NewSpring Capital Overview

NewSpring Capital is a private equity firm that is focused on leveraging operational expertise and capital to build market leading companies.

Founded 1999 in Radnor, Pennsylvania by Marc Lederman, NewSpring Capital usually funds Series B rounds for early and late stage technology and healthcare ventures.

The firm focus their expertise into five distinct platforms:

- NewSpring Growth

- NewSpring Healthcare

- NewSpring Holdings

- NewSpring Mezzanine

- NewSpring Franchise

NewSpring Capital seeks partnership with the innovators, makers, and operators of high-performing companies in dynamic industries so they can catalyze new growth and capture compelling opportunities.

NewSpring Capital AUM

According to NewSpring Capital’s data, the firm has over $3 billion in assets under management as of May 2023.

NewSpring Capital Interview Process & Questions

Even though interview processes at firms like NewSpring Capital can vary with each candidate, there are a few things that remain consistent such as:

- Candidates go through 4-6 rounds of interview

- Junior investment professionals handle the initial rounds while the more senior staff conduct the later rounds

- Entire interview process takes multiple weeks – except if it’s “on-cycle” or “on-campus” recruiting

Aside from that, be prepared to answer a mixture of fit questions, behavioral questions, and technical / investing questions when you apply at NewSpring Capital.

For more interview preparation tips, lessons, and support, check out my Growth Equity Interview Guide.

Why NewSpring Capital

“Why this firm” is one of the frequently asked questions during interviews.

Interviewers want to know the motivation behind your application and if you are familiar with the firm’s background, focus, and vision.

If you’ve done networking, this is the perfect time to mention the former or current employees you’ve met from the firm and also how they’ve made a positive impact on you.

Another thing that could help you come up with an impressive answer to this question is to listen to interviews with the firm’s founders, investors and employees because it can give you insights into the firm’s background, vision, and goals in their own words.

You can start with this great interview with Skip Maner, General Partner of NewSpring Capital:

More interviews

- NewSpring Capital’s Brian Kim and Lee Garber on Growth Equity and Buyout Investing

- Kara Donnelly of NewSpring Capital

NewSpring Capital Case Study

Case studies are an integral part of the interview process. Firms use case studies as a tool to assess their candidates’ technical knowledge and communication skills.

Most case studies at firms like NewSpring Capital dive deep on financial modeling and investment recommendations. But for junior roles, cold calling case study may be required as well.

Take a minute to check our Growth Equity Interview Guide in case you want help preparing for case studies.

NewSpring Capital Salary & Compensation

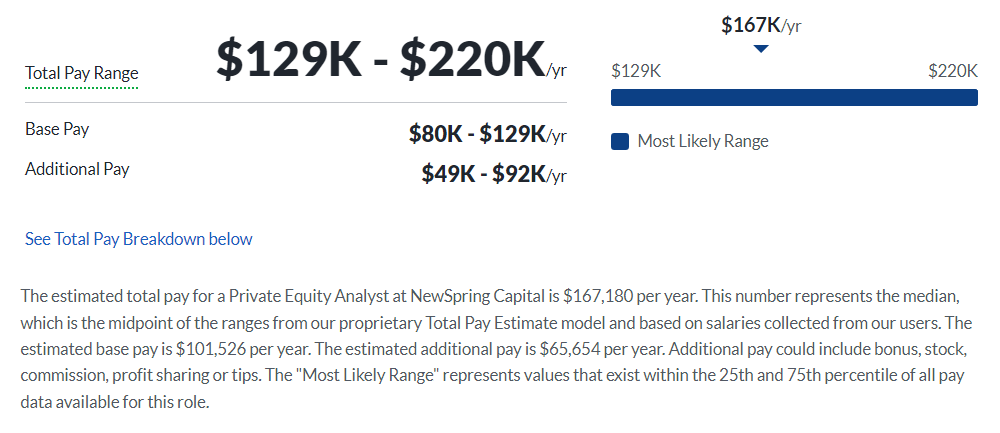

Based on Glassdoor’s publicly available data, Analysts at NewSpring Capital make an estimated total pay of $167,180 per year, while there is no recent data for Associate hires.

Individual salaries will, of course, vary depending on the individual skills, qualifications, and education of each candidate.

Analyst

NewSpring Capital Careers, Jobs, & Internships

To view recent vacant roles at NewSpring Capital and other similar firms, head over to our job board. Be the first to know and send an application.

NewSpring Capital Portfolio & Investments

NewSpring capital has an impressive track record of 154 investments across five funds.Some of their notable deals include BRC Healthcare, Clutch, and Nutrisystem, which highlights their focus on supporting high-growth companies in tech, healthcare, and business services space.

Notable Transaction: NuORDER

Buyers and sellers in the B2B wholesale segment of the retail supply chain have seen the disruptive power of the “Amazon experience” in the way consumers shop online.

They don’t approve of how things are working and are eager for technologies that can help them stand out in a hyper-competitive retail environment.

This growing market captured the attention of NewSpring Capital which led to them funding companies focused on closing the gap between B2C and B2B e-commerce capabilities.

In June 2019, NewSpring led a $15 million Series D investment in NuORDER to digitally transform the wholesale buying process.

NuORDER serves as a central hub where brands can connect to retailers and buyers through branded online catalogs and mobile apps.

Next Steps

Just like any investment firms, NewSpring Capital conducts a series of interviews to carefully screen their applicants. If you want to gain a competitive edge over other candidates and increase your chances of getting selected for the role you’ll be applying for, make sure to check out my Growth Equity Interview Guide.

Break Into Growth Equity

Break Into Growth Equity