TA Associates Overview

TA Associates is a private equity firm which focuses on industries with high growth potential including tech, healthcare, consumer, business and financial services.

The firm has more than 50 years of experience in the financial industry and their portfolio has over 500 investments worldwide. TA Associates helps the firms in their portfolio scale and keeps a strong, long-term partnership with them.

Peter Brooke, a Harvard Business School graduate, founded TA Associates in 1968.

Since then, the firm focused on providing growth capital to small business owners in the New England region. Eventually, they broadened their range of investments to accommodate businesses all over the United States and beyond.

The headquarters of TA Associates is located in Boston, Massachusetts with additional offices in Menlo Park, Hong Kong, London, and Mumbai.

As of now, TA Associates remains as a private equity firm and has not conducted an initial public offering (IPO) or raised any funds through public markets.

TA Associates AUM

TA Associates has $45.3 billion in assets under management as of March 31, 2022 as per the most recent regulatory findings.

TA Associates Interview Process & Questions

Firms have the freedom to modify their interview processes for each candidate.

However, if you happen to go through an interview at TA Associates (or similar firms), you can expect a consistent approach:

- They typically have 4-6 rounds of interviews

- The junior investment professionals will lead the initial interviews, while the more senior staff will handle the latter rounds.

- Expect the interview process to last several weeks – except if it’s part of an on-cycle or on-campus recruiting program.

Regarding the composition of questions, expect a blend of fit, behavioral, technical, and investment-related queries during interviews with TA Associates.

For interview preparations, check out my Growth Equity Interview Guide.

Why TA Associates

Despite the variety of interview processes for these investment firms, there is one question that you will most certainly get: “Why this firm?”

One good move to answer this question is to mention anyone you have met at the company and talk about the positive impression they made on you.

Another thing you can do to prepare for this question is to listen to the firm’s investors in their own words. For this, I strongly suggest that you check out interviews of individuals who work at the firm as this will give you an idea about how the firm portrays itself using its own words.

As a starting point, here’s an excellent conversation with Jason Mironov, a director at TA Associates’ Menlo Park office:

More interviews

- Insights on building a career in Private Equity by Gurnoor Kaur, Growth Equity Investor at TA Associates

- Michael Berk, MD at TA Associates, on supporting THI

TA Associates Case Study

Candidates applying for finance roles in firms like TA Associates will typically face a case study during interviews – with a chance of cold calling for junior roles.

Case studies in such firms tend to emphasize financial modeling and investment recommendations. So be sure to prepare for case studies because this is how TA Associates is going to assess your technical knowledge and communication skills.

Check out our comprehensive interview guide if you want help preparing for case studies.

TA Associates Salary & Compensation

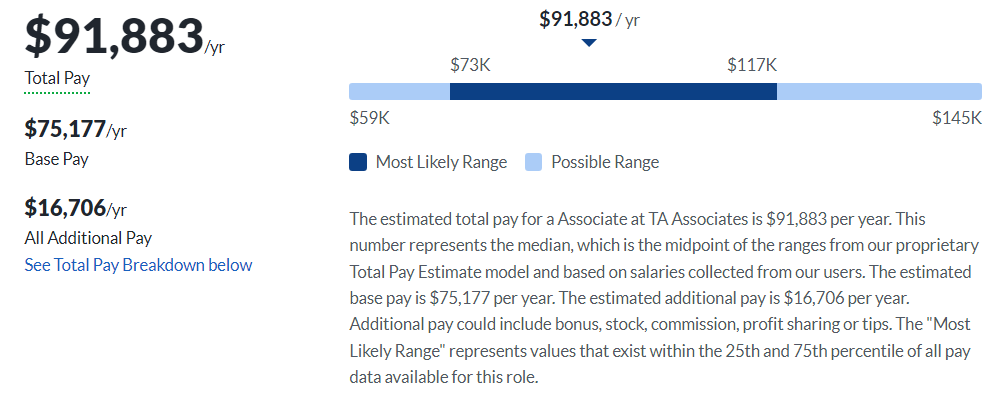

You can make an estimated total pay of $91,883 if you’re an Associate at TA Associates. But this still depends on your experience and qualifications.

Associate

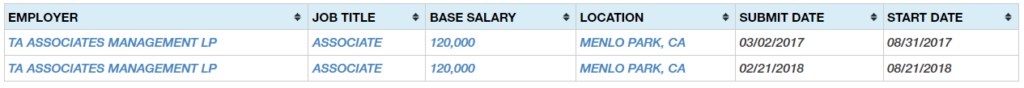

Based on other publicly available data, recent associates have earned salaries of $120,000 per year, while there is no recent data for analyst hires.

TA Associates Careers, Jobs, & Internships

Find out available positions at TA Associates and other similar firms at our job board. Be one of the first candidates to apply!

TA Associates Portfolio & Investments

To date, TA Associates has made 281 investments across 7 funds as per Crunchbase.

The firm has been involved in several notable deals – Accion Labs, ZoomInfo, and Speedcast. This only proves its reputation as a leading private equity firm.

Notable Transaction: Accion Labs

In 2020, TA Associates made a strategic growth investment in Accion Labs.

Accion Labs is a leading provider of digital engineering services which has more than 2,600 engineers all over US, Canada, UK, and Asia-Pacific.

Their services include advanced UX, artificial intelligence and machine learning, big-data/analytics to migration to SaaS, and re-engineering of legacy platforms.

The primary driver for this investment was the estimated growth of the digital engineering market – which was expected to be worth $160 billion across all industries in 2018, with around 60% of that expenditure in the US, EU, and Asia.

Accion Labs’ revenue is currently around $100 to $500 million (USD) and already received awards including the 2021 Stratus Award for Cloud Computing from The Business Intelligence Group.

Next Steps

If you are looking to land a finance role at TA Associates or other similar firms, you need to make a positive impression during interviews and stand out from competition.

Our Growth Equity Interview Guide can help you make that happen. This online course consists of easy-to-follow video tutorials that dive deep into essential knowledge and skills you need to acquire to ace interviews.

Check it out and start learning today!

Break Into Growth Equity

Break Into Growth Equity