Summit Partners Overview

Summit Partners is a global growth equity firm that invests in rapidly growing industries including technology and healthcare.

The firm started in 1984 when Gregory Avis, Roe Stamps, and Stephen Woodsum had the vision of creating a growth equity firm that would not only provide capital to entrepreneurs, but also strategic guidance, operational expertise, and long-term assistance.

The headquarters of Summit Partners is located in Boston, Massachusetts – with additional offices in Menlo Park, New York, London, and other cities across the globe.

Since its founding, Summit Partners has already invested in more than 500 firms worldwide with over $35 billion in capital commitments. They’re also consistently recognized as one of the top private equity and growth equity firms in the world.

As of now, Summit Partners remains a privately held firm.

But the firm has a track record of successfully raising multiple funds, with its most recent fund – Summit Partners Growth Equity Fund X. The said fundraising effort was oversubscribed which shows the trust and demand for Summit Partners’ investment approach and history.

Summit Partners AUM

According to most recent regulatory filings (June 16, 2022), Summit Partners has $35.2B in assets under management

Summit Partners Interview Process & Questions

Interview process can be different for each applicant. However, if you’re attending an interview with Summit Partners or the likes, you can expect the following:

- Your interview will have 4-6 rounds

- The junior investment professionals will conduct the initial interview, while the later rounds are handled by more senior staff

- The entire interview process could take several weeks to complete, unless it’s on-cycle or on-campus recruiting.

At Summit Partners, the interviews will most likely consist of fit-related, behavioral, and technical or investment-related questions.

Check out our Growth Equity Interview Guide if you want help preparing for interviews.

Why Summit Partners

The most common interview question is “Why this firm?”

If you’ve made connections through your networking efforts, this is the best time to mention the individuals you’ve met and how they made a positive impression on you.

To gain insights into the firm and better prepare for this interview question, it’s highly advisable to listen to the firm’s executives and management team expressing their thoughts.

Check out this compelling interview featuring Scott Collins, Managing Director at Summit Partners:

More interviews

- Interview with Bruce Evans, former Managing Director of Summit Partners

- Interview with Cody Lee, VP at Summit Partners (Ignite Digital Marketing Podcast)

- Summit Partners’ Michael Medici on Mavrck Deal (Bloomberg)

Summit Partners Case Study

When you interview for Summit Partners, it’s very likely that you’ll be presented with a case study. This is their way of checking if you have technical expertise and communication skills, so be ready.

At Summit Partners, the case studies typically revolve around financial modeling and investment recommendations.

But if you’re applying for a junior role, you might also get asked to do cold-calling case study to evaluate your sales and persuasion skills.

Check out our comprehensive course if you want help preparing for growth equity interviews.

Summit Partners Salary & Compensation

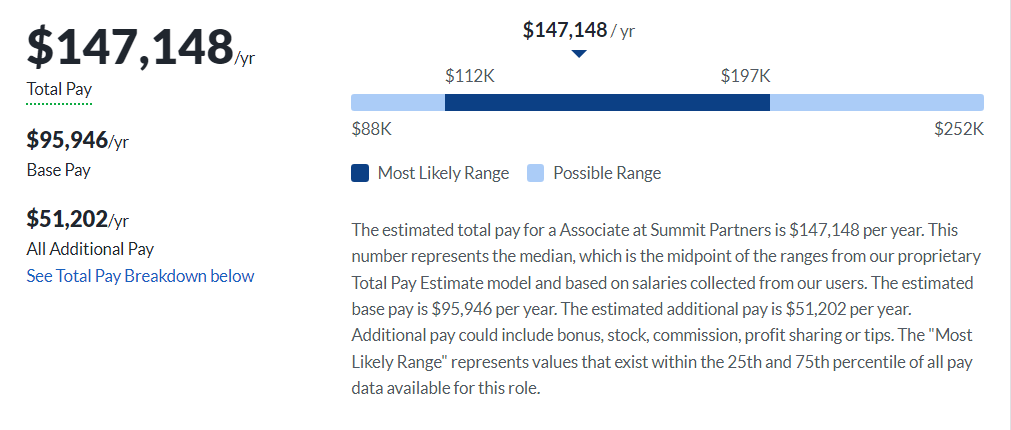

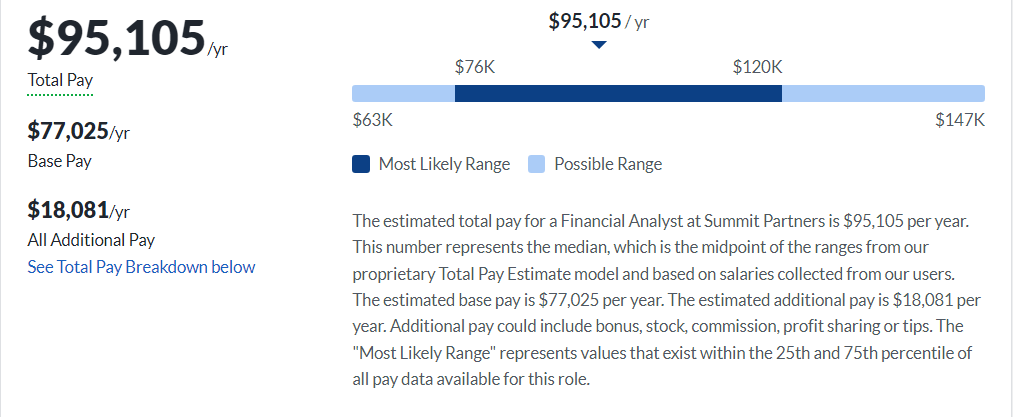

According to Glassdoor, the Associates and Analysts at Summit Partners typically make $147,148 and $95,105 per year, respectively.

Keep in mind that your experience and qualifications may affect these estimated total pay.

Associate

Analyst

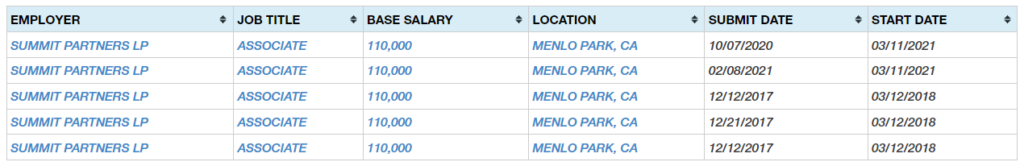

Based on other publicly available data, recent associates have earned salaries of $110,000 per year, while there is no recent data for analyst hires.

Summit Partners Careers, Jobs, & Internships

Browse through our growth equity job board if you’re interested in landing a job at Summit Partners. You can also browse through other vacancies at similar firms through our job board.

Summit Partners Portfolio & Investments

According to Crunchbase, Summit Partners has made over 428 investments across 25 funds. Summit Partners has a solid experience of making strategic investment in firms on different stages.

Notable deals include the acquisition of Webex Communications (by Cisco Systems) and their investment in Avast Software (by CVC Capital Partners).

Notable transaction: Uber Technologies

In 2011, Summit Partners invested in Uber Technologies which served as the early-stage funding for the ride-hailing firm.

This investment helped Uber to expand its operations and create new services such as UberEATS and UberPOOL.

So as a result, Uber has become one of the world’s most valuable companies with a market cap of over $100 billion. This shows that Summit Partners is one of the top venture capital firms.

Next Steps

Breaking into the growth equity industry will require you to make it through their competitive and challenging interview process.

With the help of my Growth Equity Interview Guide, you can drastically increase your chances of making a positive impression during the interview.

Because when you enroll in this course, you’ll gain access to frameworks, knowledge, and preparation you need to show up confidently in interviews and secure a role in growth equity.

This course will give you a competitive advantage in the job market and position yourself as the best candidate for the role.

Break Into Growth Equity

Break Into Growth Equity