Silver Lake Overview

Silver Lake is a global private equity firm based in Menlo Park, California that invests primarily in technology and tech-enabled businesses.

The firm was founded in 1999 during the height of the late 90’s technology boom. Rather than investing in startups as most venture capitalists do, they focused on supporting mature technology firms.

Among the firm’s founders were:

- Jim Davidson – led the Technology Investment Banking business at Hambrecht & Quist

- Roger McNamee – representative of Integral Capital Partners

- David Roux – former CEO of Liberate Technologies, and Executive VP at Oracle

- Glenn Hutchins – came from Blackstone Group, former advisor in the Clinton Admin

Silver Lake raised impressive investments during its first three fundraising events.

The firm’s first fund, Silver Lake Partners, raised $2.3 billion of investor commitments.

The second fund, Silver Lake Partners II, was raised in 2004 with $3.6 billion of commitments.

The third one, Silver Lake Partners III, was raised in 2007 with $9.6 billion of commitments.

Silver Lake AUM

As per the most recent regulatory filings, Silver Lake manages $93.5 billion in total assets as of March 31, 2022, which makes it one of the largest firms by assets under management (AUM).

Silver Lake Interview Process & Questions

Firms have the freedom to modify their interview process with each candidate. However, if you apply at Silver Lake (or a firm like it), you can expect some consistencies in their interview process such as:

- Approximately 4-6 rounds of interview

- Junior investment professionals take charge in conducting the initial rounds while the more senior staffs handle the later rounds

- The whole interview process may take weeks (unless it’s “on-cycle” or “on-campus” recruiting)

You can also expect the interviews at Silver Lake to be a combination of fit questions, behavioral questions, and technical/investing questions.

For in-depth interview preparation tips, lessons, and guidance, check out my Growth Equity Interview Guide.

Why Silver Lake

One of the most common and crucial questions you’ll get during your interview is “Why this firm?”

When the interviewer asks you this question, make sure to mention whoever you’ve met at the firm from your networking efforts and how they have made a really positive impression on you.

Aside from that, try to learn about the firm. One way to do that is to listen to interviews with their founders, investors, and people who work at the firm.

For example, here’s an interesting interview with Silver Lake Co-Founder Glenn Hutchins:

More interviews

- OneWire interview with Glenn Hutchins, Co-Founder and Managing Director at Silver Lake Partners

- Talk with Egon Durban, managing partner @ Silver Lake (Fortune’s Brainstorm Tech Conference)

Silver Lake Case Study

Firms like Silver Lake use case studies to assess your technical knowledge and communication skills. That is why case studies almost always show up during interviews.

The main focus of these case studies are financial modeling and investment recommendations.

But for junior roles, cold calling case study may be required as well.

In case you need help preparing for case studies, check out my Growth Equity Interview Guide.

Silver Lake Salary & Compensation

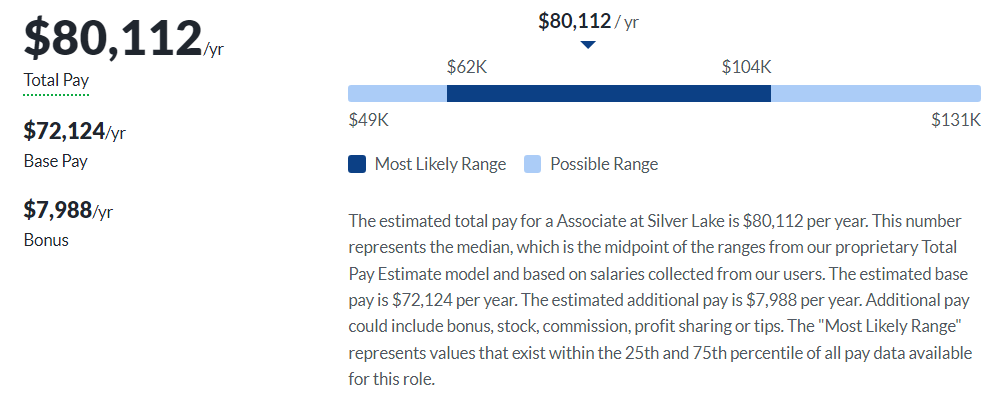

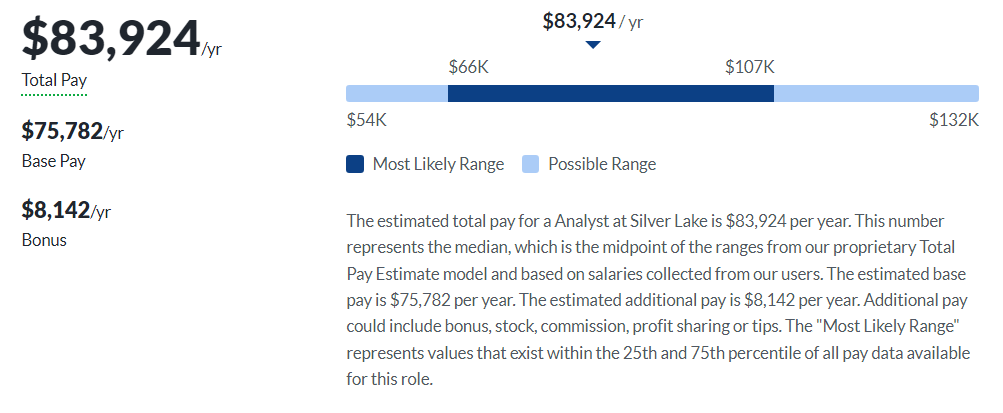

Based on Glassdoor’s data, you can make an estimated total pay of $80,112 if you’re an Associate at Silver Lake, while Analysts can earn around $83,929 per year.

These figures should give you a rough idea of how much you can make at Silver Lake, however, they may still vary depending on your level of experience and qualifications.

Associate

Analyst

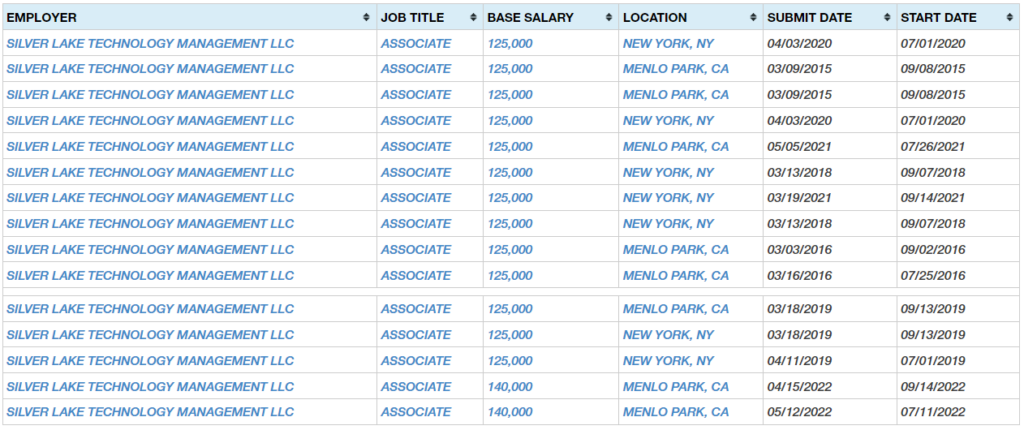

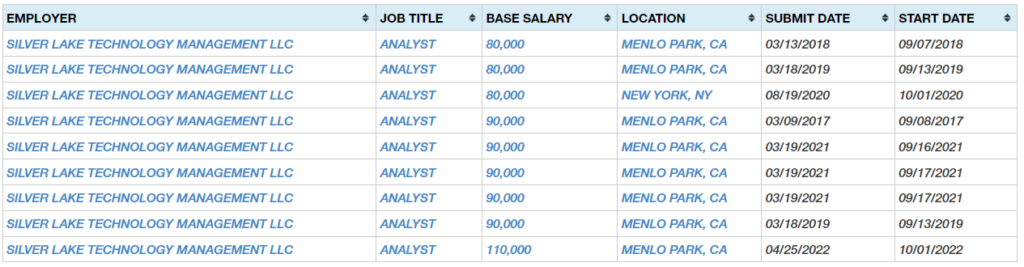

Based on other publicly available data, recent Associates have earned salaries of $140,000 per year, while Analysts have made $110,000 per year.

Silver Lake Careers, Jobs, & Internships

To find active and recent job vacancies at Silver Lake, check out our job board where we also feature open roles for similar firms.

Silver Lake Portfolio & Investments

Since its founding in 1999, Silver Lake has made a total of 124 investments with a huge percentage on technology and tech-enabled businesses.

These investments have been made across 26 client accounts.

Some of Silver Lake’s most notable deals include its investment in Skype, Alibaba, Dell Technologies, Twitter, and Seagate Technology – which are all big names in their respective niches.

These investments demonstrate Silver Lake’s expertise in managing large and complex portfolios of investments.

Notable Transaction: Symantec

In 2016, Silver Lake made two strategic investments in Symantec, a cybersecurity firm best known for its Norton antivirus software.

The first investment was made in February for $500 million.

When Symantec decided to acquire Blue Coat in June, Silver Lake invested an additional $500 million to support the move.

The $1 billion investment of Silver Lake to Symantec only shows its trust in the cybersecurity firm’s growth potential.

Next Steps

If you are someone who is very much interested in helping technology and tech-enabled firms to scale, Silver Lake is definitely a good firm to work for.

To help you land a role at Silver Lake or similar firms, I have created a Growth Equity Interview Guide. The step-by-step lessons inside this self-paced course will help you streamline your interview preparations.

After taking the course, you’ll be better equipped to answer questions about growth equity, case studies, valuation, and everything that can be asked during interviews.

Get the course and start learning today!

Break Into Growth Equity

Break Into Growth Equity