Updata Partners Overview

Updata Partners is a private equity growth firm founded in 1998 by Barry Goldsmith and John Burton and is currently based in Washington, DC.

The firm makes seed-stage, early-stage, growth-stage, and late-stage investments to high-growth B2B software and technology-driven businesses where capital and operational experience can help propel success.

Updata Partners’ ideal clients should have the following characteristics:

- B2B Software & Software-Enabled Businesses

- $5M–$50M Revenue

- 25%–100%+ Growth

- Bootstrapped or Lightly Capitalized

- Non-Bay Area

- $15M–$100M+ Equity

Basically, Updata Partners look for rare leaders with a growth mindset and values capital efficiency. Typically, they have built recurring revenue models with a repeatable go-to-market engine and strong unit economics.

Updata Partners AUM

According to Updata Partners publicly available data, the firm manages more than $1.5 billion of committed capital.

Updata Partners Interview Process & Questions

The interview process can change with each candidate, but if you interview at Updata Partners (or a firm like it), you can likely expect the following:

- The process will consist of 4-6 rounds of interviews

- Junior investment professionals or the HR team will conduct the initial rounds while the more senior takes care of the later rounds

- Entire interview process typically conclude after multiple weeks – unless it’s “on-cycle” or “on-campus” recruiting

Interviews at Updata Partners will require you to answer a mixture of fit questions, behavioral questions, and technical / investing questions.

If you need help preparing for interviews, take a minute to check my Growth Equity Interview Guide.

Why Updata Partners

“Why this firm” is one of the questions interviewers like to ask to check whether candidates have a specific and solid reason for choosing their firm, and not simply sending applications to any investment firm with open roles.

If you have met any former or current employees from the firm, this is the perfect time to mention whoever you’ve networked with and how they’ve made a really positive impression on you.

Also, listen to interviews with the firm’s founders, executives, and investors so you can learn more about them and formulate an answer to “why this firm” that’s relevant and impressive.

Check out this interview with Carter Griffin, General Partner at Updata Partners:

More interviews

- Jon Seeber, GP at Updata, on the importance of building a strong customer success function

- Amit Sharma CEO of CData Software shared his experience with partnering with Updata Partners

Updata Partners Case Study

Firms like Updata Partners are looking for candidates with technical knowledge and good communication skills. They use case studies to evaluate these two crucial attributes. That’s why it’s advisable that you prepare for case studies as they almost always show up during interviews.

Most case studies at firms like Updata Partners consist of financial modeling and investment recommendations. However, cold calling case study may also be required for junior roles.

If you’re unsure how to best prepare for case studies, my Growth Equity Interview Guide can help.

Updata Partners Salary & Compensation

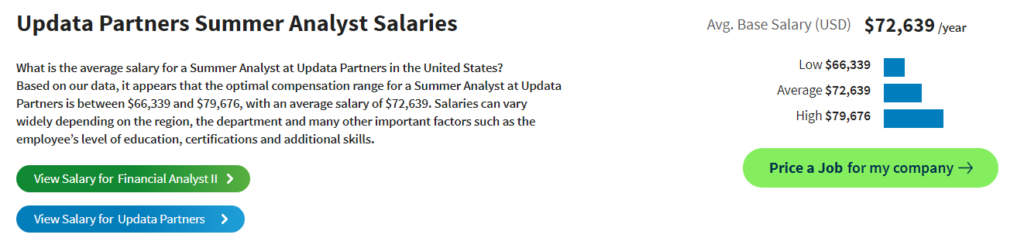

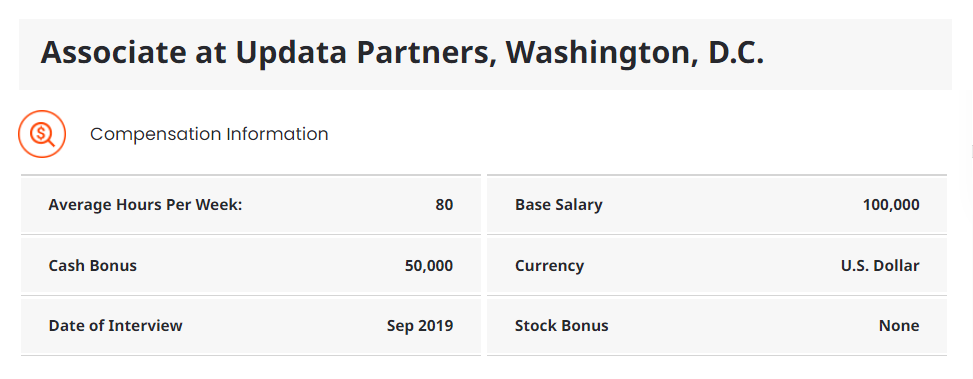

According to publicly available data, Analysts and Associates at Updata Partners typically make an average of $72,639 and $100,000 per year, respectively. These figures can vary depending on your qualifications, level of experience, and performance during the interview.

Analyst

Associate

Updata Partners Careers, Jobs, & Internships

If you like to see vacant positions at Updata Partners, go to our job board where we also feature open roles for other similar firms.

Updata Partners Portfolio & Investments

According to Crunchbase, Updata Partners has already made 89 investments since its inception in 1998 across six funds. Some of the firm’s notable deals include Acuity Insights, Glassbox, and LandTech which are all within the technology and software niche.

Notable Transaction: Nerdio

In December 2022, Nerdio secured a $117 million Series B investment from Updata Partners.

Nerdio is a premier solution for MSPs, enterprises and organizations of all sizes looking to deploy virtual desktops leveraging native Microsoft technologies.

The investment was allocated for adoption of Microsoft DaaS (Desktop-as-a-Service) management solutions.

Updata has been appointed to Nerdio’s Board of Directors as part of the investment agreement.

Next Steps

Breaking into the world of finance and landing a role at firms like Updata Partners will require you to stand out during the interview process. I created the Growth Equity Interview Guide for this purpose.

This online course helps professionals gain mastery over the crucial topics that often come up during interviews such as case studies, valuation, financial modeling, and many more.

If you want to gain a competitive edge, knowledge, and confidence to ace your interviews, go ahead and check out the course.

Break Into Growth Equity

Break Into Growth Equity