PSG Overview

PSG is a growth equity firm that primarily invests in software and tech-enabled service companies to help them achieve transformational growth, capitalize on strategic opportunities, and create a strong team.

The firm partners with software companies that have reached an inflection point through demonstrated product-market fit, customer focus, and rapid organic growth.

Mark Hastings, CEO of PSG, founded the firm in 2014. He was also the founder and managing partner of Garvin Hill Capital Partners.

PSG is located in Boston with additional offices at Kansas City, London, Paris, Madrid, and Tel Aviv.

PSG AUM

According to most recent regulatory filings, PSG manages $16.7 billion in assets as of March 31, 2022.

PSG Interview Process & Questions

Firms can always make changes in their interview process with each candidate. However, if you interview at PSG or similar firms, you can expect consistencies in the overall nature of the process such as:

- Candidates go through 4 to 6 rounds of interview

- Junior investment professionals or the HR team handle the initial interviews, while more senior folks conduct the later rounds

- The entire process can last multiple weeks – unless it’s “on-cycle” or “on-campus” recruiting activity

Interviews at PSG will consist of fit questions, behavioral questions, and technical / investing questions.

Have a look at my Growth Equity Interview Guide if you need help preparing for interviews.

Why PSG

One of the most important and frequently asked questions is “Why this firm?”

If you’ve done networking and met current or former employees at the firm, this is a great time to mention them and how they’ve influenced your decision of applying at the firm.

Learning more about the firm is also an amazing way to craft a solid answer for the “Why this firm” question. You can listen to interviews with the firm’s founders, investors, and key personnels.

Check this great interview with Shaun le Roux, Portfolio Manager at PSG:

More interview

PSG Case Study

Case studies are an integral part of interviews so be prepared for it. Firms use case studies to assess the level of technical knowledge and communication skills of each candidate.

Most of the time, investment recommendations and financial modeling are the main focus on case studies at firms like PSG. However, junior roles are often required to do cold calling case study as well.

I’ve discussed case studies in more detail inside my Growth Equity Interview Guide. Check it out if you need help preparing for it.

PSG Salary & Compensation

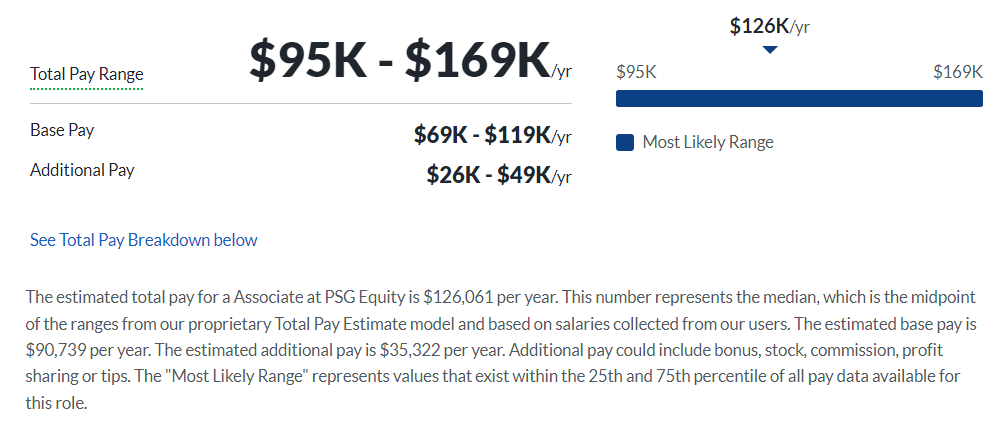

PSG offers an estimated total pay of $126,061 per year to Associates as per Glassdoor’s data. This figure represents the median, and can still vary depending on the individual’s level of experience and qualifications.

Associate

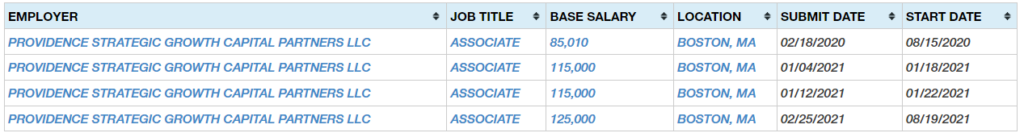

Recent associates at PSG have earned salaries of $125,000 per year based on other publicly available data, while there is no recent data for analyst hires.

PSG Careers, Jobs, & Internships

To view job vacancies at PSG, check out our job board where we feature all open positions for them and other similar firms.

PSG Portfolio & Investments

Since 2014, PSG has made 115+ investments and operates eight funds according to Crunchbase and PSG’s record. Some of the firm’s notable deals include Backlight, DigitalEd, and EverCommerce.

Notable Transaction: N2F

N2F is an expense management solution that digitizes the entire process of approving, logging, and archiving expense reports which simplifies the life of accountants, employees, and managers.

In March 2023, N2F received a EUR 24 million strategic growth investment from PSG – which represents PSG’s ninth platform investment in France.

Edward Hughes, Managing Director at PSG said, “With N2F, we believe we have identified one of the best software solutions in the market and with its established track record of innovation and success, we believe the company has tremendous growth potential. We are excited to partner with Nicolas and the N2F team and look forward to growing the business together.”

PSG’s resources will support N2F’s ambitious plan of recruiting 200 employees over the next five years and accelerating its European expansion, while continuing their R&D efforts.

Next Steps

Looking to land a role at PSG or any similar firm? Make sure to check out my Growth Equity Interview Guide. This self-paced online course has everything you need to ace your interviews and maximize your chances of landing your dream role. Growth Equity Interview Guide already helped countless professionals break into the world of finance. Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity