Clearlake Capital Group Overview

Clearlake Capital Group is a private equity firm which primarily focuses on consumer, industrial, and technology sectors. The firm is based in Santa Monica, CA with additional offices in Dublin, London, and Dallas.

Clearlake Capital aims to partner with management teams with extensive experience by providing long-term capital to dynamic businesses which can gain benefit from Clearlake’s “operational improvement approach”, O.P.S.®

In June 2023, the firm achieved 14th place in Private Equity International’s PEI 300 ranking of the biggest PE firms in the world.

José Feliciano, Behdad Eghbali, and Steven Chang founded Clearlake Capital Group in 2006.

Clearlake Capital Group AUM

According to the latest regulatory filings, Clearlake Capital Group has $59.6 BB in assets under management as of March 31, 2023.

Clearlake Capital Group Interview Process & Questions

Despite the changes in the interview changes for each candidate, the general nature of the process stays the same for the most part. In fact, you can anticipate the following:

- Interview rounds: 4-6

- Initial interviews are supervised by junior professionals, while later rounds are handled by more senior folks

- Unless it’s on-campus or on-cycle recruiting, expect that the entire process will last for multiple weeks

Get ready to answer a mixture of behavioral questions, technical questions, and fit questions when you interview at Clearlake Capital Group.

To help you with preparation, I’ve created a Growth Equity Interview Guide. Feel free to check it out.

Why Clearlake Capital Group

One of the questions you must prepare for is the “Why this firm” question.

If you’ve met employees at the firm during your networking efforts, make sure to mention them and how their experiences and testimonies helped in choosing their firm.

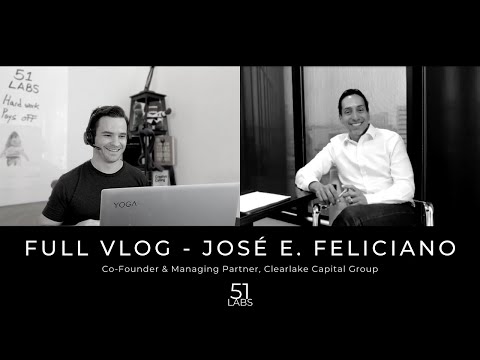

Also, do your homework and research the firm. You can try listening to interviews with its founders, management team, and investors to get to know them better.

For starters, here’s a great interview with José Feliciano, Co-Founder and Managing Partner of Clearlake Capital Group:

More Interviews

- Capital Allocators interview with José E. Feliciano, Co-Founder at Clearlake Capital

- Discussion with Behdad Eghbali, Co-Founder & Managing Partner at Clearlake Capital Group

Clearlake Capital Group Case Study

Communication skills and technical knowledge are two traits that investment firms highly value. To evaluate these, firms like Clearlake Capital Group ask candidates to perform case studies.

Most case studies will have you do financial modeling and investment recommendations. But for junior roles, a cold calling case study may also be part of the process.

I’ve discussed case studies in great detail inside my Growth Equity Interview Guide course.

Clearlake Capital Group Salary & Compensation

Clearlake Capital Group provides a total median base pay of $122,512 per year to their associates, while there’s no recent data for analyst hires. Figures may vary based on your experience, education, and other factors determined by the firm.

Associate

Clearlake Capital Group Careers, Jobs, & Internships

Head over to our job board to see open roles at Clearlake Capital Group. We also feature job vacancies from other similar firms.

Clearlake Capital Group Portfolio & Investments

Since inception, Clearlake Capital Group has made 63 investments across eight funds. Some of their notable deals include Learfield, Fanatics, and Crash Champions

Notable Transaction: Iterative Scopes

Iterative Scopes is a pioneer when it comes to the application of AI-based precision medicine for gastroenterology which aims to help optimize clinical trials that investigate treatment of inflammatory bowel disease.

In January 2022, Iterative Scopes secured $150 million Series D funding which was co-led by Clearlake Capital Group and Insight Partners, along with existing investors Breyer Capital, Eli Lilly, Johnson and Johnson Innovation-JJDC Inc., Obvious Ventures, and other financial leaders.

The said funding came just shortly after Iterative Scopes raised $30MM in a Series A round in August 2021 – which made a total of $182MM raised in 2021.

These investments proved the investors’ confidence in Iterative Scopes as the company gained momentum into becoming a market leader in AI-driven precision gastroenterology.

The funding was allocated to accelerate the company’s development of AI tech services and products.

Next Steps

If you decide to send your application and build your investing career at Clearlake Capital Group, I would highly recommend that you check out my Growth Equity Interview Guide first before attending interviews.

Growth Equity Interview Guide helps professionals get a good grasp of topics that are typically covered during interviews such as financial modeling, case studies, and more. Check it out and start learning today!

Break Into Growth Equity

Break Into Growth Equity