Sequoia Capital Overview

Sequoia Capital is a venture capital firm which aims to help “daring founders” launch companies from idea to IPO and beyond.

The firm was founded in 1972 by Don Valentine who is also considered to be one of the peonies of the venture capital Industry. That time, Valentine wanted to support early-stage tech startups which was, at that time, a new and untested area in the world of investing.

Their first ever investment was Atari which is a video game company. The said company kickstarted the computer revolution.

Fast forward to today, Sequoia has already made investments in various industries and stages (seed to growth) including companies like Zoom, Dropbox, and Stripe. They have also supported many tech giants of the last decades such as Apple, Oracle, Google, and YouTube.

Sequoia Capital remains as a privately owned firm. But many of the companies they invested in have already gone public like LinkedIn, Paypal, and Google to name a few.

This made Sequoia Capital hold the title for being the venture capital firm with the highest number of supported companies that have successfully gone public in history.

Sequoia Capital AUM

Sequoia Capital has $85.5 billion in assets under management as of June 30, 2022, according to the most recent regulatory filings.

Sequoia Capital Interview Process & Questions

While interviews may vary for each candidate depending on the firm, you can expect to undergo the following process:

- There will be 4-6 rounds of interviews

- Junior investment professionals will conduct the initial interviews then the more senior staff will handle the later rounds

- Unless it’s “on-cycle” or “on-campus” recruiting, the entire process could take several weeks

Interviews at Sequoia Capital will ask you questions that will test your fit, behavior, and technical/investing knowledge.

Check out my Growth Equity Interview Guide if you need help preparing for interviews.

Why Sequoia Capital

The most common question you’ll encounter is “Why this firm?”

When you receive this question, take this chance to show your excitement and familiarity with the firm’s history and latest news about them.

And if you’ve been doing networking, this is also the best time to mention any impressive staff you’ve met at the firm and how they have made an amazing impression on you.

Another thing that can help you prepare for this interview question is to learn more about their firm. One simple way to do this is to listen to interviews with its founders or investors.

This insightful interview with Roelof Botha, a Partner at Sequoia Capital, is a great start:

More interviews

- Interview with Douglas Leone, Global Managing Partner of Sequoia Capital (Forbes)

- Interview with Roelof Botha, Managing Partner, Sequoia Capital (Founder Institute)

- How To Build Sales Teams with Dannie Herzberg, Partner at Sequoia Capital (20VC)

- Unveiling Sequoia’s New 8 Week Accelerator with Luciana Lixandru, Partner at Sequoia Capital (20VC)

Sequoia Capital Case Study

Case studies are common during interviews at firms like Sequoia Capital.

Sequoia and similar firms use these exercises to evaluate your technical knowledge and how you communicate. Most case studies focus on financial modeling and investment recommendations.

But if you’re applying for a junior position, you might also need to complete a cold calling case study.

If you need help preparing for case studies, check out our Growth Equity Interview Guide.

Sequoia Capital Salary & Compensation

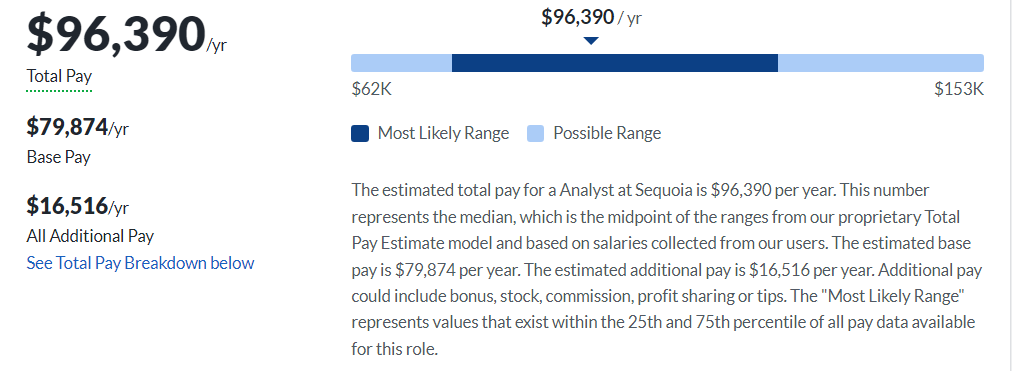

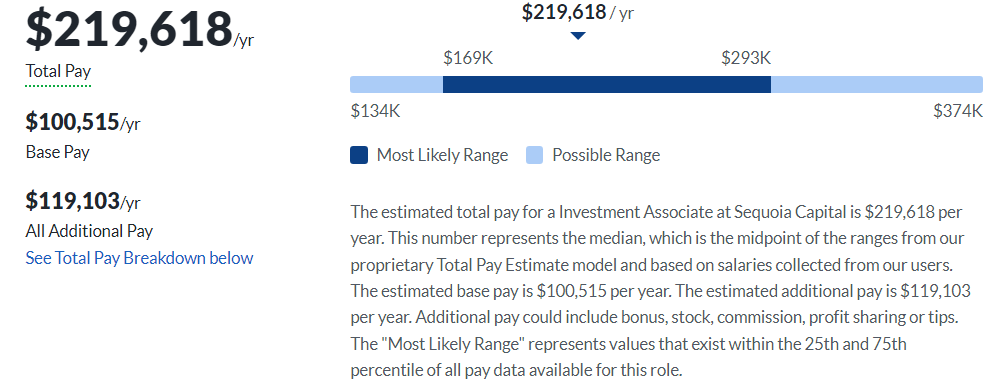

Based on Glassdoor’s data, analysts at Sequoia Capital can have an annual salary of $96,390, while associates usually earn around $219,618 per year.

But keep in mind, these numbers can more or less change based on your experience and qualifications.

Analyst

Associate

Sequoia Capital Careers, Jobs, & Internships

Check out our job board for open roles at Sequoia Capital and other similar firms.

Sequoia Capital Portfolio & Investments

Sequoia Capital is a well-known venture capital firm that has made countless investments over the years.

According to Crunchbase, the firm has participated in 1801 investments and has established 34 funds which makes it one of the largest VC firms in the industry.

Some of the firm’s notable investments include Airbnb, Dropbox, and Stripe which all have achieved notable success.

Notable Transaction: Airbnb

Sequoia Capital led an early fundraising round for the home-sharing platform, Airbnb, back in 2009.

The firm provided a $600,000 investment to Airbnb while the company was just getting started.

This investment helped with the success of Airbnb and also a major factor for becoming the global brand as it is today. Sequoia continues to support Airbnb and has participated in multiple following fundraising rounds.

Sequoia Capital was one of the largest stockholders when Airbnb was made public in 2020. The firm has around 16 million shares valued at $3.8 million.

Next Steps

Ready to land your dream job in finance? Make sure you stand out during your growth equity interviews. Get your hands on the Growth Equity Interview Guide now and prepare to ace your interview!

Break Into Growth Equity

Break Into Growth Equity