Spectrum Equity Overview

Founded in 1994, Spectrum Equity is a growth equity firm based in Boston, Massachusetts that provides capital and strategic support to software, internet, and information services companies.

The firm selects companies with defensible and sustainable business models with strong recurring revenue, structural competitive advantage, and significant operating leverage.

Typical investment from Spectrum Equity ranges from $25 to $150 million. They also play a huge role in helping their portfolio companies scale through M&A, sales & marketing optimization, and senior management and Board recruitment.

Brion Applegate and William Collatos are the founders of Spectrum Equity.

Applegate has been involved in private equity investing since 1979 when he served as a summer Associate at TA Associates, while Collatos was a General Partner with TA Associates and MC Partners prior to founding Spectrum.

Spectrum Equity AUM

According to most recent regulatory filings, Spectrum Equity has $8.2 billion in assets under management as of March 30, 2022.

Spectrum Equity Interview Process & Questions

The interview process at firms like Spectrum Equity is fluid and can always change with each. However, the general nature of the process remains consistent. Here’s what you can likely expect:

- You will go through 4 to 6 rounds of interview.

- The HR team or junior investment professionals will conduct the initial interviews, while the more senior staff supervise the later rounds.

- Entire process usually takes up to several weeks – unless it is “on-cycle” or “on-campus” recruiting.

Interviews at Spectrum Equity comprise fit questions, behavioral questions, and technical / investing questions.

My Growth Equity Interview Guide is a great resource to help you prepare for interviews.

Why Spectrum Equity

Interviewees almost always have to answer this question: “Why this firm?”

It’s one of the most common and crucial interview questions because it reveals the motivation behind your application and the quality of reasons that made you decide to join the firm.

If you’ve made connections with former or current employees at the firm, this is a great time to mention them and how they’ve made a really positive impression on you.

Another thing you can do is to have a deep understanding of the firm. One of the best ways to learn more about the firm is to listen to interviews with its founders, investors, or executives.

For example, here’s a great interview with Spectrum Equity’s Managing Director, Ben Spero by Growth Investor with GrowthCap‘s RJ Lumba:

Spectrum Equity Case Study

Case studies are an integral part of interviews so expect interviewers to bring it up. Firms use case studies to assess each candidate’s technical knowledge and communication skills.

Most case studies at firms like Spectrum Equity consist of investment recommendations and financial modeling exercises. However, junior roles are often required to conduct a cold calling case study as well.

Prepare for case studies with the help of Growth Equity Interview Guide.

Spectrum Equity Salary & Compensation

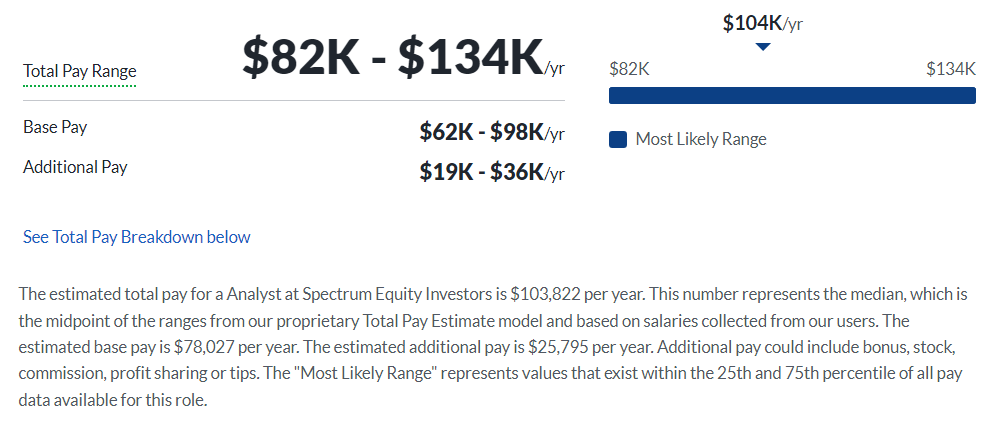

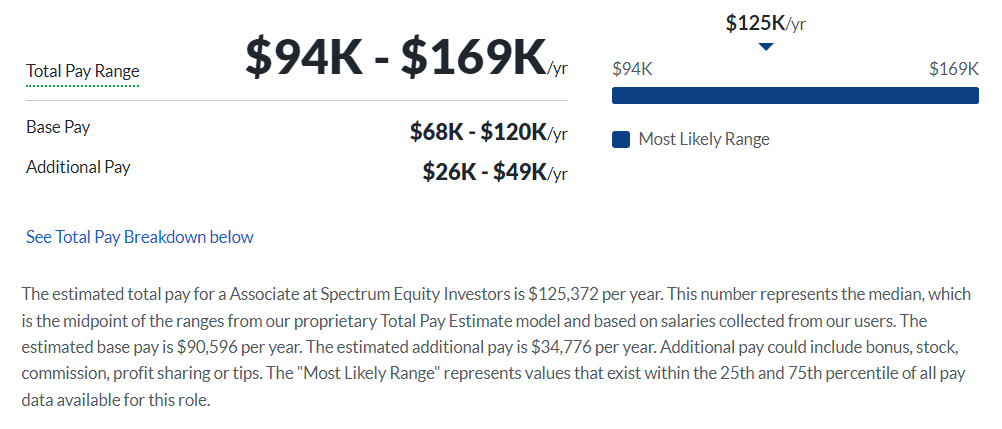

Spectrum Equity offers competitive salaries to their investment professionals. Based on Glassdoor’s data, Analysts and Associates at the firm can earn an estimated total pay of $103,822 and $125,372 per year, respectively.

These figures represent the median, and can still change depending on your level of experience and qualifications.

Analyst

Associate

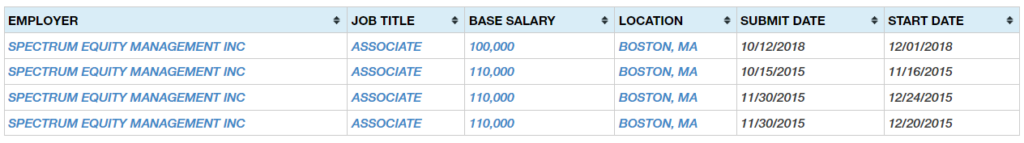

According to other public sources, recent Associates have earned salaries of $110,000 per year and Analysts have made around $70,000 per year.

Spectrum Equity Careers, Jobs, & Internships

To see open roles at Spectrum Equity and other similar firms, check out our job board and browse through exciting opportunities in finance.

Spectrum Equity Portfolio & Investments

Spectrum Equity has made 125 investments across ten funds since inception according to Crunchbase. Some of their notable deals include Kajabi, Prezi, and Scribd – which are all leading companies in their respective industries.

Notable Transaction: Bitly

Bitly is well-renowned for its link shortening capabilities. But as it continues to develop new services, Bitly now provides an enterprise-grade Link Management Platform which connects every component of a company’s internal and external communications, and also offers data, tools and analytics for transparency and control over the customer experience.

In July 2017, Bitly received a $63 million majority investment from Spectrum Equity.

The fund was allocated for Bitly’s expansion of its link management capabilities from a strong foothold in enterprise marketing to its growing set of customers and teams.

According to Spectrum Equity’s statement, the reason behind the said investment is Bitly’s impressive job of turning the company from “free only” to a fast growing and profitable freemium SaaS company.

Next Steps

Landing a role at Spectrum Equity (or any firm like it) requires hard work and enough preparation for their interview process. To help you maximize your chances of acing your interview and getting selected for the role, I’ve created the Growth Equity Interview Guide.

This self-paced online course contains step-by-step lessons which will show you how to do well in case studies, valuation, and other topics that are typically covered in interviews.

Countless professionals have already made the leap into finance with the help of the Growth Equity Interview Guide. Get the course today and be one of them!

Break Into Growth Equity

Break Into Growth Equity