Blackstone Overview

Blackstone is an alternative asset manager based in New York, NY.

The firm primarily invests in buyouts, debt, M&A, and growth capital. But they are also active in infrastructure, insurance, hedge funds, secondaries, and credit.

Blackstone has been one of the biggest investors in LBO in the last decades, while its real estate wing has actively acquired commercial real estate.

As per Blackstone, their total assets under management were around $951 billion in Q3 of 2022 – which makes it the largest alternative investment firm worldwide.

Peter G. Peterson and Stephen A. Schwarzman, who both worked together at Lehman Brothers, started Blackstone in 1985 as a mergers and acquisitions firm.

Today, Blackstone is listed on the New York Stock exchange under “BX”. At the time of the firm’s IPO, Blackstone raised $4.13 billion.

Blackstone AUM

According to most recent regulatory filings, Blackstone has $114.3 billion in assets under management as of May 7, 2022.

Blackstone Interview Process & Questions

Blackstone and other similar firms often change their interview process with each candidate. But the general nature of the process stays the same for the most part:

- Interviews have around 4-6 rounds

- For the initial rounds, junior investment professionals take the lead. The more senior staff handle the remaining rounds.

- The overall process can last up to several weeks – unless it’s “on-cycle” or “on-campus” recruitment activity

Expect a combination of fit, behavioral, and technical/investing questions from Blackstone’s interview process.

For more in-depth interview preparation, check out my Growth Equity Interview Guide.

Why Blackstone

“Why Blackstone” is one of the most important and highly anticipated questions in your interview.

If you’ve had the chance to connect with Blackstone’s staff, this is your chance to bring it up and mention the positive impression they left on you.

Here’s another tip to come up with an impressive response to “Why this firm”: take the time to learn more about the firm by diving into the insights of the firm’s founders, executives, and people who work at the firm.

For example, watch this one-on-one interview with Joe Baratta, Blackstone’s Global Head of Private Equity:

More interviews

- Interview with Blackstone Senior Managing Director for Real Estate, Nadeem Meghji

- Portfolio Company CEOs Describe Their Experience Working with Blackstone

- Early Career Experiences at Blackstone

- Linda Garino’s experience as an analyst at Blackstone’s London office

Blackstone Case Study

Candidates applying for roles at Blackstone almost always face a case study during interviews.

Case studies is one of the tools that firms use to evaluate their candidate’s technical knowledge and communication skills.

Most case studies at firms like Blackstone centers around financial modeling and investment recommendations. But for junior positions, cold calling case study can be part of the interview process as well.

I discuss case studies in more detail and how to prepare for it inside my Growth Equity Interview Guide.

Blackstone Salary & Compensation

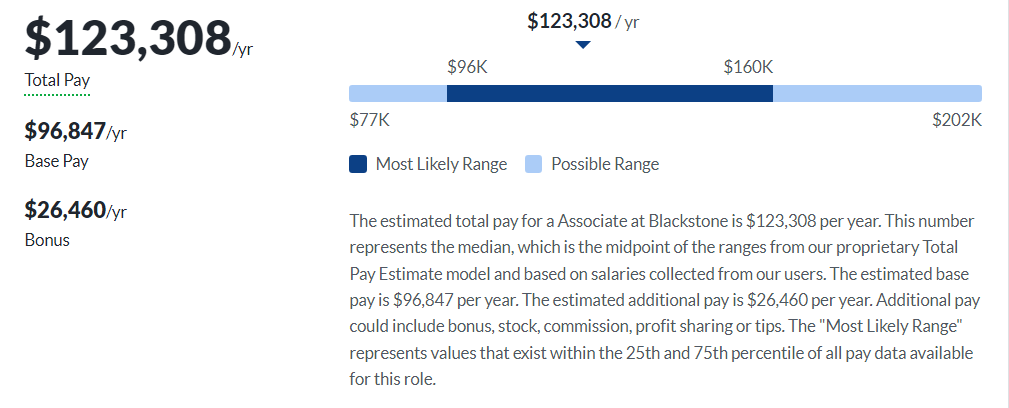

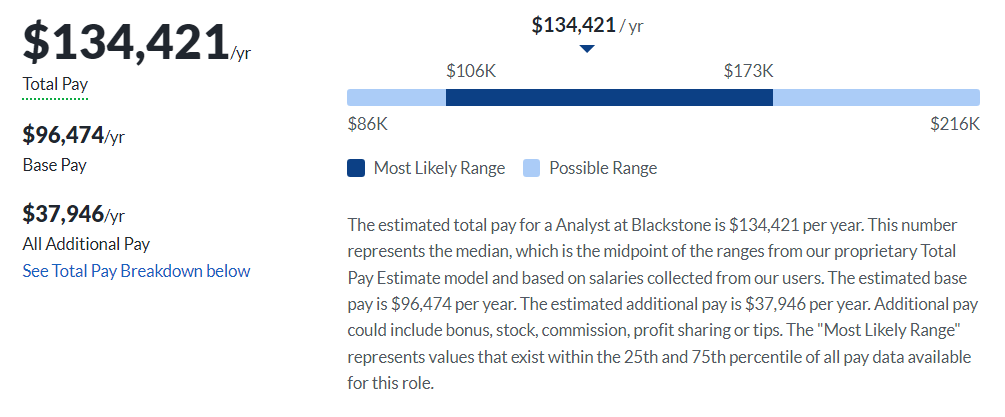

Based on Glassdoor’s publicly available data, Associates at Blackstone can earn an estimated total pay of $123,308, while Analysts can make around $134,421 per year. But these figures still depend on the candidate’s level of experience and qualifications.

Associate

Analyst

Based on other publicly available data, recent Associates have earned salaries of $140,000 per year, while there’s no recent data for Analysts.

Blackstone Careers, Jobs, & Internships

If you’re interested to know what positions are currently open at Blackstone, check out our job board which features all available job vacancies for them and other similar firms.

Blackstone Portfolio & Investments

Blackstone manages funds on behalf of institutions, pension plans, and high net-worth individuals.

As per Crunchbase, the firm has made 178 investments across multiple industries and manages 33 funds.

Notable deals of Blackstone include the cloud security company Wix, digital payment platform PayCargo, and blockchain analysis firm called Chainalysis.

These transactions showcase Blackstone’s knack for identifying high-growth potential firms with innovative business models.

Notable Transaction: PayCargo

PayCargo is a freight payment platform that aims to reduce costs, delays, and risks that come with outdated and manual payment methods like checks, cash, and wire transfers.

In 2022, PayCargo secured up to $130 million in Series C round from Blackstone which they used to support their international expansion and new product development. PayCargo has been in four funding rounds since inception and this deal with Blackstone is currently their largest funding round.

As per Blackstone, they decided to invest in PayCargo because it combines the two areas in which tech is in demand to improve efficiency: supply chain and financial services.

Next Steps

Blackstone can be quite an amazing firm to work at.

However, before you secure a role at Blackstone or similar investment firms, you have to pass their interview process and ‘beat’ other qualified candidates.

To make that happen, you need to make the necessary interview preparations and make sure that you are spending your time and effort on the questions and information that are most likely to get asked during interviews.

If you need help with this, check out my Growth Equity Interview Guide, a step-by-step guide specifically made for acing growth interviews.

Break Into Growth Equity

Break Into Growth Equity