Activant Capital Overview

Activant Capital is a global investment firm based in Greenwich, Connecticut that seeks to support high-growth founders and teams that are transforming commerce.

Activant Capital started with a focus on technology companies, retail infrastructure, and building ecommerce. Over time, they’ve covered logistics, insurance, fintech, and healthcare as well.

The firm typically invests when two criteria are met:

- The company shows potential to achieve escape velocity and transform the entire industry.

- The founders demonstrate capacity to lead the company through hyper growth, and Activant’s support can make a huge impact on the probability of their success.

In terms of funding, Activant Capital participates 3-5 times per year in Series B growth funding with an average initial commitment of $20-40 million.

Steven Sarracino founded Activant Capital in 2015 to bridge the gap between venture and traditional growth equity by focusing on high-growth companies with an active operational approach.

Activant Capital AUM

Activant Capital manages $2.5 billion of assets as of June 26, 2022 according to the most recent regulatory filings.

Activant Capital Interview Process & Questions

Firms often make changes in their interview process with each candidate. However, if you interview at Activant Capital (or a firm like it), you can expect the following consistencies:

- You will go through 4 to 6 rounds of interview.

- Junior investment professionals or the HR team often handle the initial interviews, while the more senior staff supervise the later rounds.

- The entire process can take several weeks to conclude – unless it’s “on-cycle” or “on-campus” recruiting

Interviews at Activant Capital will be composed of fit questions, behavioral questions, technical / investing questions.

Check out my Growth Equity Interview Guide for comprehensive interview preparation lessons, expert tips, and guidance.

Why Activant Capital

Interviewers often ask the question “Why this firm?”

It’s one of the most common and important interview questions because it reveals whether or not the candidates have specific and well-researched reasons why they particularly selected the firm.

If you’ve had the chance to meet current or former employees at the firm, this is a great time to drop their names and share how they’ve made a really positive impression on you.

You can also improve your answer when you learn about the firm. One of the best ways to do this is listening to interviews with the firm’s investors, founders, and key personnels.

For starters, here’s an insightful interview with Activant Capital CEO & Founder Steve Sarracino:

More interviews

- Activant Capital Archives – The Full Ratchet

- Fintech Investing, Driving Growth, and Staying Vigilant with Steve Sarracino, Founder of Activant

- FinTech and e-commerce – investor perspective with David Yang, Partner @ Activant Capital

Activant Capital Case Study

Interviewees almost always need to conduct case studies during interviews. Case studies help firms evaluate their candidate’s technical knowledge and communication skills.

At firms like Activant Capital, case studies typically consist of investment recommendations and financial modeling. However, junior roles often need to do a cold calling case study as well.

Check out my Growth Equity Interview Guide if you want to see my comprehensive discussion of case studies.

Activant Capital Salary & Compensation

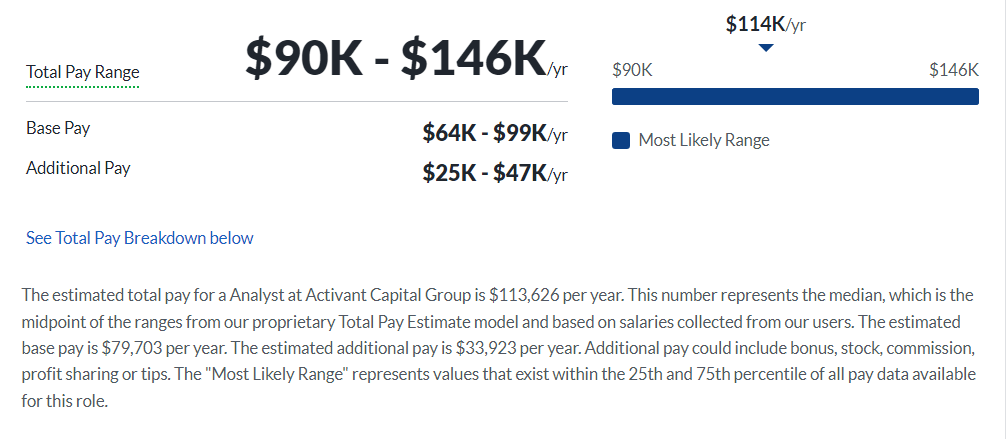

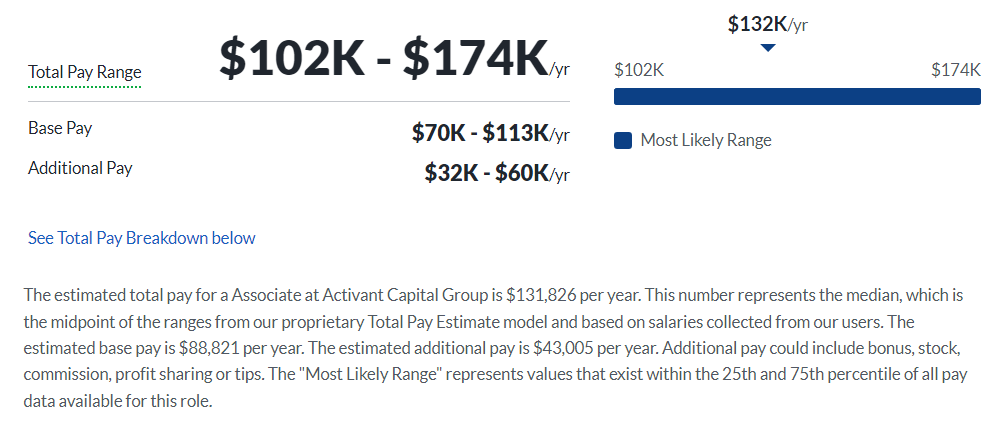

According to Glassdoor, the estimated total pay for Analysts at Activant Capital is $113,626 per year, and $131,826 per year for Associates. These figures represent the median and can vary depending on the candidate’s level of experience and qualifications.

Analyst

Associate

Activant Capital Careers, Jobs, & Internships

If you want to see open roles at Activant Capital, go to our job board where we also feature job vacancies at similar firms.

Activant Capital Portfolio & Investments

According to Crunchbase, Activant Capital has made 62 investments and operates 10 funds. Since 2015, Activant Capital have partnered with companies across the globe and many of them have successfully overcome challenges to become category-defining companies.

Some of the firm’s notable deals include Finix, Hive, and WorkMotion.

Notable Transaction: Bolt

Bolt provides merchants a simple but powerful checkout solution to help them increase conversion rates and eliminate fraud – which also gives consumers and retailers more control, choice, and flexibility over their transactions.

In just one year, the Bolt team has expanded from just ten team members to over 125 employees with talents coming from companies like Google, Uber, Airbnb, Facebook, Braintree, and Pinterest.

To support Bolt’s goal of perfecting checkout experience, Activant Capital together with Tribe Capital raised $68 million in Series B funding round.

Bolt allocated the capital for scaling their engineering team, investing in more enterprise functionality, partnering with best ecommerce tools, shopping carts, and payments, building advanced functionality and features, and global expansion.

Next Steps

Activant Capital is a good fit for you especially if you’re particularly interested in supporting high-growth companies in the commerce sector. If you want to land a role at Activant Capital, I highly suggest you check out my Growth Equity Interview Guide.

This self-paced online course contains step-by-step lessons on topics like case studies, financial modeling, valuation, and many more. You’ll get your hands on proven frameworks, mental models, and expert tips which can help you stand out during interviews.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity