M33 Growth Overview

M33 Growth is a private equity firm located in Boston, Massachusetts founded in 2017 by Brian Shortsleeve, Gabe Ling, and Mike Anello.

M33 Growth derived its name from Mach 33, the speed at which an object hits escape velocity and breaks free from the gravitational pull of the Earth.

Their name mirrors the firm’s approach: supporting ambitious bootstrapped founders and CEOs through capital funding and providing resources to propel growth and transform their already-great businesses into market leaders.

They accelerate the growth of their portfolio companies by:

- Applying experience in boosting sales and marketing engines

- Driving strategic acquisitions

- Building value through the creation of data assets

While many firms only provide capital, M33 Growth prides itself for bringing a differentiated hands-on experience to the entrepreneurs they partner with.

M33 Growth AUM

According to the publicly available data at JoinHandshake.com, M33 Growth has $440 million in assets under management.

M33 Growth Interview Process & Questions

Firms can always make changes in their interview process with each candidate. However, the nature of the process stays the same so when you interview at M33 Growth (or a firm like it), you can likely expect the following:

- Going through 4-6 rounds of interview

- Junior investment professionals conducts the initial rounds, then the more senior staff take over for later rounds

- The entire process could take several weeks except if it’s on-cycle or on-campus recruitment initiative

Expect to answer a combination of fit questions, behavioral questions, and technical / investing questions at the M33 Growth interview.

For more interview insights, lessons, and expert tips, check out my Growth Equity Interview Guide.

Why M33 Growth

“Why this firm” is one of the favorite questions interviewers like to ask. That’s because they want to know if you can provide specific reasons why you chose their firm – and not other investment firms.

If you’ve done networking, this is your chance to mention whoever you’ve met at the firm and how they influenced your perception of the firm.

To make your answer even more relevant to their firm, one thing you can do is to listen to interviews with their founders, investors, or any key personnels so you can learn more about their firm.

As a starting point, here’s an amazing interview with Brian Shortsleeve, Co-Founder and Managing Director of M33 Growth:

M33 Growth Case Study

Firms use case studies to evaluate each candidate’s technical knowledge and communication skills. That’s why you can likely expect to face a case study during interviews. However, junior roles may often be required to conduct a cold calling case study as well.

Check my Growth Equity Interview Guide if you need help preparing for case studies.

M33 Growth Salary & Compensation

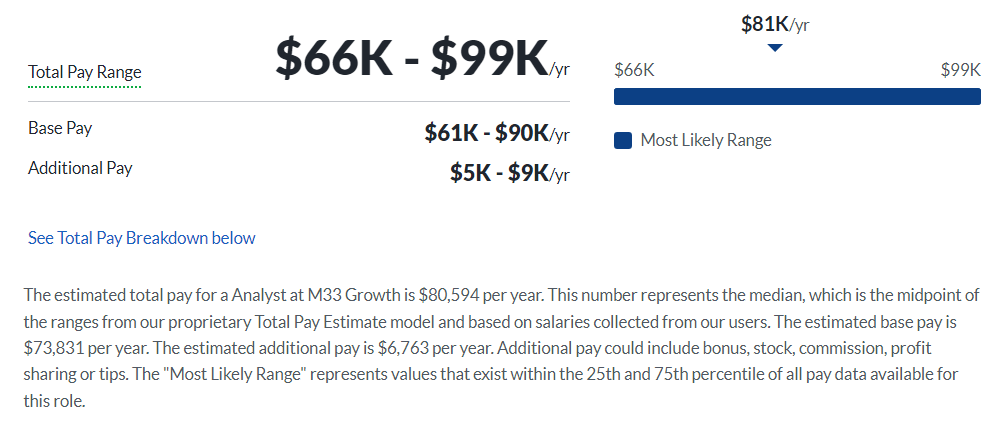

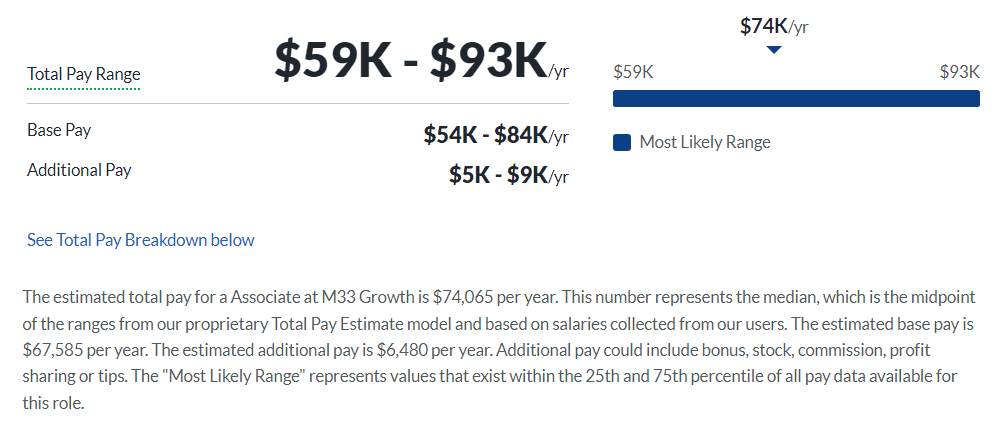

M33 Growth provides an estimated total pay of $80,594 per year for Analysts and $74,065 per year for Associates according to Glassdoor. These figures represent the median and may vary depending on the applicant’s level of experience and qualifications.

Analyst

Associate

M33 Growth Careers, Jobs, & Internships

If you’re looking to work at M33 Growth, feel free to check their open roles at our job board where we also feature job vacancies at similar firms.

M33 Growth Portfolio & Investments

Since inception, M33 Growth has made 10 investments across two funds in the healthcare and vertical software sectors. Some of their notable deals include BeSmartee, Contruent, and GoDocs.

Notable Transaction: Mize

Mize provides a connected customer experience platform and service lifecycle management software for manufacturers.

M33 Growth made a significant equity investment to Mize in March 2020 because it stood out as the only true enterprise grade platform that allows manufacturers to manage the entire customer service lifecycle.

“We have joined forces with M33 Growth so we can leverage their financial and strategic resources to better meet customer needs and accelerate our growth globally.”, said Mize CEO after securing the investment.

The fund was used to accelerate growth, drive customer success, and support product innovation.

Next Steps

If you’re looking to land a finance role in growth equity firms like M33 Growth, the Growth Equity Interview Guide can equip you with the right knowledge, frameworks, and insider tips.

This competitive advantage will help you ace your interviews and maximize your chances of securing a role in finance.

Break Into Growth Equity

Break Into Growth Equity