Waud Capital Partners Overview

Waud Capital Partners (WCP) is a private equity firm which primarily invests in market-leading companies within the Healthcare Services and Software & Technology sectors.

One of the firm’s distinct characteristics is their “pairing” approach. They thoughtfully select and match their executives and sectors to give them the maximum value.

This approach results in a long-lasting and sustainable growth.

Since inception, Waud Capital has already generated 350% and 300% average revenue growth during WCP’s holding period for health care services and software & technology platforms, respectively.

WCP Managing Partner Reeve Waud founded Waud Capital Partners in 1993. Prior to founding WCP in 1993, Reeve worked at the private equity firm Golder, Thoma, Cressey, Rauner, Inc.

Waud Capital Partners is based in Chicago, Illinois, United States.

Waud Capital Partners AUM

Waud Capital Partners has $4.1 billion in assets under management as of March 31, 2022 according to most recent regulatory filings.

Waud Capital Partners Interview Process & Questions

The interview process at firms like Waud Capital Partners can always change for each candidate. However, the general nature of the process remains the same.

- You can expect 4 to 6 rounds of interview.

- The junior investment professionals or the HR team tend to conduct the initial rounds while the more senior staff handle the later rounds.

- Entire interview process typically concludes after multiple weeks – unless it is “on-cycle” or “on-campus” recruiting.

Prepare to answer a mixture of fit questions, behavioral questions, and technical / investing questions when you interview at Waud Capital Partners.

For more in-depth interview preparation, consider getting my Growth Equity Interview Guide.

Why Waud Capital Partners

One of the most important questions you need to anticipate is “Why this firm?”

If you’ve done networking prior to your interview and have met some of the firm’s employees, this is a great time to mention them and how they’ve influenced your decision to join their firm.

To come up with a better and more impressive answer to the question “Why this company?” try listening to interviews with the firm’s founders, investors, and key personnel. They can provide valuable insights that will make your response more relevant and compelling.

For example, here’s an interesting discussion with Waud Capital’s Founder & Managing Partner, Reeve Waud:

More interview

Waud Capital Partners Case Study

Good communication skills and sufficient technical knowledge are two crucial attributes that firms like Waud Capital Partners look for when selecting the ideal candidate. Case studies help them assess these qualities.

Most case studies focus on investment recommendations and financial modeling, but cold calling case study may also be required for junior roles.

To better prepare for case studies, check out my Growth Equity Interview Guide.

Waud Capital Partners Salary & Compensation

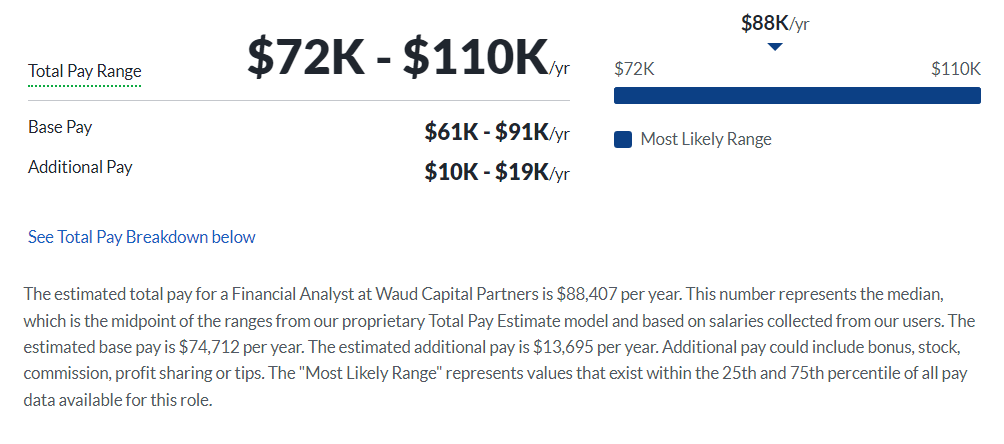

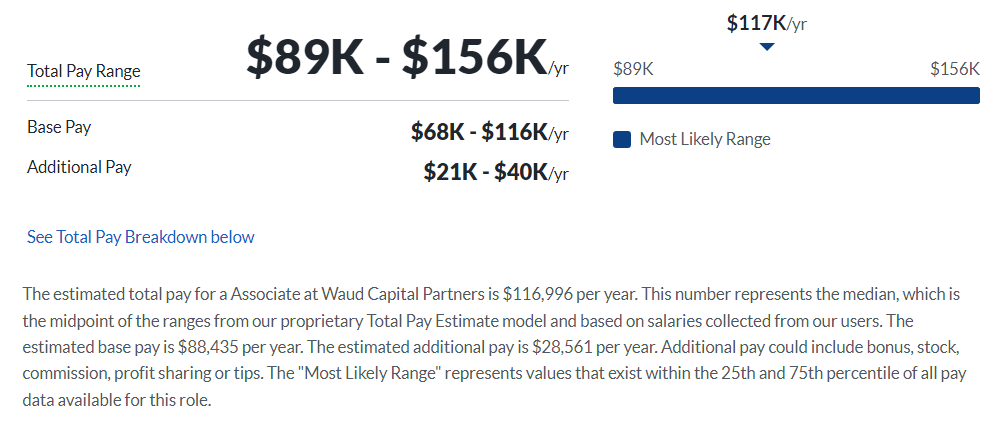

When you work at Waud Capital Partners, you can earn an estimated total pay of $88,407 per year if you’re an analyst and $116,996 per year if you’re an associate as per Glassdoor. These figures represent the median, and can still change depending on your experience, qualifications, and performance.

Analyst

Associate

Waud Capital Partners Careers, Jobs, & Internships

To check open roles at Waud Capital Partners, head over to our job board where you can also see all open roles for other similar firms.

Waud Capital Partners Portfolio & Investments

Since its founding, Waud Capital has successfully completed more than 400 investments, including platform companies and follow-on opportunities, and operates six funds. Some of their notable deals include Acadia, Dimensional Dental, and Pharmacy Partners.

Notable Transaction: GI Alliance

GI Alliance is a physician-led and majority-physician owned GI practice management company which provides services to nearly 700 gastroenterologists operating in the US.

Aside from operational support, GIA also aims to unite gastroenterologists nationwide by aligning interests and improving patient care.

On September 15, 2022, Waud Capital Partners announced that it has completed its sale of a controlling ownership stake in GI Alliance as part of a physician-led buyout and recapitalization.

David Neighbours, Partner at WCP, commented:

“Since our initial investment, GIA has increased its physician count by nearly five times. This growth was achieved through both organic initiatives and highly targeted, strategic acquisitions. We wish GIA continued success with its new partner, Apollo.”

This transaction valued GIA at $2.2 billion and was facilitated by an investment from funds managed by Apollo.

Next Steps

Waud Capital Partners can provide an exciting opportunity especially if you’re passionate about healthcare services and software & technology. If you want to land a role at their firm (or a firm like it), I highly suggest you check out my Growth Equity Interview Guide.

This self-paced, online course contains everything you need to ace your interviews and get selected for your dream role over other candidates.

Growth Equity Interview Guide has already helped countless professionals break into finance and now, it’s your turn. Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity