Blueprint Equity Overview

Blueprint Equity, located in Solana Beach, California, is a technology-focused, growth equity investment firm founded by Bobby Ocampo and Sheldon Lewis in 2018.

The ideal partners of Blueprint Equity have to follow certain criteria:

- Generating at least (or close to) $1M in recurring revenue

- Have not yet raised significant institutional capital for their growing enterprise

- Based in North America

- Run an enterprise / B2B software, financial tech, or tech-enabled services business

- Looking to potentially raise $1-15M to scale their organization

Blueprint Equity doesn’t invest in big ideas that may become a business one day.

They obsess over highly-addictive business-critical enterprise applications and aim to work side-by-side with industry veterans who are equally obsessed in solving problems.

Blueprint Equity AUM

According to most recent regulatory filings, Blueprint Equity manages $107.6 million worth of assets as of June 2022.

Blueprint Equity Interview Process & Questions

Firms can always make changes in their interview process with each applicant. But if you interview at Blueprint Equity (or similar firms), you can find consistencies in the nature of their process:

- Expect to undergo 4-6 rounds of interview

- Junior investment professionals or the HR team conducts the initial rounds while more senior staff handle the later rounds

- The entire interview process could last for several weeks – unless it’s “on-cycle” or “on-campus” recruiting

Interviews at Blueprint Equity will be a combination of fit questions, behavioral questions, and technical / investing questions.

Take a minute to check my Growth Equity Interview Guide if you want further help at preparing for interviews.

Why Blueprint Equity

You will stand out more during interviews if you can answer the “why this firm” properly. Interviewers like to throw in this question to see whether candidates have solid reasons why they specifically chose to apply at their firm.

If you’ve done networking, this is the right time to mention any former or current employees you’ve met at the firm and how they’ve made a really positive impression on you.

To understand the firm better, try listening to interviews with its founders, investors, and key personnels so you can come up with a more relevant and impressive answer.

This interview with Sheldon Lewis, Co-Founder of Blueprint Equity, is a great start:

More interviews

- Interview with Bobby Ocampo, Co-Founder @ Blueprint Equity

- Sheldon Lewis (Managing Partner, Blueprint Equity): Raising a $70M Fund from Scratch

Blueprint Equity Case Study

Case studies almost always show up during interviews because firms use case studies to assess the technical knowledge and communication skills of each candidate.

The typical focus on case studies at firms like Blueprint Equity is investment recommendations and financial modeling. Cold calling case studies are often required as well if you’re applying for junior roles.

My Growth Equity Interview Guide contains an in-depth discussion of case studies. Check it out if you need help with it.

Blueprint Equity Salary & Compensation

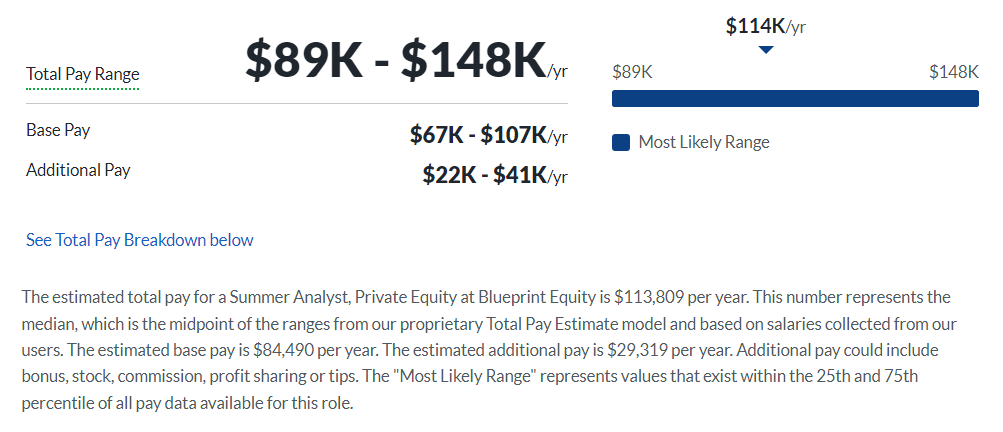

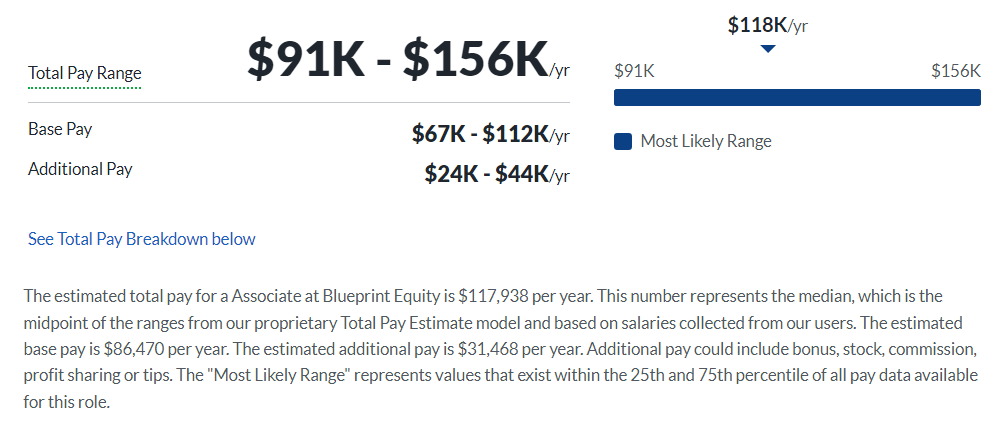

According to Glassdoor, you can earn an estimated total pay of $113,809 if you’re an Analyst and around $117,938 per year if you’re an Associate at Blueprint Equity.

Keep in mind that these figures may vary depending on your experience and qualifications.

Analyst

Associate

Blueprint Equity Careers, Jobs, & Internships

Head over to our job board if you want to view open roles at Blueprint Equity and all job vacancies at other similar firms.

Blueprint Equity Portfolio & Investments

According to Crunchbase, Blueprint Equity has made 12 investments since 2018 across two funds. Their notable deals include Quativa, Tovuti, and RocketRez.

Notable Transaction: CompanyCam

CompanyCam is a Lincoln, Neb. -based documentation and communication app for roofing contractors which allows them to document their jobs and fully organize photo feeds for their business.

With this app, contractors can easily organize all their job site photos and files

In June 2020, CompanyCam secured a $6M Series A funding. The round was led by Blueprint Equity.

CompanyCam used the funds to accelerate their growth, expand functionality, and expand their in-house and remote teams to meet user demands.

Next Steps

If you’re looking to land a role at Blueprint Equity (or a firm like it), make sure to prepare enough for the interview process so you can stand out from their pool of applicants.

One thing that helped countless professionals ace their interviews is the Growth Equity Interview Guide. It’s a self-paced online course which consists of step-by-step lessons and expert tips on Case Studies, Valuation, Financial Modeling, and many more.

Everything you need to maximize your chances of landing a role in finance is inside this course. Check it out and start learning today!

Break Into Growth Equity

Break Into Growth Equity