INTRODUCING

The Definitive Online Course for Growth Equity Case Studies & Modeling Taught by An Industry Expert

- Step-by-step videos

On-demand video tutorials

- Templates & examples

Excel walkthroughs with answers

- Self-paced course

Get immediate access; go at your own pace

SELECT STUDENT OFFERS

"Simply put, this was critical in helping me land my job at KKR Growth! Highly recommend."

WHAT YOU'LL LEARN

Course Syllabus

The course is comprised of easy-to-follow video tutorials that dive deep into each topic. Each section includes supplemental templates, spreadsheets, and PDFs for download.

- 88 lessons

- 18+ video hours

- Templates & examples

- What is growth equity?

- How do growth investors make money?

- What are growth investments?

- A more nuanced view of growth investing

- Who does growth investing?

- How do firms evaluate investment prospects?

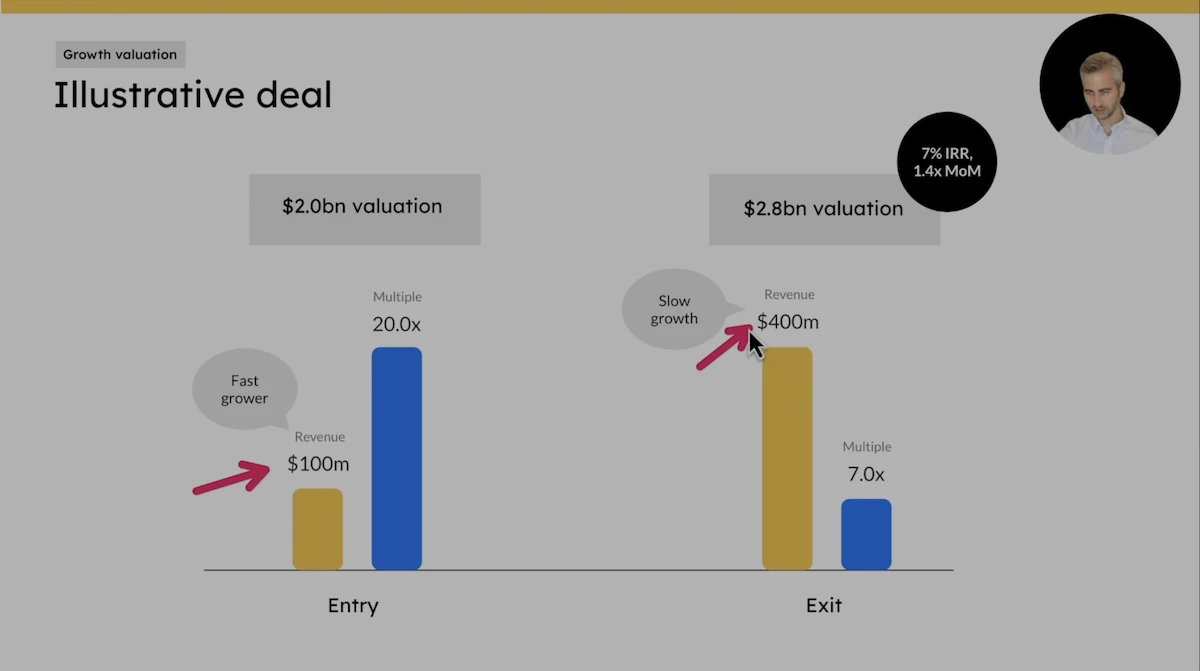

- Step-by-step process for valuing growth companies

- Challenges in growth valuation

- Valuation multiples in growth

- Factors that drive valuation

- Cultivating a growth (valuation) mindset

- Top valuation interview questions

Financial modeling & case studies – part 1 out of 3

- Financial modeling process

- Basic financial modeling

- Base technical concepts for any model

- Case study: Paper LBO

- Paper LBO example walkthrough

Financial modeling & case studies – part 2 out of 3

- Extending Paper LBO to full LBO

- How are LBO models used in growth

- Growth modeling vs. LBO modeling

- Case study: LBO model

Financial modeling & case studies – part 3 out of 3

- Growth modeling vs. LBO modeling

- Pre-money vs. post-money

- Minority investments + rollover stakes

- Primary vs. secondary proceeds

- Employee option pools

- Projecting revenue growth

- SaaS ARR waterfalls & cohort analysis

- SaaS cash flow & accounting

- Unit economics – LTV, CAC, and SaaS metrics

- Net operating losses (“NOLs”)

- Entry vs. exit valuations

- IPO exits vs. acquisitions

- Liquidation preference

- What is sourcing?

- Why is it important?

- What to expect in a mock cold call interview exercise?

- How to prepare + cold call script template

- Top sourcing and cold call interview questions

- Mock cold call case study

- Example walkthrough

- Why prepare a market thesis?

- What growth firms are looking for?

- Common mistakes

- Case study: Insight Partners

- Market thesis template

- Idea generation

- Finding and vetting private company prospects

- Example walkthrough, step-by-step

COURSE PREVIEW

Try a Free Sample Lesson

A lesson from “Valuation in Growth Investing”; just one of more than 80+ expertly-crafted lessons and 18+ video hours

TESTIMONIALS

What Past Students Say

CONSULTING –> GROWTH

UNDERGRAD –> GROWTH

CORP DEV –> GROWTH

CONSULTING –> GROWTH

UNDERGRAD –> GROWTH

HEDGE FUND –> GROWTH

TARGET FIRMS

Designed for Roles Across the Growth Landscape

I’ve studied the interview process at the top firms, so I can cover exactly what you need to know.

Pure-Play Growth

Firms focusing exclusively on growth stage investments

- General Atlantic

- Summit Partners

- TA Associates

- TCV

- Insight Partners

- Bond Growth

- Norwest Venture Partners

- And many others ...

Asset Manager

Private equity, hedge funds, and other investors focused on growth

- TPG Growth

- KKR Growth

- Blackstone Growth

- Tiger Global

- Coatue Management

- Softbank

- Sovereign wealth funds

- And many others ...

Venture Capital

Early stage firms raising dedicated, late stage growth funds

- Sequoia Capital

- Andreessen Horowitz (a16z)

- Redpoint Ventures

- Lightspeed Venture Partners

- New Enterprise Associates (NEA)

- Capital G (Google Ventures)

- General Catalyst

- And many others ...

About Your instructor

Mike Hinckley Is a Growth Stage Expert, Based in San Francisco

10+ years of growth stage experience

General Atlantic

Investor at leading growth firm with $86b in assets

Airbnb

Operator at General Atlantic's portfolio company

Wharton MBA

Graduate of top business school

IMPROVE YOUR RESUME

Earn Verified LinkedIn Credentials While You Learn

Looking to boost your resume and demonstrate your skills? At the end of each module, you’ll take a quiz to assess your knowledge. By receiving a passing score, you will earn a LinkedIn Verified Certificate. Certificate does not expire.

PRICING

Choose The Best Option For Your Needs

BASIC

$345

- 44 step-by-step lessons

- 10+ video hours

- Case studies & templates

- Intro to growth investing

- Interview prep checklist

- Financial modeling foundations

- LBO modeling for growth

- Growth-stage modeling

- SaaS fundamentals

- Growth valuation

- Market thesis

- Mock cold call

- Advanced SaaS metrics

- Advanced SaaS cohort analysis

- Advanced SaaS financial modeling

100% Money Back Guarantee

STANDARD

POPULAR

$645

- 88 step-by-step lessons

- 18+ video hours

- Case studies & templates

- Intro to growth investing

- Interview prep checklist

- Financial modeling foundations

- LBO modeling for growth

- Growth-stage modeling

- SaaS fundamentals

- Growth valuation

- Market thesis

- Mock cold call

- Advanced SaaS metrics

- Advanced SaaS cohort analysis

- Advanced SaaS financial modeling

100% Money Back Guarantee

STANDARD + ADVANCED SAAS

$885

- 140 step-by-step lessons

- 25+ video hours

- Case studies & templates

- Intro to growth investing

- Interview prep checklist

- Financial modeling foundations

- LBO modeling for growth

- Growth-stage modeling

- SaaS fundamentals

- Growth valuation

- Market thesis

- Mock cold call

- Advanced SaaS metrics

- Advanced SaaS cohort analysis

- Advanced SaaS financial modeling

100% Money Back Guarantee

100% Money Back Guarantee

If you aren’t satisfied, for any reason, just send me an email at himike@growthequityinterviewguide.com within 14 days of your purchase and you’ll get a full refund.

Frequently Asked Questions

If you have any questions not answered below, feel free to email me at himike@growthequityinterviewguide.com, and I’ll answer as soon as I can!

The course can help both candidates who are pressed for time (e.g. interview in next couple days) and candidates who have lots of time to prepare (e.g. interviews expected to be weeks or months away).

If your interviews are very soon, the course is helpful because it covers the core topics you really need to know without fluff, and it is designed to be flexible, so you can prioritize what's most helpful for you.

However, many candidates who have lots of time to prepare, also enjoy the course because it provides a structured roadmap for their prep in the coming weeks/months. Also, the course provides the opportunity to go deeper through examples and templates for further practice where needed.

Because many concepts I cover are overlapping, many students find this course to be helpful for private equity recruiting as well. For instance, I cover LBO modeling and Paper LBOs in the modeling section. However, this course is designed to be most helpful for growth equity and late-stage venture roles in the growth stage.

The course is designed for candidates applying for these growth equity roles:

- Undergrad analyst or internship

- Pre-MBA associate (on-cycle or off-cycle)

- Post-MBA associate or VP

While every student brings a different level of knowledge, the course assumes a basic understanding of accounting and corporate finance. If you have no experience in these areas (professional or in school), I do NOT recommend buying the course.

I offer a 100% money back guarantee. If you don't like it, email me at himike@growthequityinterviewguide.com for any reason within 14 days, and I'll refund you.

This course is focused on overall growth investing skills across all industry verticals plus interview/case study prep. I cover the basics of SaaS, but I don't go into a ton of detail.

For those who'd like to go deeper into SaaS concepts (or those who are interviewing with a SaaS-focused fund), I offer a bundle of my Standard Growth Equity course with my full SaaS Metrics & Financial Modeling course. See the "Standard + SaaS Add-On" above.

The SaaS course includes detailed lessons on all things SaaS, including SaaS metrics, cohort analysis, financial modeling, and other advanced topics. I recommend purchasing the bundle with detailed SaaS lessons for those who are interviewing for SaaS-specific funds or for those who'd simply like to go the "extra mile".

For more information on the SaaS course, or to purchase it individually, go here.

You'll get immediate access to the course right after you purchase!

You get lifetime access!

That way, you can purchase now and use across multiple recruiting cycles down the road.

Yes! Just email me at himike@growthequityinterviewguide.com and you'll pay the difference.

Email me at himike@growthequityinterviewguide.com and I'll get back to you ASAP