Lead Edge Capital Overview

Lead Edge Capital is a growth equity firm which offers its entrepreneurs flexible capital and extensive domain expertise through its robust Limited Partner Network, a global advisory group of entrepreneurs, executives, and dealmakers who built and run some of the world’s most successful companies.

The firm leverages its LPs to connect companies with the customers, partners, talent, and advisors needed to accelerate success. The investment of Lead Edge Capital ranges from $10 million to $200 million across private and public technology companies.

Aside from funding, Lead Edge Capital also helps their portfolio companies grow through:

- Business Development

- Advisory

- Recruiting

Lead Edge Capital was founded in 2009 by Mitchell Green and has offices in New York City and Santa Barbara, California.

Lead Edge Capital AUM

According to most recent regulatory filings, Lead Edge Capital manages $3.5 billion of assets as of April 11, 2022.

Lead Edge Capital Interview Process & Questions

The interview process with each candidate can always change. However, if you interview at Lead Edge Capital (or a firm like it), you can expect a few consistencies in the nature of their process:

- Interview process is comprised of 4-6 rounds

- Junior investment professionals or the HR team tend to conduct the initial interviews, while the later rounds are under the supervision of more senior staff

- Firms often select the right candidate after several weeks – unless it’s “on-cycle” or “on-campus” recruiting

Interviews at Lead Edge Capital will have you answer a mixture of fit questions, behavioral questions, and technical / investing questions.

To help you prepare for interviews, I suggest you check out my Growth Equity Interview Guide.

Why Lead Edge Capital

“Why this firm” is one of the most common questions interviewers ask.

The reason is firms like to know if you have specific reasons why you chose their firm and also to check if you’re a good match for the role.

To avoid giving a generic answer, do some research about the firm and try to incorporate what you gathered in your answer. One approach is to listen to interviews with the firm’s investors, founders, and management team.

This interview with Lead Edge Capital Founding Partner Mitchell Green is a great start:

More interviews

- Interview with Mitchell Green, Lead Edge Capital Founding Partner

- CNBC Interview with Mitchell Green

- Mitchell Green discuss if he’d call China investable as the crackdown continues

Lead Edge Capital Case Study

When you apply at Lead Edge Capital or similar firms, you have to prepare for case studies because they almost always show up during interviews. Case studies help firms evaluate your technical knowledge and communication skills.

Most case studies focus on investment recommendations and financial modeling. However, you may also be required to conduct a cold calling case study if you’re applying for a junior role.

In any case, my in-depth discussion of case studies inside my Growth Equity Interview Guide can definitely help you a lot.

Lead Edge Capital Salary & Compensation

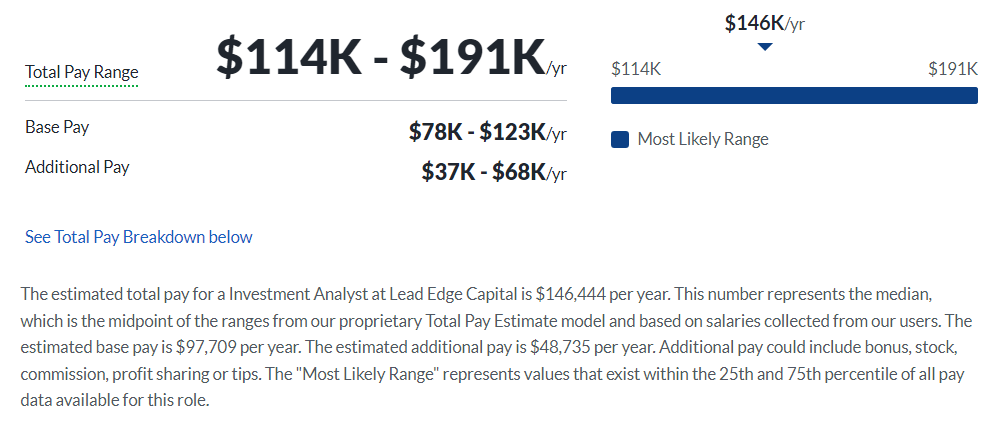

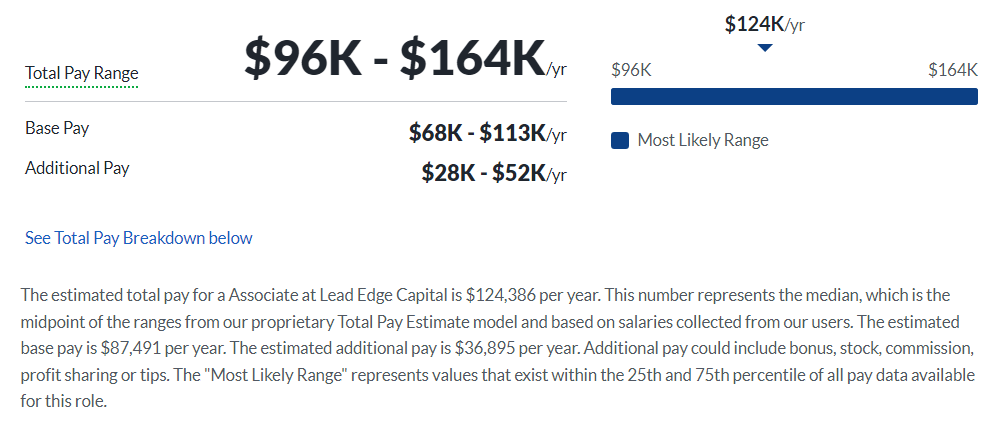

Lead Edge Capital offers an estimated total pay of $146,666 per year for Analysts and $124,383 per year for Associates. These figures represent the median, and can vary depending on your level of experience and qualifications.

Analyst

Associate

Lead Edge Capital Careers, Jobs, & Internships

Head over to our job board to see open roles at Lead Edge Capital and all other job vacancies at similar firms.

Lead Edge Capital Portfolio & Investments

Since inception, Lead Edge Capital has made 55+ investments across six funds, and built a portfolio of companies from internet, software, consumer, and tech-enabled services sectors. Some of their notable deals include Asana, Spotify, and Wise.

Notable Transaction: Wise

Wise is a global technology company that is one of the top ways to move money around the world.

Individuals and businesses use Wise to hold over 50 currencies, make money transfers between countries, and spend money abroad.

On May 21, 2019, Wise received a $292 million secondary funding round which doubled its valuation to $3.5 billion.

Lead Edge Capital, together with Lone Pine Capital and Vitruvian Capital, were the growth capital investors who led the round.

This is Lead Edge Capital’s 1st transaction in the Financial Services sector and 1st transaction in the United Kingdom.

Next Steps

Lead Edge Capital is making waves in the finance world. If you want to be part of their professional team, I suggest you check out my Growth Equity Interview Guide.

This self-paced online course will help you ace your interviews so you can maximize your chances of landing a role in finance. Growth Equity Interview Guide contains step-by-step lessons on topics like case studies, valuation, and many more – which often show up during interviews.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity