BlackRock Overview

BlackRock is a multinational investment company and is considered to be the largest asset manager in the world, with $10 trillion in assets under management as of 2023.

The firm is also one of the leading providers of advisory, risk management, and investment solutions.

BlackRock manages iShares group’s exchange-traded fund, and along with State Street and The Vanguard Group, the firm is considered one of the “Big Three” index fund managers.

Larry Fink founded BlackRock in 1988. Currently, the firm is based in New York City, with 78 offices in 30+ countries, and clients in a hundred countries.

BlackRock held its Initial Public Offering on October 1, 1999, on the New York Stock Exchange under the ticker symbol “NYSE:BLK”.

BlackRock AUM

According to Statistica, BlackRock has approximately $10 trillion in assets under management as of the second quarter of 2023.

BlackRock Interview Process & Questions

Although the interview process may vary slightly for each candidate, the overall structure remains mostly consistent. In general, you can expect the following:

- Number of interview rounds: 4-6

- Early interviews are managed by junior staff, while later rounds involve senior personnel

- The process may span several weeks, especially for off-campus or out-of-cycle recruitment

Prepare for a combination of behavioral, technical, and fit questions during your interview at BlackRock.

To help with your interview preparation, I’ve created a Growth Equity Interview Guide. Feel free to check it out.

Why BlackRock

Prepare yourself to answer the “Why this firm” question.

If you’ve connected with employees from the firm through networking, be sure to mention them and how their stories influenced your decision to choose the company.

Additionally, conduct research on the firm. Consider listening to interviews with its founders, management team, and investors to gain a deeper understanding of the organization.

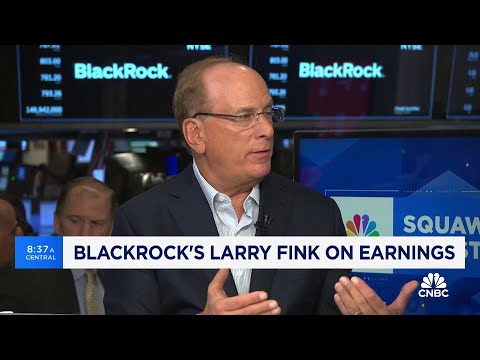

For starters, here’s CNBC Television interview with BlackRock CEO Larry Fink:

More Interviews

- Larry Fink, BlackRock CEO, joins ‘Squawk Box’ to discuss the SEC’s approval of bitcoin ETFs

- Interview with Larry Fink, BlackRock Chairman and CEO and Adebayo Ogunlesi, Global Infrastructure Partners Chairman and CEO

BlackRock Case Study

Investment firms place great emphasis on both communication skills and technical expertise. To assess these qualities, firms like BlackRock often ask candidates to complete case studies.

These case studies typically involve financial modeling and making investment recommendations. However, for junior positions, the process may also include a cold calling case study.

Check out Growth Equity Interview Guide if you need more help regarding case studies.

BlackRock Salary & Compensation

According to Glassdoor, analysts and associates at BlackRock have a median total pay of $117K and $141K, respectively.

Keep in mind that individual salaries can still vary depending on many factors such as job position, department, location, and individual’s unique background (education, certifications, skills, and so on).

Analyst

Associate

Based on other public records, analysts have earned $60K-$70K per year, while associates have made $110K-$135K per year.

BlackRock Careers, Jobs, & Internships

View open roles at BlackRock inside our job board where we also feature all open roles for similar firms.

BlackRock Portfolio & Investments

According to Crunchbase, BlackRock has made 342 investments across 21 funds. Some of their notable deals include Hometree, Enviria, and Lodha Group.

Notable Transaction: RapidSOS

RapidSOS is an intelligent safety platform which connects data to 911 and first responders.

Whenever there’s an emergency or unsafe moment, devices, homes, buildings, and vehicles that are RapidSOS Ready deliver the information to the response team.

More than 200 companies are already part of the RapidSOS ecosystem – including leading consumer, technology, education, logistics, and transportation companies.

In March 2024, RapidSOS secured an additional $75 million funding from accounts managed by BlackRock. This closes the Company’s latest round at $150 million.

Next Steps

If you choose to apply for a position at BlackRock and pursue a career in investing, I strongly suggest reviewing my Growth Equity Interview Guide before your interviews.

The Growth Equity Interview Guide offers a solid understanding of topics commonly discussed in interviews, such as financial modeling and case studies.

Explore the guide and start your preparation today!

Break Into Growth Equity

Break Into Growth Equity