Madison Dearborn Partners Overview

Madison Dearborn Partners (MDP) is a private equity firm that collaborates with excellent management teams to create growth and achieve significant long-term value appreciation not only for its portfolio companies but also for its limited partners.

MDP has expertise in executing leveraged buyouts of privately owned or publicly listed companies, as well as divisions of larger corporations.

They also specialize in recapitalizing family-owned or closely held businesses, restructuring balance sheets, providing financing for acquisitions, and making growth capital investments in established companies.

The firm implements an industry-focused investment approach and focuses on five sectors:

- Basic Industries

- Business & Government Software and Services

- Financial & Transaction Services

- Healthcare

- Telecom, Media & Technology Services.

Madison Dearborn Partners was founded in 1992 by John A Canning Jr, Paul J. Finnegan, Samuel M. Mencoff, and Nicholas W. Alexos, and is currently located in Chicago, Illinois.

Madison Dearborn Partners AUM

As of March 31, 2022, Madison Dearborn Partners has $17.9 billion assets under management based on the most recent regulatory filings.

Madison Dearborn Partners Interview Process & Questions

Firms have the flexibility to change their interview process for each candidate, but if you interview at Madison Dearborn Partners (or a firm like it), you’ll likely experience the following:

- 4-6 rounds of interview

- Junior investment professionals or the HR team supervise your initial interviews while more senior folks lead the later rounds

- The entire process can take several weeks, unless it’s “on-cycle” or “on-campus” recruiting

You can expect a combination of interview questions relating to suitability, behavior, and technical / investing expertise when you interview at Madison Dearborn Partners.

Check out my Growth Equity Interview Guide if you’re looking for help with your interview preparation.

Why Madison Dearborn Partners

“Why this firm” is one of the commonly asked questions during interviews. This question is crucial because it reveals how well-researched and compelling your reasons are for choosing their firm to work for.

If you’ve had the chance to meet employees at the firm, remember to mention whoever you’ve interacted with and how they’ve made a really positive impression on you.

Try to learn more about the firm as well because it can help you come up with an answer that’s relevant to the firm’s vision, direction, and values. One of the best ways to do this is to listen to interviews with its founders, investors, and employees.

For starters, here are great interviews and talks from Madison Dearborn Partners’ leadership:

- Insights from Michael Cole, Managing Director @ MDP

- Interview with Madison Dearborn Partners Chairman John Canning Jr.

Madison Dearborn Partners Case Study

Sufficient technical knowledge and good communication skills are two important attributes that firms consider when selecting their ideal candidate. Firms use case studies to assess these qualities.

Most case studies at firms like Madison Dearborn Partners will have you conduct financial modeling and investment recommendations. However, junior roles are often required to do a cold calling case study as well.

To better prepare for case studies, check out my course Growth Equity Interview Guide.

Madison Dearborn Partners Salary & Compensation

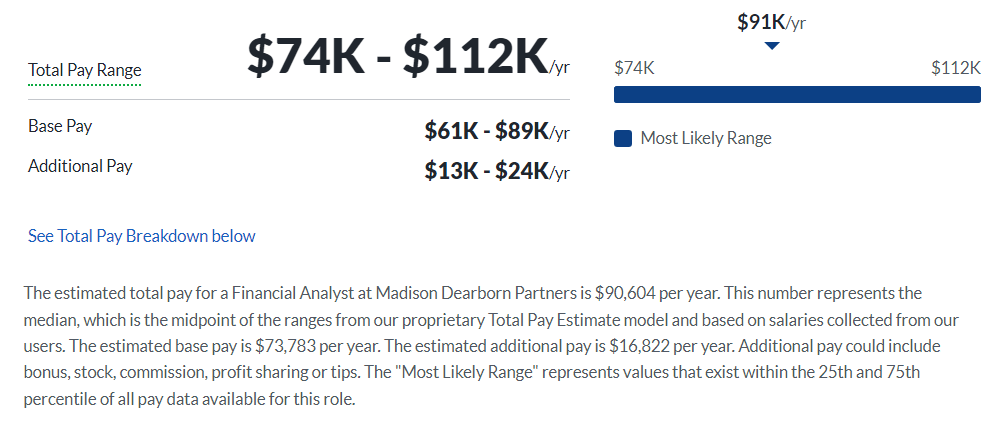

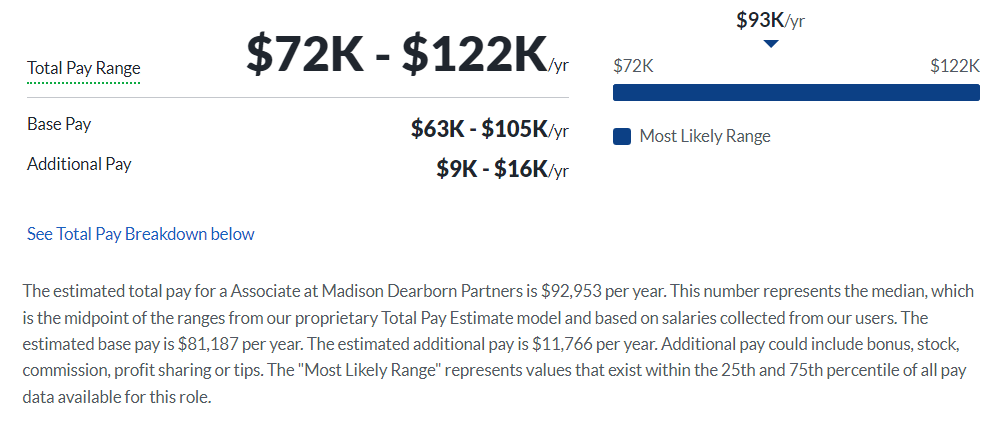

You can expect an estimated total pay of $90,604 per year if you’re working as an analyst at Madison Dearborn Partners, and $92,953 per year if you’re an associate. These figures are based from Glassdoor and represent the median.

The salaries can still vary depending on many factors such as your education, years of experience, and qualifications.

Analyst

Associate

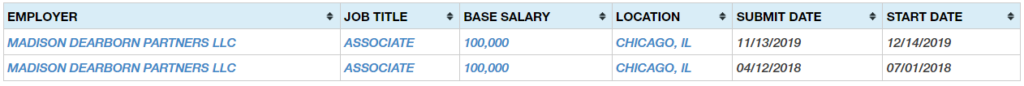

From other publicly available data, recent associates at Madison Dearborn Partners have a base salary of 100,000 per year, while there’s no recent data for analysts.

Madison Dearborn Partners Careers, Jobs, & Internships

To view open positions at Madison Dearborn Partners, check out our job board which also features other job vacancies for similar firms.

Madison Dearborn Partners Portfolio & Investments

Madison Dearborn Partners has invested in more than 150 companies across five industries since inception, and operates 6 funds. Some of their notable deals include Paypal, Bluecat, and CapitalSource.

Notable Transaction: Ankura Consulting Group

Ankura Consulting Group is a business advisory firm that provides consulting services.

The company specializes in expert witness, litigation support, bankruptcy and corporate restructuring, forensic accounting, general management consulting services, and geopolitical risk assessment.

On March 3, 2016, Madison Dearborn Partners made a strategic growth commitment of $100 million to Ankura Consulting Group.

The fund was allocated to support Ankura’s continued expansion so they can further attract new clients as well as best talents.

Next Steps

Madison Dearborn Partners is just one of many firms that can provide you with an exciting career opportunity in finance. If you want to land a role at any of these firms, I highly suggest you check out my Growth Equity Interview Guide.

This self-paced online course will equip you with the right knowledge that you’ll need to ace your interviews. Check out the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity