TrueBridge Capital Partners Overview

TrueBridge Capital Partners is an alternative asset management firm which aims to generate massive returns in the venture capital industry.

The firm is well-known for relying heavily on data and analytics when investing in venture and seed/micro-VC funds. They also invest directly in high-growth tech companies together with other top VC investors.

In 2011, TrueBridge partnered with Forbes to create the “Midas List” of the world’s top 100 venture capitalists.

The Midas List is a data-intensive list that uses over 20 years of deal information across countless funds and investors to come up with the most accurate ranking of the world’s top investors for each year.

TrueBridge Capital Partners, founded in 2007 by Edwin Poston and Mel Williams, is located in Chapel Hill, North Carolina, United States.

TrueBridge Capital Partners AUM

TrueBridge Capital Partners has $5 billion in assets under management as of April 19, 2022 according to most recent regulatory filings.

TrueBridge Capital Partners Interview Process & Questions

Each candidate may go through a slightly different interview process. However, if you interview at TrueBridge Capital Partners (or similar firms), you can expect the general nature of the process to stay consistent:

- Interviews consist of 4-6 rounds

- Junior investment professionals or the HR team usually handle the initial part, while the more senior staff conduct the later rounds.

- The entire process can take several weeks, unless it is “on-cycle” or “on-campus” recruiting.

When interviewing at TrueBridge Capital, you should anticipate a combination of fit questions, behavioral questions, and technical / investing questions.

Need help preparing for interviews? Check out my Growth Equity Interview Guide.

Why TrueBridge Capital Partners

“Why this firm” is one of the questions you’ll almost always hear from interviewers.

If you’ve met people from the firm, this is also a great time to mention whoever you’ve interacted with and how they’ve made a really positive impression on you.

Another thing you can do to provide a more relevant and impressive answer to the “Why this firm” question is to learn more about the firm. One of the best ways to do this is to listen to interviews with their founders, investors, or key personnels.

For example, here’s a great interview with Rob Mazzoni, Principal at TrueBridge Capital Partners:

TrueBridge Capital Partners Case Study

Case studies are almost always part of the interview process. Firms use case studies to assess the technical knowledge and communication skills of their candidates.

Most case studies at firms like TrueBridge Capital Partners will have you perform financial modeling and investment recommendations.However, for junior roles, cold calling case study may also be required.

Check out my Growth Equity Interview Guide for a more comprehensive discussion of case studies.

TrueBridge Capital Partners Salary & Compensation

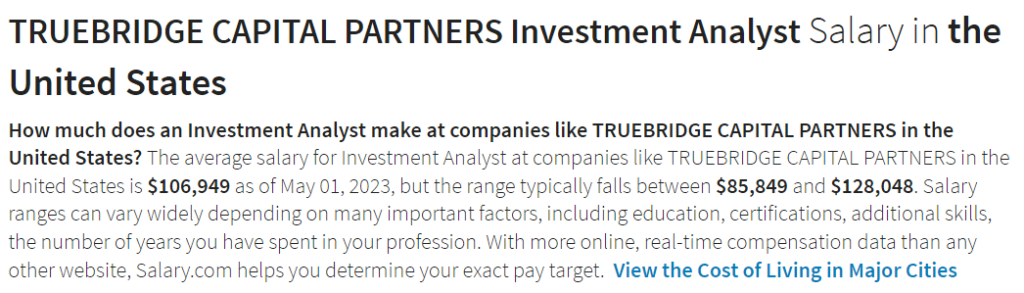

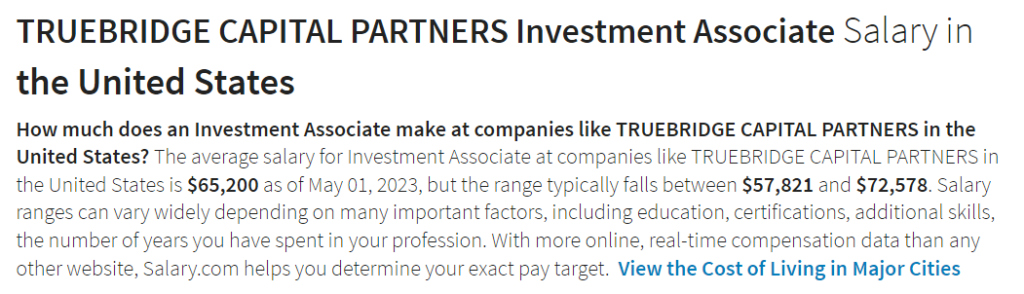

Based on publicly available data, the average salary of analysts and associates at TrueBridge Capital Partners are $106,949 and $65,200, respectively. These figures can still vary depending on an individual’s qualifications, experience, and performance.

Analyst

Associate

TrueBridge Capital Partners Careers, Jobs, & Internships

To view open positions at TrueBridge Capital Partners, go to our job board where you can also find open roles for other similar firms.

TrueBridge Capital Partners Portfolio & Investments

As per Crunchbase, TrueBridge Capital Partners has been able to complete seven investments since inception across nine funds. Some of their notable deals include Aviatrix Systems, Cloud9, and Insightly.

Notable Transaction: Lotame

Lotame is a data management platform which allows marketers, agencies, and publishers to collect customers’ data so they can effectively segment their audience and improve campaign targeting.

The platform uses machine learning algorithms to enable their users to analyze users’ behaviors and create strategies to reach performance goals.

On March 5, 2014, Lotame secured $15 million in Series D funding.

TrueBridge Capital Partners and Sozo Ventures led the funding round together with existing investors.

The fund was allocated for Lotame’s development of the platform so they can become the fastest and largest growing independent pure-play DMP.

Next Steps

If you’re interested in landing a role at TrueBridge Capital Partners and need some help preparing for your interviews, check out my Growth Equity Interview Guide.

This online course will equip you with technical knowledge and skills that you’ll need to stand out during interviews. From case studies to market thesis to case studies, and valuation to financial modeling, Growth Equity Interview Guide got it covered.

Get the course and improve your chances of getting selected by your dream investment firm!

Break Into Growth Equity

Break Into Growth Equity