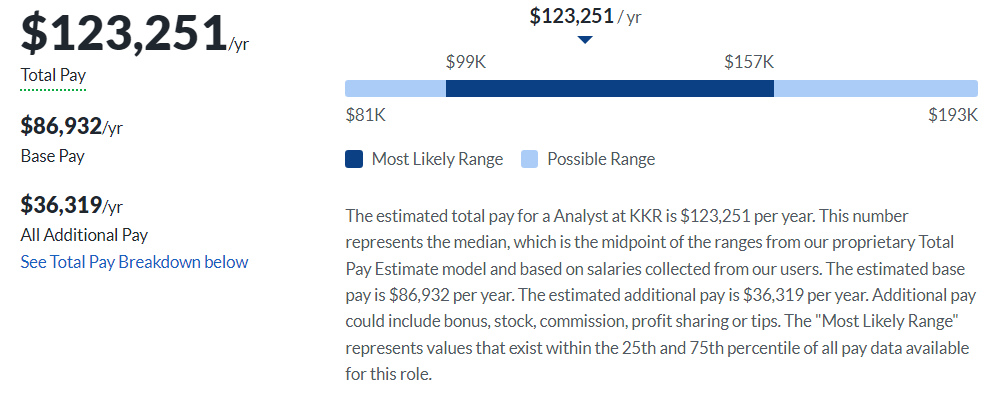

Based on the publicly available data on Glassdoor, you can earn an estimated total pay of $147,647 at KKR & Co. Inc. as an Associate at KKR & Co. Inc. and around $123,251 per year as an Analyst.

These figures may slightly vary depending on your level of experience and qualifications.

Associate

Analyst

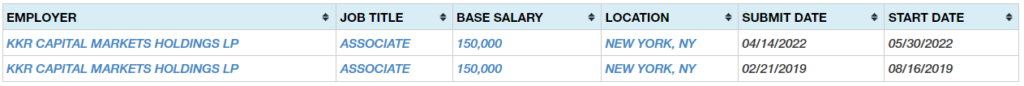

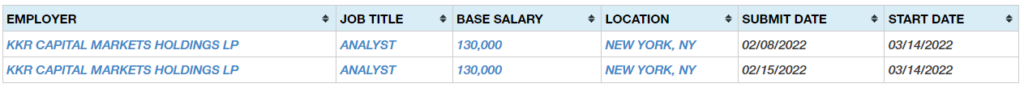

Based on other publicly available data, recent Associates have earned salaries of $150,000 per year, while Analysts have made around $130,000 per year.

KKR & Co. Inc. Careers, Jobs, & Internships

Check out our job board to see vacancies at KKR & Co. Inc. You can also find other open roles from other similar firms there.

KKR & Co. Inc. Portfolio & Investments

KKR & Co. Inc. prides itself for managing a wide range of funds across different asset classes such as real estate, private equity, and credit. The firm invests in businesses from various industries, regions, and stages of development.

According to Crunchbase, KKR & Co. Inc. has invested in more than 296 firms across its 32 funds.

Notable deals of the firm include the acquisition of BMC Software – a provider of enterprise IT management software, and US Foods which is a foodservice distributor.

KKR also invested in Advanced Navigation which develops advanced navigation systems in the defense industry.

Notable Transaction: FGS Global

In April 2023, KKR acquired a 30% stake in FGS Global which made this firm’s value rise to $1.425 billion. FGS operates as a strategic advisor on business-critical financial communications.

Under their terms of agreement, WPP will keep a majority stake and FGS employees will remain as substantial shareholders, while KKR takes a minority position.

As per FGS, they plan to expand their employee ownership to include half of its staff worldwide.

Next Steps

Increase your chances of breaking into the growth equity industry through my Growth Equity Interview Guide.

This self-paced comprehensive online course will equip you with the knowledge and interview strategies that will help you ace your interviews.

Get the course now and level up yourself to secure a role in growth equity!

Break Into Growth Equity

Break Into Growth Equity