Volition Capital Overview

Volition Capital is a growth equity firm that primarily invests in high growth potential, founder-owned tech companies across the US and Canada that have between $5 million and $50 million in revenue.

The firm’s specialization is in software, internet applications, information services, and tech-enabled services companies that demonstrate capital efficiency and aspirations for greatness.

Larry Cheng, Roger Hurwitz, and Sean Cantwell founded Volition Capital in 2010, in Boston, MA.

Volition Capital stays committed to their investment approach of supporting founders who share their “bootstrapped mentality” of putting in the work while keeping their heads down.

Volition Capital AUM

In January 2023, Volition Capital closed Volition Capital Fund V, L.P. with $675M in Capital Commitments, bringing their total assets under management to over $1.7 billion.

Volition Capital Interview Process & Questions

Firms can always modify how they conduct their interviews with each candidate; however, there are some consistencies on the nature of the interview process if you apply at Volition Capital or similar firms.

- You will go through 4-6 rounds of interview

- Junior investment professionals are the ones in charge of the initial rounds while the more senior staff handle the later rounds

- The whole interview process can take several weeks – unless if it’s “on-cycle” or “on-campus” recruitment initiative

For the interview questions, expect to answer a mixture of fit questions, behavioral questions, and technical/investing questions.

Check out my Growth Equity Interview Guide in case you need help preparing for interviews.

Why Volition Capital

The “Why this firm” question almost always comes up during interviews because the interviewers like to know what made you decide to apply specifically at their firm.

If you’ve met former and current employees at their firm, this is the best time to mention them and how they’ve made a really positive impression on you. You can also bring up the good things they said about the firm.

One of the best ways to prepare for this interview question is to listen to interviews with the firm’s founders, executives, and investors.

For example, here’s an interesting interview with Tomy Han, Principal with Volition Capital:

More interviews

- Interview with Sean Cantwell, founding team member @ Volition Capital (Boston Speaks Up)

- TechCrunch Live featuring Larry Cheng, Managing Partner @ Volition Capital

Volition Capital Case Study

One of the tools that firms like Volition Capital use to assess the candidate’s technical knowledge and communication skills is case study. That’s why you’re most likely to face case studies during interviews. For junior roles, candidates are often required to do cold calling case study as well.

I’ve given detailed explanation, examples, and framework for case study inside my Growth Equity Interview Guide. Check it out if you need help preparing for case studies.

Volition Capital Salary & Compensation

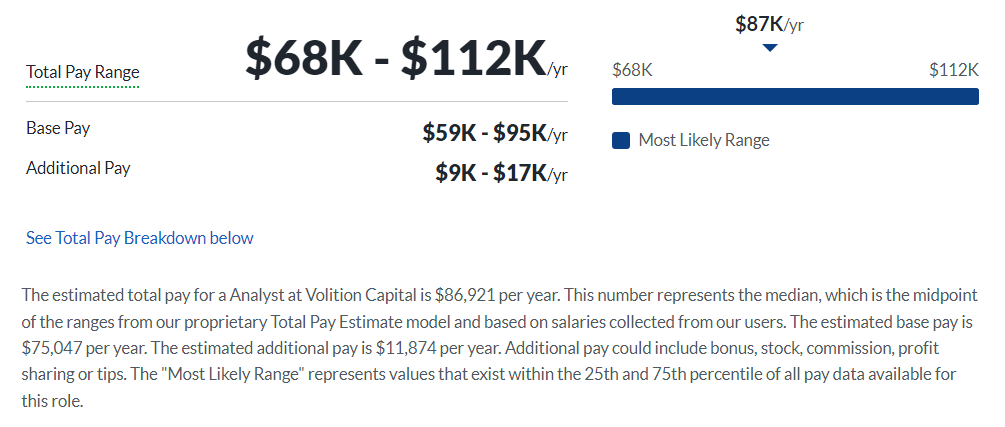

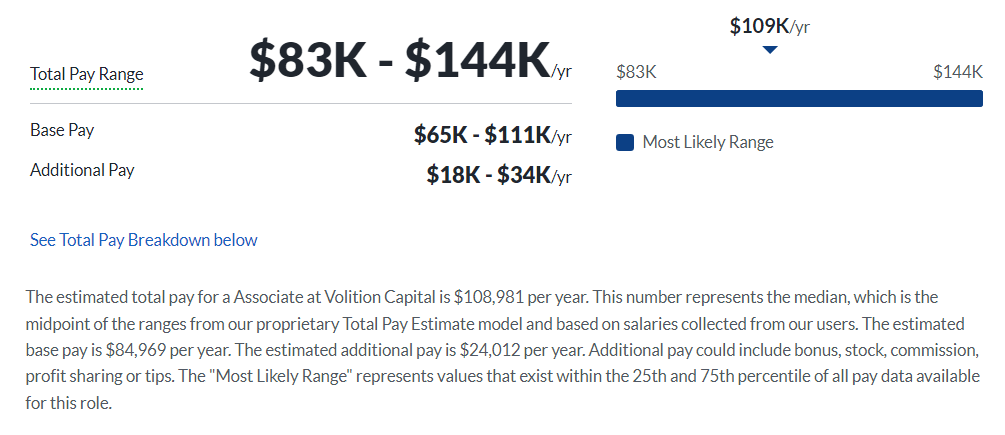

According to Glassdoor’s publicly available data, the median annual salary for Analysts and Associates who work at Volition Capital is $86,921 and $108,981, respectively.

These figures may vary depending on the candidate’s level of experience and qualifications.

Analyst

Associate

Volition Capital Careers, Jobs, & Internships

Check out our job board to see open roles at Volition Capital and other top firms in the financial industry. We keep our job listings updated so you can be the first to know and apply.

Volition Capital Portfolio & Investments

As per Crunchbase, Volition Capital made 66 investments across different industries such as SaaS, healthcare, and consumer technology since its inception.

The firm manages five funds., with a total capital commitment of around $1.7 billion.

Some notable deals of Volition Capital include Assent Compliance, Dragonfly, and Tracelink.

Notable Transaction: Black Kite

Volition Capital believes that cybersecurity is only as strong as its weakest link.

The firm said that CISOs today face a big unknown – third parties. These entities outside the organization’s firewall are holding sensitive data, but insights into third parties’ cybersecurity risk are limited.

Black Kite, a third-party cyber risk monitoring platform built by former white hat hackers, addresses this gap.

Volition Capital saw the potential of Black Kite which led to a $22 million Series B investment in October 2021.

Next Steps

Volition Capital is just one of many firms that can provide you with a fulfilling career in finance. Regardless of the firm you choose, you always have to go through their competitive interview process first.

If you want to ace your interviews, get ahead of your competitors, and maximize your chance of landing a role in finance, check out my Growth Equity Interview Guide.

Inside this self-paced online course, you’ll see step-by-step lessons which will show you everything you need to learn so you can stand out during interviews. Join countless successful professionals who made it to the finance world with the help of the course.

Start learning today!

Break Into Growth Equity

Break Into Growth Equity