TPG Overview

TPG is a global asset management firm that is well-known for its collaborative approach.

Their investment teams use their extensive product and industry knowledge to create value for their investors, portfolio companies, and communities. TPG’s investment focus is on Capital, Growth, Impact, Real Estate, and Market Solutions.

TPG’s legacy began when David Bonderman founded the firm back in 1992. He was the Founding Partner and Chairman at TPG Holdings Committee until TPG was opened to the public in 2022 where the firm got a $9 billion valuation.

The headquarters of TPG is currently located in San Francisco, California.

TPG AUM

According to most recent regulatory filings, TPG has $91.2 billion in assets under management as of June 28, 2022.

TPG Interview Process & Questions

TPG applicants go through 4-6 rounds of interviews.

For the initial rounds of interviews, the junior investment professionals will be incharge. While the more senior staff will handle the later rounds.

Candidates can expect to encounter fit, behavioral, and technical/investing questions. These questions evaluate the candidate’s values, technical knowledge, and ability to work with a team.

The interview process at TPG could take many weeks, unless it’s an “on-cycle” or “on-campus” recruiting event.

For interview tips and guidance, check out my Growth Equity Interview Guide.

Why TPG

The frequently asked question during interviews at TPG and similar firms is this:

“Why this firm?”

If you’ve had the chance to connect with the firm’s employees, this is the perfect time to mention your amazing interaction with them and the positive impression they left on you.

When answering the question “Why this firm”, it really helps to know more about the firm. For this, I highly recommend listening to interviews with the founders, investors, and key personnels at the firm.

This interview with TPG President Todd Sisitsky about his views on market volatility is a great start:

More interviews

- TPG Co-Founder and Chairman Jim Coulter on his investment firm’s focus on impact investing

- Interview with David Trujillo, Co-Managing Partner of TPG Growth

TPG Case Study

Case studies are a common part of the interview process at investment firms like TPG.

That’s because case study is their way to assess their candidate’s technical knowledge and communication skills – which are both essential in the finance industry.

The main focus of their case studies are financial modeling and investment recommendations. So make sure to prepare for these two.

However, if you’re applying for a junior role, there’s a good chance you’ll have to do cold calling case study as well.

Check out our Growth Equity Interview Guide if you want help preparing for case studies.

TPG Salary & Compensation

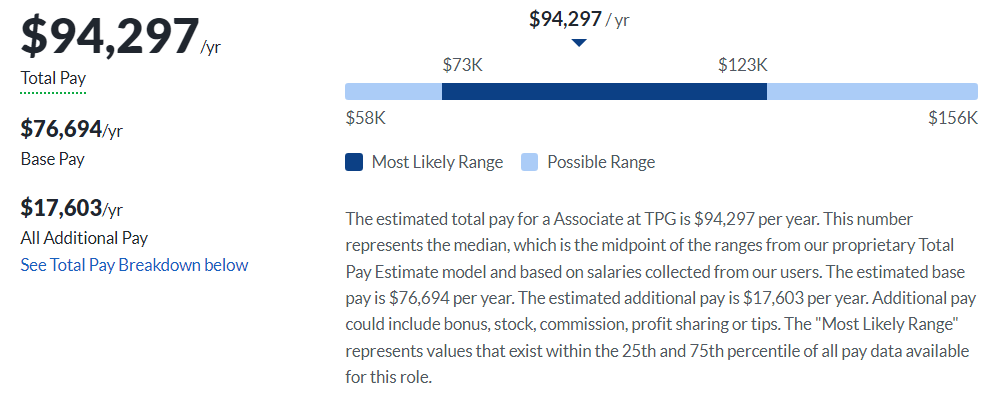

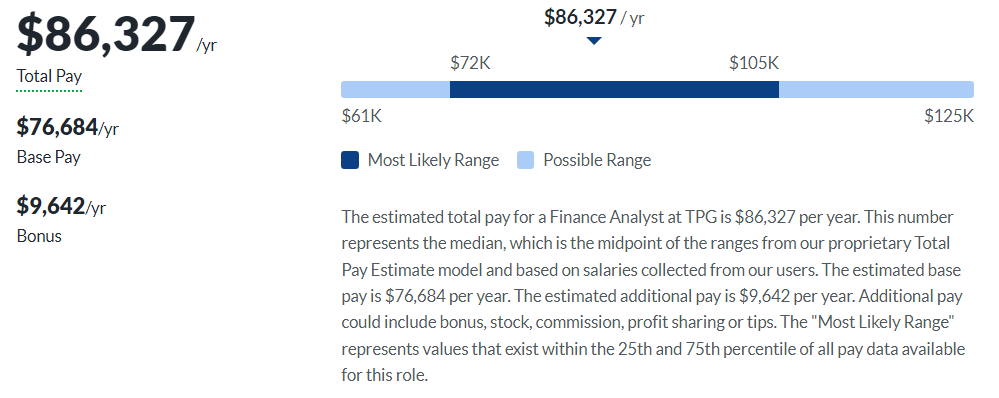

According to Glassdoor, if you work at TPG as an Associate, you can make around $86,327 per year. And if you work as an Analyst, you can expect around $94,297 per year.

These figures may vary depending on your experience and qualifications.

Associate

Analyst

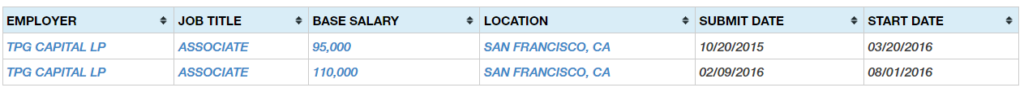

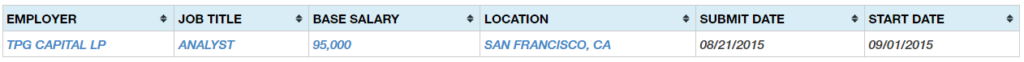

Based on other publicly available data, recent Associates have earned up to $110,000 per year, while analysts have made $95,000 per year.

TPG Careers, Jobs, & Internships

You can browse our job board to view current open positions at TPG and other similar firms.

TPG Portfolio & Investments

According to Crunchbase, TPG has made 206 investments and manages 11 funds. Some of the companies that TPG invested in are SauceLabs, MusixMatch, and Yoco.

Notable Transaction: Saluda Medical

TPG’s most recent investment was on Apr 13, 2023 with Saluda Medical – a company that develops medical devices in the field of neuromodulation for treating neurological disorders.

Wellington Management led the said investment activity where TPG participated.

After the fundraising event, Saluda Medical raised $150M in equity funding. The fund was used to drive the launch of the Evoke® Spinal Cord Simulation (SCS) System and other business development activities.

Next Steps

If you’re looking to land a finance role in growth equity firms like TPG, the Growth Equity Interview Guide can equip you with the right knowledge, frameworks, and insider tips.

This competitive advantage will help you ace your interviews and maximize your chances of securing a role in finance.

Break Into Growth Equity

Break Into Growth Equity