TCV Overview

TCMI, Inc. or better known as TCV (Technology Crossover Ventures) provides capital to multi-stage firms in the tech space.

TCV firm has a solid track-record of supporting private and public businesses that evolve into big players in the internet, fintech, software, and enterprise IT.

The firm has invested over $17 billion in over 350 tech companies since inception.

Some of the firms they’ve invested in are Airbnb, Facebook, GoDaddy, Spotify, WorldRemit, Zillow, Netflix, and a lot more.

Jay Hoag and Rick Kimball founded TCV in 1995. Before TCV, Jay was a Managing Director at Chancellor Capital Management and a tech investor for 40 years.

After 26 years, TCV was listed on the Nasdaq under “TCVA”.

TCV raised $350 million through their initial public offering of 35 million Class A ordinary shares at $10 per share.

TCV AUM

TCV has $25.1 billion in assets under management as of March 31, 2022 according to most recent regulatory filings.

TCV Interview Process & Questions

Interview process can vary with each candidate, however, if you interview at TCV (or a similar firm), there are some consistencies:

- Candidate will go through 4-6 rounds of interviews

- Junior investment professionals conduct the first few rounds while the more senior staff handle the latter part of the interview.

- The whole interview process could take multiple weeks – unless it’s “on-cycle” or “on-campus” recruiting.

When you interview at TCV, expect to get a blend of fit, behavioral, and technical / investing questions so make the necessary preparations beforehand.

Just in case you need help preparing for your interviews, feel free to check out my Growth Equity Interview Guide.

Why TCV

Interviewers at TCV and similar firms almost always ask “Why this firm?”

It’s their way of knowing the motivation of candidates for wanting to work specifically for their firm, and not just any other firm in the finance industry.

When asked this question, make sure to mention whoever you’ve met at the firm during your networking efforts and how they’ve left a really positive impression on you.

Improve your response further by exploring the thoughts and perspectives of the firm’s founders, management teams, and key personnels.

This insightful talk with Woody Marshall, a general partner at TCV, is a good start:

More interviews

- Learnings From Backing The Likes of Spotify and Airbnb with Woody Marshall, General Partner @ TCV

- Jay Hoag, co-founder of TCV, on Calibrating Market Adoption

TCV Case Study

Case Studies have always been a part of the interview process at firms like TCV.

The interviewers use case studies to assess their candidate’s ability to communicate and their technical knowledge.

At TCV, most case studies focus on financial modeling and investment recommendations. But interviewers may also require candidates to do cold calling case study if they are applying for junior roles.

My Growth Equity Interview Guide tackles case studies in more detail. Check it out for more information.

TCV Salary & Compensation

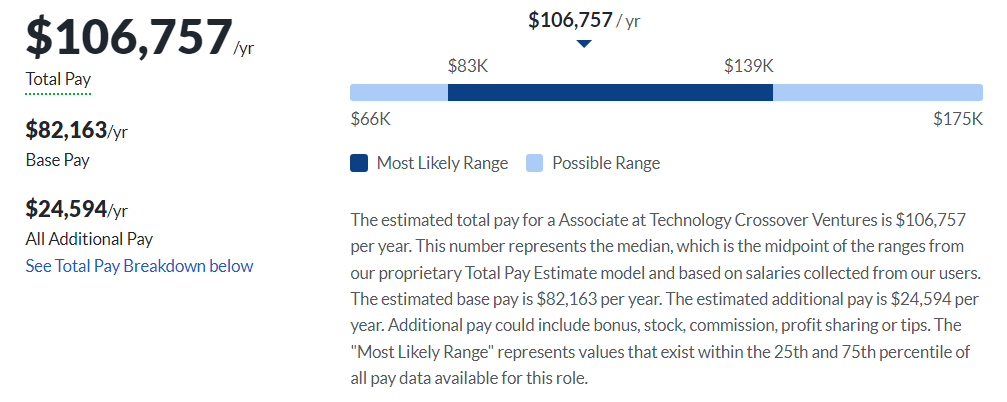

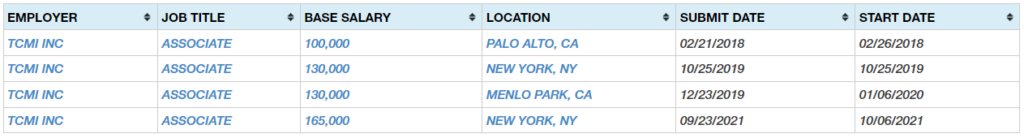

According to Glassdoor and other publicly available data, the estimated total pay for Associates at TCV can range from $100,000 up to $165,000.

Figures depend on the location, level of experience and qualifications of the candidate.

TCV Careers, Jobs, & Internships

Explore open roles at TCV using our job board which also features all job vacancies at other similar firms.

TCV Portfolio & Investments

TCV has 397 investments and 12 funds according to Crunchbase.

Some of the notable deals in TCV’s portfolio include Arize AI, Aido, and Legit Security. All of these companies are tech-based firms.

Notable Transaction: Evisort

Evisort is a no-code contract platform for legal, procurement and sales operations.

In May 2022, Evisort raised $100 million in capital. This Series C funding was led by TCV – which is also the key investor in market-defining firms like LinkedIn, Netflix, and Airbnb.

Evisort used the funds to improve customer experience, develop premium products, and fasttrack their growth.

Next Steps

Thinking about landing a role at TCV?

If so, check out my Growth Equity Interview Guide. This online course can help you ace your interviews through its step-by-step lessons.

It is designed to help candidates streamline their interview preparations, deep dive on topics that are most likely to get asked during interviews, and mental models for answering interview questions.

Get the course now and start learning!

Break Into Growth Equity

Break Into Growth Equity