Riverside Acceleration Capital Overview

Riverside Acceleration Capital (RAC) provides capital to expansion-stage B2B software and technology companies that need to launch new products, grow their business, and maximize value without diluting control, ownership, or optionality.

RAC is part of The Riverside Company, a private equity firm that invests in growing businesses valued at up to $400 million.

Riverside Acceleration Capital takes a flexible investment approach, providing both growth equity and growth loans.

For Growth Equity, the firm look for:

- B2B software for businesses

- $4-15M ARR

- Strong unit economics, retention and growth

- Scalable go-to-market approach

For Growth Lending, the firm look for:

- B2B software businesses

- $2-15M ARR with 20%+ growth

- Capital efficient growth

- Good retention & strong unit economics

The Riverside Company, the parent company of RAC, was founded by Béla Szigethy in 1988. RAC is currently located in New York, NY with additional offices in San Francisco, CA and Cologne Germany.

Riverside Acceleration Capital AUM

With over 30 years dedicated to growing companies, Riverside Acceleration Capital has $13+ billion in assets under management according to the firm’s record.

Riverside Acceleration Capital Interview Process & Questions

The interview process can always change with each candidate. Despite the changes, the general nature of the process at Riverside Acceleration Capital (or a firm like it) remains consistent. You can likely expect:

- 4-6 rounds of interview

- Junior investment professionals or the HR team conduct the initial interviews, while the more senior folks handle the later rounds.

- The entire process lasts for several weeks – unless it’s “on-campus” or “on-cycle recruitment initiative

Interviews at Riverside Acceleration Capital will be composed of fit questions, behavioral questions, and technical / investing questions.

My Growth Equity Interview Guide is a great resource for anyone who needs help preparing for interviews.

Why Riverside Acceleration Capital

Interviewers are curious to know if the candidate has specific reasons for selecting their firm, and not simply sending applications to any firm with job vacancies. So make sure to prepare for the “Why this firm” question as it will likely show up during the interview.

If you’ve met employees at the firm, this is a great time to mention them and how they’ve influenced your decision through the insights they shared about the firm.

To better understand the firm and improve your answer to “Why this firm” question, it’s also advisable to listen to interviews with its founders, investors, and management team.

To get you started, here’s an interview with George Cole, Managing Partner, The Riverside Company:

More interviews

- Brian Bunker, Managing Director @ The Riverside Company, on private equity

- The Deal Interviews PE Pros: Bob Landis, the Riverside Company

Riverside Acceleration Capital Case Study

Interviewees almost always have to conduct a case study during interviews. Firms include case studies in the interview process to assess the communication skills and technical knowledge of their candidates.

Most of the time, case studies at firms like Riverside Acceleration Capital focus on investment recommendations and financial modeling. But for junior roles, they also require a cold calling case study.

I’ve tackled case studies in more detail inside my Growth Equity Interview Guide. Take a look if you want help preparing for it.

Riverside Acceleration Capital Salary & Compensation

Riverside Acceleration Capital, part of The Riverside Company, provides competitive salaries to their investment professionals.

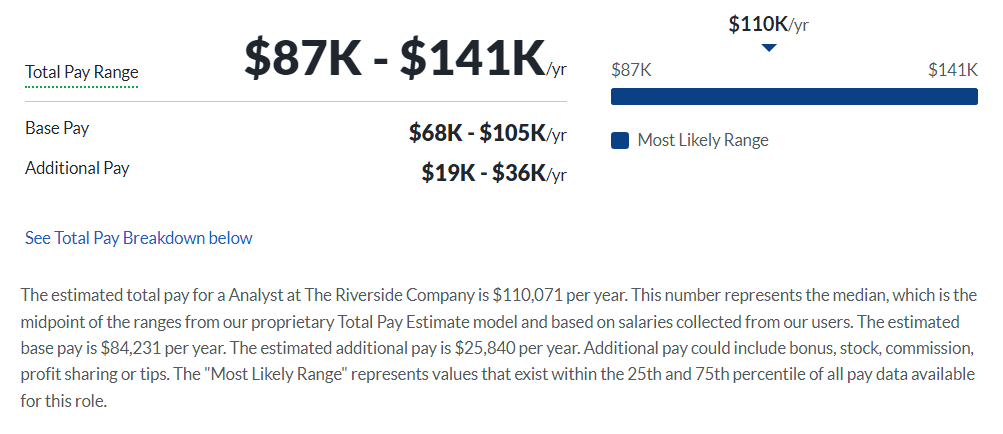

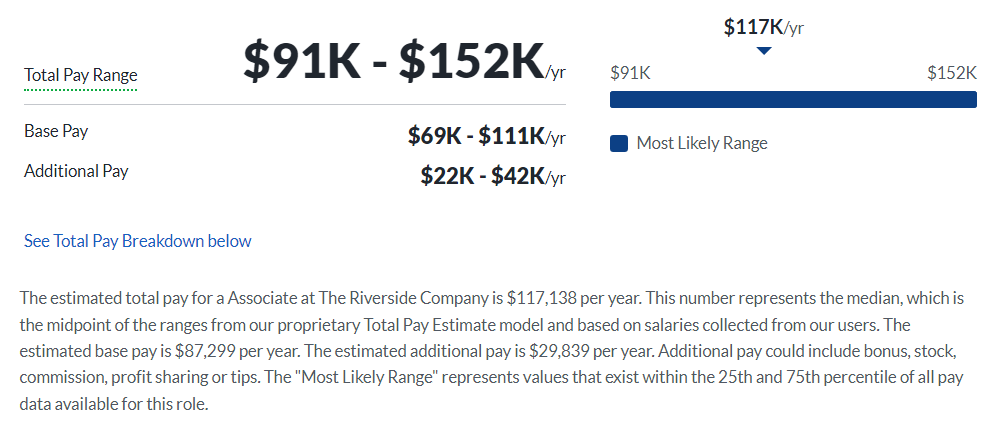

According to Glassdoor, the estimated total pay for their Analysts and Associates are $110,071 and $117,138 per year, respectively. These figures represent the median, and can still vary depending on the level of experience and qualifications of the candidate.

Analyst

Associate

Riverside Acceleration Capital Careers, Jobs, & Internships

To view open roles at Riverside Acceleration Capital, head over to our job board where we also feature job vacancies at other similar firms. We keep our job board updated so you can easily find new exciting opportunities for your finance career.

Riverside Acceleration Capital Portfolio & Investments

According to Crunchbase, Riverside Acceleration Capital has already made 22 investments across two funds. Some of their notable deals include Convertr, MarketMuse, and Mediafly.

Notable Transaction: Ziflow

Ziflow is an online proofing software which helps businesses and marketing agencies in the consumer goods, manufacturing, retail, financial services, and healthcare industries manage content review and approval processes through a centralized platform.

In February 2023, Riverside Acceleration Capital, together with Companyon Ventures, led a Series A funding round which raised $20 million for Ziflow.

RAC was compelled by Ziflow’s ability to reduce time and friction in the creative process for companies who are pressured to do more with less.

Ziflow used the funding to invest heavily in product development, marketing efforts, and expanding global sales.

Next Steps

If you want to land a role at Riverside Acceleration Capital (or a similar firm), I highly suggest you check out my Growth Equity Interview Guide.

This self-paced online course will give you a competitive edge and help you ace your interviews which leads to higher chances of landing your dream role in finance. Inside the course, you’ll find step-by-step lessons, frameworks, and expert tips on topics like case studies, financial modeling, and many more.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity